SweetBunFactory

Biogen Inc. (NASDAQ:BIIB) is a global biotechnology company developing therapies for neurological and neurodegenerative conditions. BIIB’s IP portfolio includes Lecanemab (Leqembi), Zuranolone, Skyclarys, Tofersen, and treatments for Multiple Sclerosis [MS]. Moreover, Leqembi’s 2023 approval in the US, Japan, and China addresses amyloid beta plaques, slowing Alzheimer’s disease [AD] progression. Zuranolone was also approved in 2023 as a fast-acting GABA receptor modulator for postpartum depression [PPD]. Skyclarys treats Friedreich’s Ataxia by activating the Nuclear Factor Erythroid 2-related (Nrf2) pathway, and Qalsody’s accelerated approval targets SOD1 gene mutations in ALS patients. Unfortunately, BIIB appears somewhat expensive with few meaningful growth prospects, so I rate it a “hold” for now.

Neutral Prospects: Business Overview

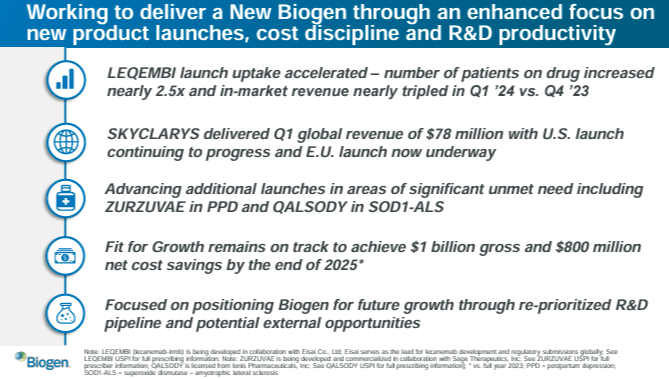

Biogen, founded in 1978, is a global biotechnology company focused on innovative therapies for neurological and neurodegenerative conditions. BIIB’s headquarters are in Cambridge, Massachusetts, USA. The company’s portfolio includes four approved drugs: Lecanemab (Leqembi), Zuranolone (Zurzuvae), Skyclarys (Omaveloxolone), and Tofersen (Qalsody). Additionally, the company advances its pipeline with assets in Alzheimer’s, neuropsychiatry, specialized immunology, neuromuscular disorders, Parkinson’s and movement disorders, multiple sclerosis, genetic neurodevelopmental disorders, and neuropathic pain.

Source: Corporate Presentation. April 24, 2024.

First, Lecanemab (Leqembi) was approved in 2023 by the US, Japan, and China. It is a monoclonal antibody indicated for AD that binds to amyloid beta [Aβ] plaques, clearing them from the brain. This prevents new plaques and lowers the number and size of existing ones. Thus, Lecanemab protects neurons from further damage, slowing AD progression and improving cognitive function. Its phase 3 clinical trial, Clarity AD, showed promising results in early-stage AD with a manageable safety profile. It’s worth noting that BIIB partnered with Eisai (OTCPK:ESALF) for this program. The idea is to leverage Eisai’s reach in Asia and Biogen in North America and Europe.

As for Zuranolone (Zurzuvae), it was FDA-approved in August 2023 for PPD and is on phase 3 trials for Major Depressive Disorder [MDD]. Zuranolone is a gamma-aminobutyric acid [GABA] receptor modulator that helps as an inhibitory neurotransmitter for regulating mood, anxiety, and neural excitability. Unlike other antidepressants, Zuranolone has a rapid action onset, improving symptoms within days. BIIB’s Skylark and Robin studies in phase 3 have rapidly alleviated postpartum depression [PPD] symptoms with well-tolerated side effects. These trials were part of Zuranolone’s Landscape and Nest programs.

Source: Corporate Presentation. April 24, 2024.

Moreover, BIIB’s Skyclarys (Omaveloxolone) is a nuclear erythroid 2-related factor 2 [Nrf2] activator approved in the US and the EU in February 2023. Nrf2 is a transcription factor, part of a cellular defense against oxidative stress and inflammation that improves mitochondrial function. FA is a rare genetic condition that damages the nervous system due to a reduced expression of an important protein for mitochondrial function: frataxin. Omaveloxolone’s clinical trials showed improved neurological functions in FA patients, reducing disease progression with a reasonable safety profile.

