The billionaire founder and CEO of Citadel, Ken Griffin, isn’t usually involved with battles over market share, however on the subject of EVs, it’s a distinct story. After China’s largest EV maker, BYD, managed to outsell Tesla within the fourth quarter, Griffin mentioned he fears the West might want to discover a solution to hold low-cost Chinese language EVs from flooding the market.

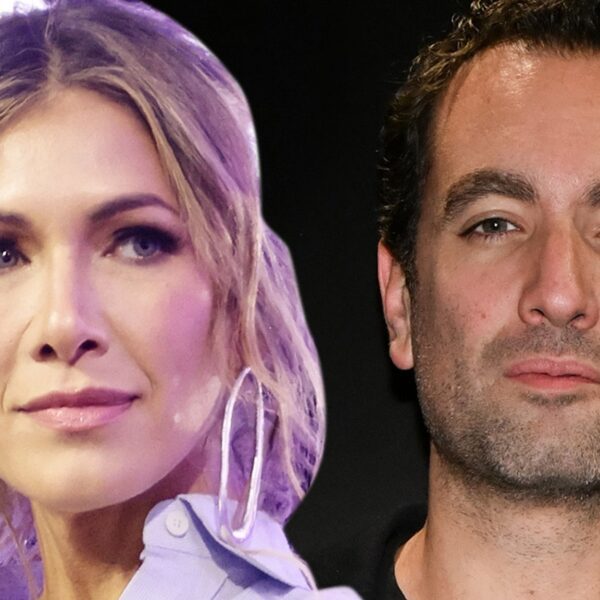

“Watching BYD surpass Tesla in global sales was a bit of a heartbreaking moment,” he told CNBC on the MFA Community convention in Miami on Tuesday, including that “we’ve got a real competitor in China.”

Earlier this month, BYD, which has been aggressively increasing its operations internationally, revealed it sold a report 525,409 electrical automobiles (EVs) within the fourth quarter of final 12 months. In the meantime, Tesla delivered simply 484,507 EVs over the identical interval.

Griffin famous that China has used its measurement and comparatively low labor prices to dominate many key industries in recent times, together with photo voltaic panels, EVs, and client electronics, making them a critical financial competitor to the U.S. “We often lose sight of the fact that the Chinese economy represents 1.4 billion people. So they have a huge advantage when it comes to simple economies of scale, combined with a strong education system that produces four times as many STEM graduates,” he mentioned.

Griffin went on to argue that a number of the West’s inexperienced vitality insurance policies may also find yourself benefiting Chinese language EV makers, until commerce boundaries are put in place.

“California wants no internal combustion cars in the foreseeable future. Are we going to make that happen by buying Chinese vehicles? Because that’s the most cost-effective way to do so for American consumers,” he mentioned, arguing that may be a “really hard pill to swallow.”

The feedback come after Tesla CEO Elon Musk referred to as Chinese language automobile corporations the “most competitive” globally on the corporate’s fourth quarter earnings call earlier this month. “If there are no trade barriers established, they will pretty much demolish most other car companies in the world,” he argued. “They’re extremely good.”

General Motors CEO Mary Barra additionally addressed Musk’s feedback in her firm’s fourth quarter earnings name this week, saying that “we do need a level playing field” and remarking on the significance of “the right cost base” with out elaborating on potential commerce boundaries. “Give us a level playing field, and I’ll put our products up against any,” she mentioned.

Chinese language EVs are already topic to a 25% import tariff within the U.S., however the Biden administration has reportedly been contemplating elevating it to assist American producers stay aggressive.

“We are taking a strategic, thoughtful, deliberative approach to our bilateral economic and trade relationship with China, and that certainly applies to our review of these tariffs,” White Home Press Secretary Karine Jean-Pierre mentioned in December, per Bloomberg.

Sustaining a pleasant rivalry, avoiding a counterproductive conflict

Whereas Citadel’s Griffin is frightened that key U.S. industries are being challenged by Chinese language rivals, he was additionally clear that sustaining a constructive relationship with China is crucial transferring ahead. “The big issue is the geopolitical tension between the world’s two most important economies. And I really do hope that we continue to maintain some sense of the détente that has been playing out over the past few months,” he mentioned.

Griffin famous that some research present that the U.S. economic system would expertise an 8% to 10% GDP hit if we misplaced entry to Taiwanese semiconductors within the occasion of a battle with China.

“If there were a rupture around Taiwan, it would be catastrophic to both the Chinese and the American economies. And by catastrophic, I think you’re looking at Great Depression circumstances,” he added.

The worldwide economic system suffered by a chip shortage between 2020 and 2023 that affected 169 industries and prompted the Biden administration to enact the $280 billion CHIPS and Science Act to bolster U.S. provide. Though many crucial chips at the moment are again in inventory, the rise of AI has led to a brand new vulnerability within the trade. And Taiwan is on the heart of this trade, with the Taiwanese semiconductor large TSMC dominating the high-end AI chip market, though it’s been struggling to satisfy demand, even because it builds out new factories.

For Griffin, meaning U.S.-China relations are as necessary as ever. He argued the 2 nations want to make sure they at all times keep a “constructive tone” in discussions, even after they disagree. “It’s really important as a matter of national economic security that we’re able to maintain the peace in that region of the world,” he mentioned.