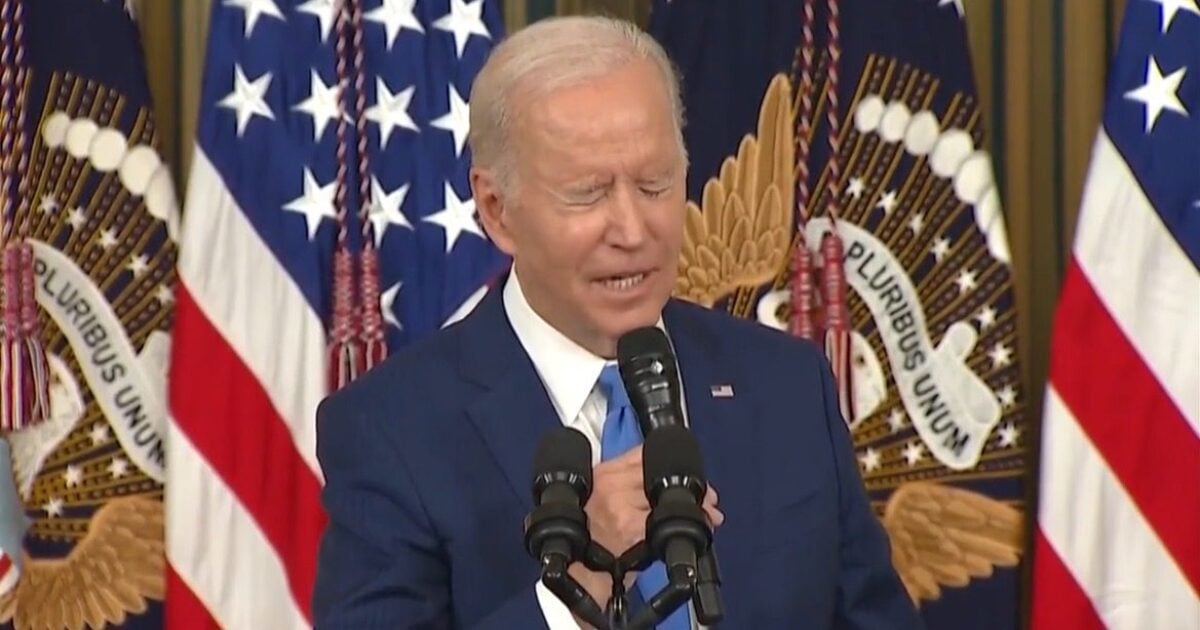

The value tag of President Joe Biden’s scholar mortgage amnesty simply retains rising — and it’s not the neediest who’re getting the cash, both.

In line with the New York Post, a brand new examine by the College of Pennsylvania estimates {that a} new spherical of scholar mortgage cancellation packages raises the quantity that taxpayers are caught holding to $559 billion complete, together with $84 billion beneath new provisions introduced final week.

The kicker? The most recent provisions beneath the Saving on a Invaluable Schooling, or SAVE, plan will profit these in higher tax brackets probably the most.

The income-driven plan was launched final summer time, however new mortgage cancellations for 277,000 debtors had been introduced final week.

“Today’s announcement shows — once again — that the Biden-Harris Administration is not letting up its efforts to give hardworking Americans some breathing room,” Schooling Secretary Miguel Cardona stated in a press release, the Post reported.

“As long as there are people with overwhelming student loan debt competing with basic needs such as food and healthcare, we will remain relentless in our pursuit to bring relief to millions across the country.”

Cardona was doing the standard media rounds selling how the plan was going to assist probably the most weak scholar mortgage recipients:

.@SecCardona breaks down who qualifies for President Biden’s new scholar debt aid plan.#GMA3 pic.twitter.com/BB3PVT76K4

— GMA3: What You Want To Know (@ABCGMA3) April 9, 2024

Nevertheless, the College of Pennsylvania’s Penn Wharton Price range Mannequin discovered that the brand new spherical of cancellations wasn’t precisely going to assist those that had been struggling to place meals on the desk — until their food plan consisted of three sq. meals of foie gras and Wagyu steak.

