Key Notes

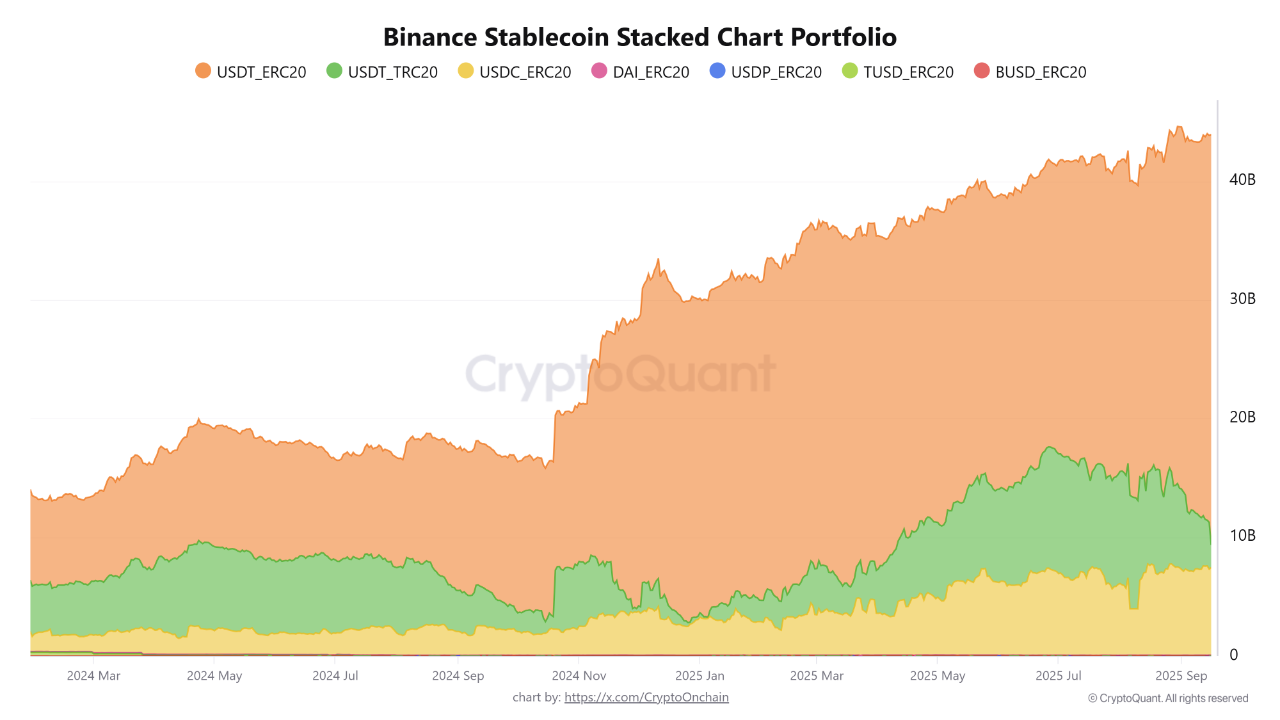

- ERC20-based USDT reserves surge to roughly $32.6 billion, offsetting a TRC20 decline.

- Single-day inflows on Binance recently exceeded $2.1 billion in USDT and USDC.

- Analysts see rising institutional deposits and a possible bullish Q4 for crypto markets.

Binance’s total stablecoin holdings have climbed to a record $45 billion as traders prepare for potential Q4 volatility.

Market analysts suggest this fresh liquidity may strengthen the exchange’s ability to support large trades, creating a more attractive environment for traders.

Data from CryptoQuant shows a clear shift toward Ethereum-based

ETH

$4 581

24h volatility:

2.1%

Market cap:

$552.78 B

Vol. 24h:

$42.37 B

stablecoins.

While TRC20 USDT holdings have dropped about $8 billion over the past few weeks, ERC20 USDT reserves have surged to $32.6 billion.

USDC on ERC20 has also grown steadily, now totaling around $7.4 billion.

Binance stablecoin stacked chart portfolio. | Source: CryptoQuant

Together, these gains pushed total Binance stablecoin reserves to a record $45 billion just as the Fed trimmed interest rates by 25bps.

On-chain data further reveals that the exchange recently saw more than $2.1 billion in combined USDT and USDC inflows in a single day.

Whale Deposits Rise

The surge is not limited to stablecoins. Bitcoin

BTC

$117 165

24h volatility:

0.6%

Market cap:

$2.33 T

Vol. 24h:

$58.16 B

inflows reached about $1 billion on September 16, marking the largest single-day BTC inflow of the week.

Average whale deposits have jumped to roughly $214,000, up sharply from $63,000 in July, underscoring growing institutional engagement.

With the Fed’s decision to cut interest rates by 25 bps, CryptoQuant data shows Binance attracting over $2.1 billion in USDT and USDC inflows. Whale deposits now average $214,000 vs. $63,000 in July, suggesting growing institutional activity.

Altcoin deposits are also booming:… pic.twitter.com/5q0ONVBuAL

— Ali (@ali_charts) September 18, 2025

Popular crypto analyst Ali Martinez noted on X that altcoin deposits on Binance are also accelerating, with 25,000 recorded versus just 6,000 on Coinbase. The overall altcoin address activity has nearly doubled since early September.

Altcoin Season Ahead?

This exchange reserve upswing coincides with seasonal trends that have historically favored crypto bulls. Fourth quarters have often delivered double-digit gains for both Bitcoin and major altcoins.

With less than two weeks left in September, many traders are positioning for a potentially strong finish to the year.

Crypto analyst 0xNobler recently pointed out on X that September has often marked the beginning of strong altcoin rallies.

The REAL Altcoin Season begins tomorrow 🔥

Every altseason has started in September – and this one won’t be any different.

Back in September 2021, I made over 200x on under-the-radar lowcaps.

Here are the best altcoins I’m buying today 👇🧵 pic.twitter.com/TDMZ8aGvdP

— 0xNobler (@CryptoNobler) September 17, 2025

He predicts that many alternative cryptocurrencies could climb as much as 175x in the coming months, highlighting HYPE

HYPE

$57.69

24h volatility:

5.1%

Market cap:

$15.64 B

Vol. 24h:

$739.79 M

, ONDO

ONDO

$1.05

24h volatility:

4.0%

Market cap:

$3.32 B

Vol. 24h:

$296.36 M

, and SUI

SUI

$3.88

24h volatility:

8.8%

Market cap:

$13.82 B

Vol. 24h:

$2.04 B

among his top picks for this cycle. This could be an important phase for investors looking for the next 1000x crypto tokens.

The broader crypto market has seen an upward trend on September 18, gaining 1.48% in market cap in the past day.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.