A sharp sell-off in 2024’s winning tech giants has left investors wondering whether it’s safe to scoop up the pummeled shares. Popular artificial intelligence related stocks fell sharply Monday after Friday’s weak July jobs report stoked concerns that the Federal Reserve is behind the curve on rate cuts and that the U.S. economy is barreling toward a recession. Technology stocks bore the brunt of those losses as investors entered risk-off mode and doubts mounted over how soon these megacap companies will start to monetize their hefty AI investments. At one point during Monday’s rout, the “Magnificent Seven” stocks combined had lost nearly $1 trillion in value , later recovering some of the losses. .IXIC 5D mountain Nasdaq performance over the last five trading days That’s left some investors wondering whether the AI trade is beginning an unwind, and questioning whether the sell-off is buying opportunity — or signs of broader contagion to come. Watching for pullbacks “It’s painful, but it’s necessary,” said Jamie Meyers, senior analyst at Laffer Tengler Investments. “We do believe we’re in a secular bull market, and these bull markets can last a very long time when they’re tempered by corrections. We’re a little overdue for one.” To be sure, some investors on Wall Street are pumping the brakes after Monday’s sell-off, cautioning others to hold off on buying the dip just yet. Harvest Portfolio Management’s Paul Meeks recommended waiting until the end of the reporting season to snatch up shares. He told CNBC’s ” Money Movers ” on Monday that he favors these stocks “fundamentally” but needs to see signs of stabilization for a few sessions. “We don’t think it’s a hurry to jump in with both feet,” added Laffer Tengler’s Meyers. He’s bracing for the potential of additional declines, adding that the firm began trimming overweight names that sold off during Monday’s session about a month ago. That includes Broadcom , Microsoft and Tesla . Many investors viewed the sell-off as a necessary pullback in what’s been a seemingly endless uptrend in the market. “When it feels completely inevitable, that’s when you need to start asking questions. That’s inherently when there are going to be cracks in the system,” Kayne Anderson Rudnick’s chief market strategist Julie Biel said Monday night during a CNBC special report. “When the consensus is totally united, that’s when you need to be really worried.” Seeking a discounted opportunity Adam Sarhan, CEO of 50 Park Investments, views the sell-off as an opportunity for investors to get in on AI stocks, noting that this is the third time since October 2022 that the Nasdaq 100 came near its 200-day moving average — a key momentum indicator watched by Wall Street. “The Nasdaq 100 is extremely oversold,” he said. “It’s down five weeks in a row, so from a probability standpoint, this offers long term investors a good risk to reward entry point.” NVDA 1M mountain Nvidia shares over the last month The index has fallen more than 10% over the last month, and it ended Monday more than 13% off its record high. AI darling Nvidia settled about 26% below its closing high from June on that day, while the S & P 500 ended the session roughly 8% off its record close from last month. Jay Woods, chief global strategist at Freedom Capital Markets added that market days like Monday offer an opening for investors that have complained about missing the AI trade. Like many investors, he also views Monday’s pullback as a small blip in the AI trade’s record run. “Investors who have been waiting for a dip and believe the AI story is in the early innings — this is an opportunity that in a few weeks they may look back and regret,” he said.

Hot Topics

-

Social media stirs up blended reactions about GOP congresswoman residing in retirement facility

-

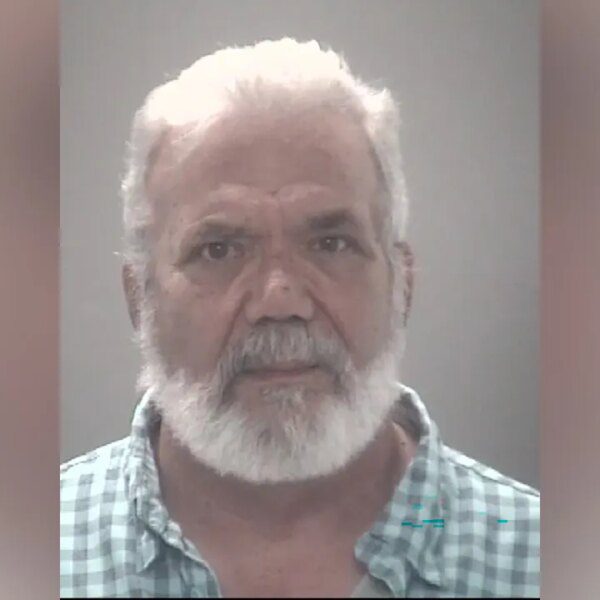

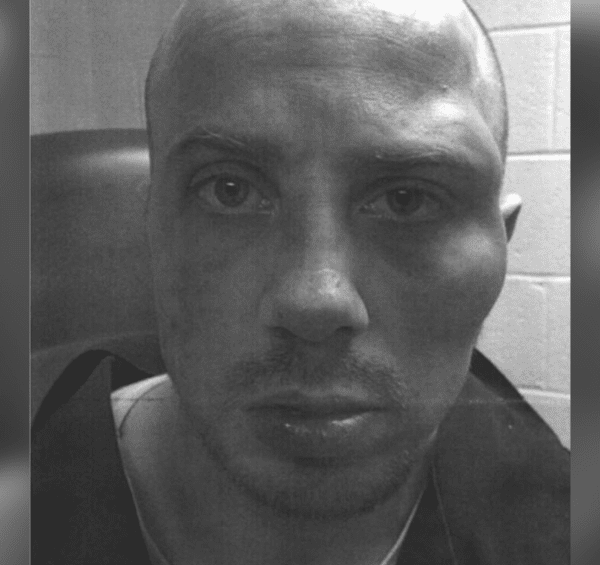

Ex-Abercrombie CEO could dodge intercourse trial as legal professionals declare dementia and Alzheimer’s

-

Ford Donates Eye-Watering Amount of Cash for Trump's Inauguration Along with Vehicle Fleet | The Gateway Pundit

Subscribe to Updates

Get the latest tech, social media, politics, business, sports and many more news directly to your inbox.