“President Biden recently announced five main provisions to provide student loan debt relief. Some of provisions are already mostly covered by President Biden’s SAVE plan introduced in 2023. Some provisions, however, are more incremental to the SAVE plan, including one provision — the forgiveness of longer-term debt — that expands eligibility to higher-income households,” learn a Thursday media release of the examine’s key takeaways.

“We estimate that the New Plans will price $84 billion along with the $475 billion that we estimated for President Biden’s SAVE plan, for a complete price of about $559 billion throughout each plans.

“While the New Plans, like the SAVE plan, contain provisions to relieve debt based on individual or household income, the New Plans will also relieve some longer-term student debt for about 750,000 households making over $312,000 in average household income,” it continued.

“The main reason for this high average household income is that the SAVE plan already provides long-term debt relief to households with lower incomes.”

Of the 5 main elements of the brand new plans introduced on April 8, two specifically stick out as driving the aid up the income ladder.

First is the brink for waiving accrued and capitalized curiosity on the loans: “Up to $20,000 in accrued and capitalized interest will be waived for borrowers with current balances above the initial balance upon entering repayment, regardless of borrower’s income,” the Wharton media launch learn.

“Single borrowers making less than $120,000 or couples making less than $240,000 a year will qualify for a total waiver of all current balances above the initial balance if they are enrolled in any IDR plan. Automatic relief will be applied, and so no application is needed.”

Second is the elimination of undergraduate scholar debt for individuals who have been paying it for over 20 years or gradate debt for 25 years.

“If student loan repayments started on or before July 1, 2005, all debt will be eliminated for borrowers with undergraduate loans only. (For borrowers with any graduate debt, this date is pushed back to July 1, 2000). No enrollment in IDR plans will be needed to receive the relief, but currently it’s unclear if any other application will be required from the borrowers,” the information launch stated.

The full price of all of the 5 measures is a contact over $84 billion, added to the estimated $475 billion Biden’s unilateral scholar mortgage aid has already put taxpayers on the hook for.

Nevertheless, on this case, Biden is offering aid to households who’re lower than $100,000 away from that magical $400,000 quantity that he says makes you one of many rich that he plans to tax to pay for his spending sprees — you recognize, those that want to start out paying their “fair share.”

To say that is ridiculous is an understatement — till, after all, you notice that 2024 is an election yr and Biden’s ballot numbers haven’t seemed sizzling because the starting of the race, even though Democrat DAs and the Division of Justice have been on a quest to tie up the presumptive Republican nominee in court docket till November.

As Home Price range Committee chairman Rep. Jodey Arrington, a Texas Republican, famous, this wasn’t simply unconstitutional, it was a “quest to buy votes.”

“In reality, his plan will shift the responsibility of paying for loans owed by high-income earners who freely incurred them onto the backs of all taxpayers, many of whom do not even have a college degree,” Arrington stated through a press release.

“[Biden’s] administration is dead set on circumventing the Supreme Court, defying Congress, and saddling our country with more debt.”

And in contrast to he says, it’s not taking from the wealthy to offer to the poor. It’s taking from those that didn’t take faculty loans or paid them off and giving aid to rich individuals who did and haven’t.

Is that this what student debt relief ought to seem like? It’s when one is down badly in the polls and is greedy at straws to get suburban voters in swing states. That’s hardly good coverage — however as cynical strategizing, it’s not half dangerous.

This text appeared initially on The Western Journal.

![LinkedIn Shares Insights into B2B Advertising Traits of Focus [Infographic]](https://whizbuddy.com/wp-content/uploads/2024/01/bG9jYWw6Ly8vZGl2ZWltYWdlL2xpbmtlZGluX3RlY2hfaW5mbzEucG5n-600x421.jpg)