The world’s largest cryptocurrency change says it’s elevated year-over-year spending on compliance from $158 million to $213 million, buying a raft of latest software program programs to dam and report suspicious transactions. The elevated outlay additionally displays personnel prices, together with Binance’s determination to convey again govt Steve Christie as its deputy chief compliance officer.

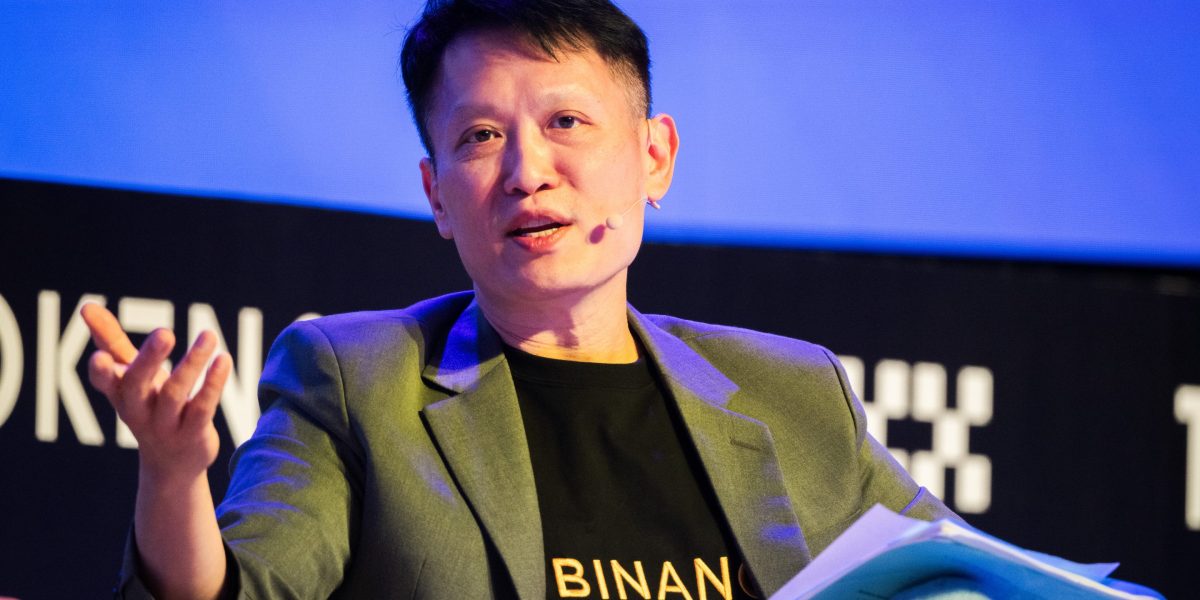

“We have significantly matured our compliance culture. This is made possible with the quality of our talent who continue to meet the new challenges and opportunities of this exciting and fast-evolving industry,” mentioned CEO Richard Teng, a former regulator who took over the highest job from Binance founder Changpeng Zhao in November.

Binance’s give attention to compliance is in stark distinction to its earlier days when the corporate grew to become the business chief partially due to its willingness to show a blind eye to dangerous actors utilizing its platform. Late final yr, the corporate entered a settlement with U.S. authorities to place an finish to a number of long-running investigations. The deal, which coincided with Zhao pleading responsible to prison cash laundering prices, requires the corporate to pay over $4 billion in fines and penalties.

As a part of the settlement, Binance should additionally settle for a court-appointed monitor tasked with upholding phrases imposed by the Division of Justice in addition to the Finance Crimes Enforcement Community and the sanctions-focused Workplace of International Belongings Management, each of that are divisions of the U.S. Treasury.

The imposition of the monitor is prone to stop Binance from partaking within the questionable techniques, together with skirting rules, that beforehand helped it achieve marketshare. The monitor has but to be formally appointed by the courtroom, however a Binance spokesperson mentioned the announcement is prone to come quickly. The selection of monitor relies on an inventory proposed by Binance and vetted by the businesses.

Zhao, in the meantime, is awaiting a sentencing listening to set for later this month at a Seattle federal courtroom. Studies have recommended he’ll obtain 18 months in federal jail, although the ultimate period of time might be much less or extra.

Regardless of all this, Binance has loved the identical bounceback skilled by others within the crypto business following the conviction of Sam Bankman-Fried, Zhao’s one-time rival and founding father of FTX, who’s going through a long time in jail after a fraud conviction.

Based on the corporate spokesperson, Binance pulled in over $3.5 billion in new funds in January, essentially the most in a month since November 2022, with whole property on the platform now over $80 billion—$10 billion larger than earlier than Zhao stepped down.

In an interview with Fortune, Christie mentioned he selected to return to Binance after taking some private time together with his household and that he believes the compliance tradition on the firm is stronger than ever, partially because of the presence of Chief Compliance Officer Noah Perlman, who as soon as served as the worldwide head of economic crimes at Morgan Stanley.

“The amount of tech Binance has for compliance, due diligence and transaction monitoring is unparalleled, said Christie. “There’s ore tech at your fingertips than anywhere I’ve worked.”