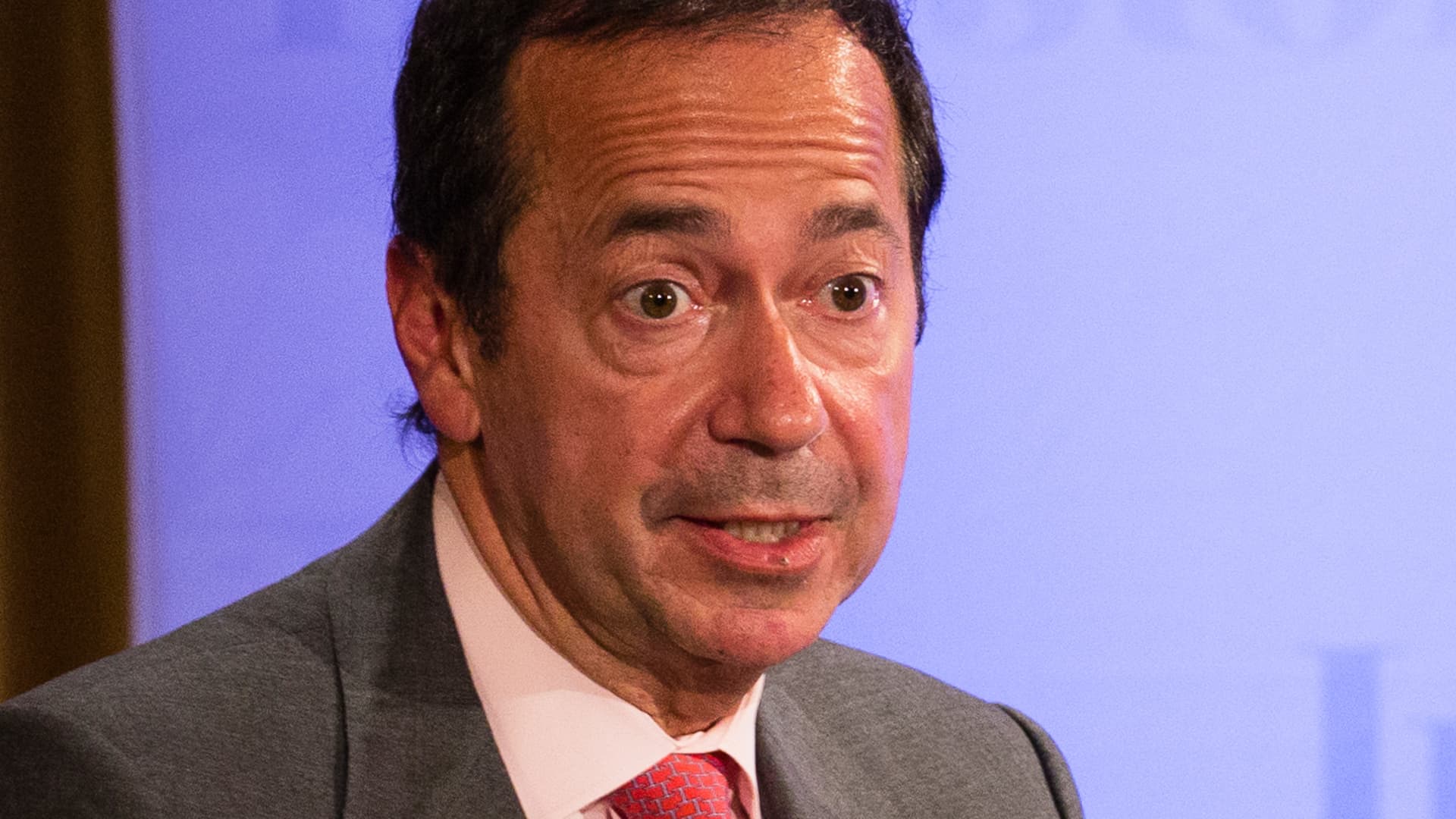

Billionaire investor and hedge fund veteran John Paulson said Friday that he would like to see the Federal Reserve start big with its rate cuts. The Fed is expected to lower its benchmark interest rate on Wednesday, but traders are split on how big the move will be. The central bankers seem to be deciding between a cut of 25 basis points or 50 basis points. A basis point is equal to 0.01 percentage points. Paulson said Friday on CNBC’s ” Money Movers ” that he thinks a 50 basis point cut would be more appropriate. “I think the Fed is a little behind the curve. … I think they’ve seen enough data that they can start bringing rates down, and I would suggest more aggressively would be better,” he said. One asset class that often rises when the Federal Reserve cuts rate is gold, and Paulson is a long-time bull on the yellow metal. He said that one reason that gold is trading near record highs is because of interest from foreign governments. “I think the major reason why gold is rising is a global [trend of] … having less confidence in paper currencies, particularly among central banks,” Paulson said. He added that a 10% allocation to gold could be “prudent” for investors, though specified he was not making a firm recommendation. Paulson said his portfolio has exposure to both stocks and derivatives tied to gold. His family office, Paulson & Co., has stakes in several gold mining stocks, including Agnico Eagle Mines , according to VerityData. Paulson, a campaign donor to Donald Trump, warned that the stock market would ” crash ” if some of the tax proposals from Vice President Kamala Harris’ campaign were implemented. He also said that he is concerned about the federal government’s debt but is not betting against U.S. Treasurys currently. Paulson is a veteran figure in the hedge fund world and is perhaps most famous for betting against the housing market ahead of the 2007 crash. Paulson announced in 2020 that he was converting his hedge fund into a family office.

Hot Topics

Subscribe to Updates

Get the latest tech, social media, politics, business, sports and many more news directly to your inbox.