The price to overdraw a checking account may drop to as little as $3 below a proposal introduced by the White Home, the newest effort by the Biden administration to combat fees it says pose an pointless burden on American shoppers, notably these residing paycheck to paycheck.

The proposed change by the Shopper Monetary Safety Bureau would probably remove billions of {dollars} in payment income for the nation’s greatest banks, which have been gearing up for a battle even earlier than Wednesday’s announcement. Precisely how a lot income will depend on which model of the brand new regulation is adopted.

Banks cost a customer an overdraft fee if their checking account steadiness falls under zero. Overdraft began as a courtesy supplied to some prospects when paper checks used to take days to clear, however proliferated because of the rising recognition of debit playing cards. So, for example, a $10 debit card transaction may value a financial institution buyer $40 if their steadiness goes under zero.

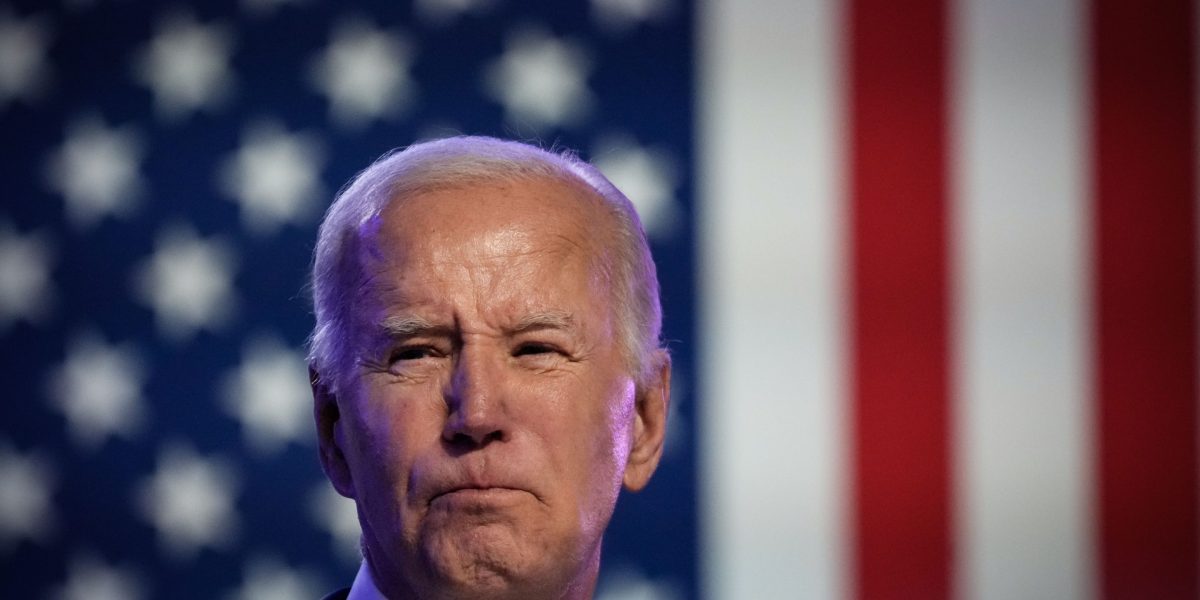

“For too long, some banks have charged exorbitant overdraft fees — sometimes $30 or more — that often hit the most vulnerable Americans the hardest, all while banks pad their bottom lines,” President Joe Biden mentioned in an announcement. “Banks call it a service — I call it exploitation.”

Underneath the proposed rule, banks may solely cost prospects what it could value them to interrupt even on offering overdraft providers. This might require banks to point out the CFPB the prices of operating their overdraft providers, a activity few banks would need to deal with.

Alternatively, banks may use a benchmark payment that may apply throughout all affected monetary establishments. Regulators proposed a number of charges — $3, $6, $7 and $14 — and can collect business and public enter on essentially the most applicable quantity. The CFPB says it arrived at these figures by taking a look at how a lot it value banks to recoup losses from accounts that went unfavorable and have been by no means paid again.

Banks may additionally present small strains of credit score to permit prospects to overdraft, a service that may function like a bank card. Some banks like Truist Financial institution at present supply that kind of service.

In keeping with analysis performed by Bankrate final August, the average overdraft fee was $26.6 1. Some banks cost as a lot as $39. The nation’s greatest banks nonetheless soak up roughly $8 billion in overdraft charges yearly, based on information from the CFPB and banks’ public data. The bureau’s analysis additionally exhibits overdraft charges overwhelmingly impression the poor and households of colour, who usually overdraft a number of instances a 12 months.

Biden has made the elimination of “junk fees” one of many cornerstones of his administration’s financial agenda heading into the 2024 election. Overdraft charges have been on the middle of that marketing campaign, and the White Home directed authorities regulators final 12 months to do no matter is of their energy to additional curtail the observe.

The foundations would apply solely to banks with greater than $10 billion in property, which is roughly 175 banks that make up many of the monetary establishments People do enterprise with. The foundations spare small banks and credit score unions, a few of which rely disproportionately on overdraft charges. CFPB officers instructed reporters that it selected to concentrate on the most important banks since most People financial institution at these massive establishments and that’s the place the widespread abuses have traditionally occurred. Roughly two-thirds of all overdraft charges are charged by these 175 banks.

Many years in the past, banks created a service that allowed sure prospects with checking accounts to go unfavorable of their accounts to keep away from bouncing paper checks. What began as a distinct segment service grew to become an enormous revenue middle for the banks after the proliferation of debit playing cards that prompted prospects to debit their financial institution accounts for small and huge quantities of cash a number of instances a day.

Overdraft charges have been a monetary bonanza for the banking business, with the CFPB estimating that banks collected $280 billion in overdraft charges within the final 20 years. These charges grew to become so in style that one financial institution CEO named his boat the “ Overdraft.”

However banks have modified their overdraft practices in response to political and in style strain in the previous few years, and query the necessity for the federal government regulators to step in now. A lot of the greatest banks have added safeguards to prospects’ accounts to permit them to carry the steadiness again into optimistic territory earlier than they incur a payment. Bank of America, as soon as thought-about by business critics to be the most important abuser of overdraft charges, lower its payment from $35 to $10 two years in the past and says revenue from overdraft fees is now lower than 10% of what it had been.

JPMorgan, the nation’s largest financial institution, now provides prospects a $50 cushion once they go unfavorable of their account. CEO Jamie Dimon instructed lawmakers in 2022 that with adjustments the financial institution has made, roughly 70% of all transactions that trigger a unfavorable steadiness don’t incur overdraft charges.

The banking business is predicted to struggle the brand new rules vigorously to guard the payment income. The rules are more likely to find yourself in a protracted authorized battle that would attain the Supreme Courtroom. If the rule is adopted and survives political and authorized challenges, the brand new rules would go into impact within the autumn of 2025.

Banks have lengthy argued that authorities rules on overdraft may trigger them to remove the service altogether. Whereas some banks have eradicated overdraft charges and created accounts that can’t go unfavorable, Bankrate estimates that roughly 9 out of 10 banks nonetheless supply the service.

“If enacted, this proposal could deprive millions of Americans of a deeply valued emergency safety net while simultaneously pushing more consumers out of the banking system,” mentioned Lindsey Johnson, president and CEO of the Shopper Bankers Affiliation, the commerce and foyer group for the bigger shopper banks.

___

The Related Press receives assist from Charles Schwab Basis for academic and explanatory reporting to enhance monetary literacy. The unbiased basis is separate from Charles Schwab and Co. Inc. The AP is solely liable for its journalism.