Tofersen is a synthetic nucleic acid that binds and degrades the messenger RNA [mRNA] produced by the SOD1 gene, reducing toxic SOD1 proteins that kill motor neurons. Tofersen’s clinical trials showed reduced SOD1 levels and stabilized motor and respiratory functions in ALS patients. This therapy is indicated for a familial form of Amyotrophic Lateral Sclerosis [ALS] related to superoxide dismutase 1 [SOD1] gene mutations presented in 2% of all ALS cases. Tofersen recently filed in the EU for reducing toxic ALS SOD1 protein.

Source: Corporate Presentation. April 24, 2024.

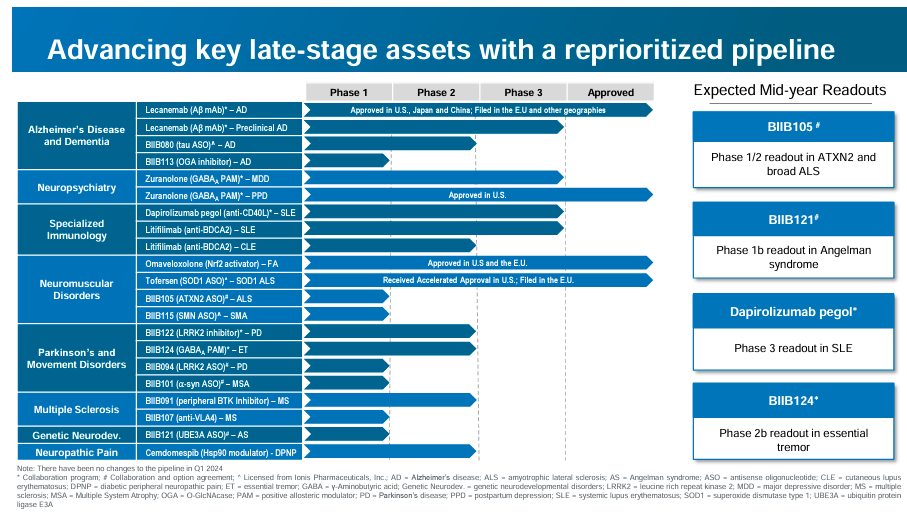

Additionally, BIIB’s pipeline includes: 1) For AD and DEM therapies, the drug candidates BIIB080, which reduces tau protein buildup to slow dementia, and BIIB113, a GGA protein inhibitor to reduce AD effects. Both drugs are researched in phase 2. Also, for 2) neuropsychiatry, BIIB’s Zuranolone modulates GABA receptors to relieve MDD symptoms (ongoing phase 3 trials). Lastly, BIIB’s 3) specialized immunology program has a phase 2 trial on Dapirolizumab pegol and Litifilimab. Dapirolizumab pegol blocks CD40L, reducing inflammation for systemic lupus erythematosus [SLE]. Litifilimab is an SLE anti-BCDCA2 for cutaneous lupus erythematosus [CLE], controlling immune response in lupus.

BIIB’s neuromuscular disorders category also includes BIIB105 for ALS therapy in phase 2, which lowers the ATXN2 protein. As for BIIB115, this one increases SMN proteins to enhance muscle function in spinal muscular atrophy [SMA] (phase 2). Moreover, BIIB’s drug candidates for Parkinson’s are 1) BIIB122, which inhibits LRRK2 protein to reduce PD progression, is in phase 2. 2) BIIB124 modulates GABA receptors to reduce tremors for essential tremor [ET] in phase 2. Finally, 3) BIIB094 reduces LRRK2 protein to slow PD advance in phase 1.

BIIB’s ongoing trials in MS include three phase 1 drugs: 1) BIIB104, which reduces α-synuclein to protect nerve cells, indicated for MS atrophy. 2) BIIB091 targets VL4 to regulate the immune response in MS. And 3) BIIB118, a peripheral BTK inhibitor that reduces immune cell activity in MS. The company also has a phase 1 genetic neurodevelopmental disorders trial on BIIB121, which increases UBE3A protein, improving neurological function for Angelman syndrome [AS]. It’s also worth mentioning that BIIB’s Compendosib is in phase 1 trials for neuropathic pain as an Hsp90 modulator that alleviates diabetic peripheral neuropathic pain [DPNP].

Challenges in Alzheimer’s and ALS

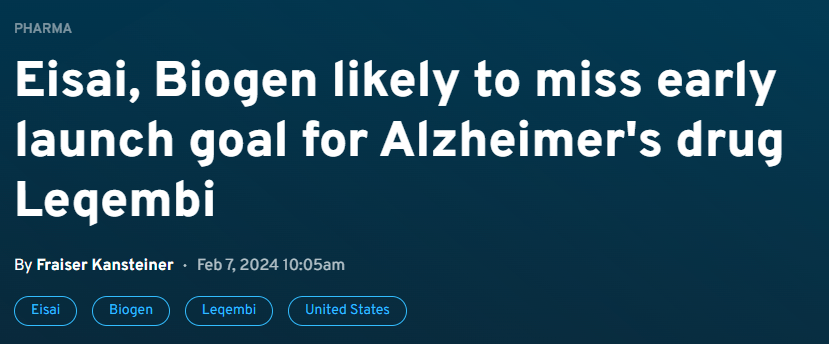

Biogen Inc.’s Leqembi is an approved treatment for amyloid-beta plaques produced by Alzheimer’s disease (AD), which is expected to reach a market size of $15.5 billion by 2031. Despite this potential, Leqembi’s market adoption has slowed, with only 2,000 patients enrolled in the US, far short of its goal of 10,000 by March 2024. This slowdown is partly due to intense competition from other AD treatments, such as Lilly’s (LLY) Donanemab, which the FDA approved on July 02, 2024, and will be marketed as Kisunla. Remternetug is currently in phase 3. These competing drugs offer more convenient dosing schedules, with doses every four weeks compared to Leqembi’s every two weeks. However, Leqembi’s monthly dosages have a PDUFA date set for January 25, 2025.

Source: Fierce Pharma.

For context, Donanemab clears N3pG-modified amyloid-beta plaques. In contrast, Leqembi eliminates soluble and insoluble amyloid-beta protofibrils to stop plaque formation, theoretically making Leqembi’s approach more comprehensive for handling amyloid-beta levels. Furthermore, other upcoming competitors include Anavex Life Sciences’ (AVXL) Blarcamesine (Phase ⅔), Roche’s (OTCQX:RHHBY) and UCB’s (OTCPK:UCBJY) Bepranemab (Phase 2), and Cassava Sciences’ (SAVA) Simufilam (Phase 3).

Leqembi’s annual treatment cost is $26,500 in the US and $20,400 in Japan. Notably, Eisai and Biogen also launched Leqembi in China on June 28, 2024, where each vial costs $345.04 for two weeks. Likewise, the ALS market is expected to reach $1.3 billion by 2029 due to early intervention treatments requiring complex therapies. However, BIIB once again faces tough competition here as well. Competitors include 1) Sanofi’s (SNY) Rilutek, 2) Mitsubishi Tanabe Pharma’s (OTCPK:MTLHY) Radicava and its 3) oral formulation (ORS), 4) Avanir Pharmaceuticals’ (OTCPK:OTSKY) Dextromethorphan/Quinidine, and 5) ITF Pharma’s recently approved thickened riluzole suspension.

Expensive Headwinds: Valuation Analysis

BIIB trades at a $34.5 billion market cap from a valuation perspective, placing it among the sector’s pharma giants. Its balance sheet holds $1.1 billion in cash against financial debt. It has $26.6 billion in total assets, most of it ($17.8 billion) stemming from PPE, Goodwill, and Intangibles, which aligns with its recent acquisition of Reata Pharmaceuticals and its crown jewel Skyclarys. On the other hand, its total liabilities amount to $11.4 billion, most in financial debt ($6.5 billion), and the rest seem to be operating liabilities. Thus, BIIB’s equity is $15.2 billion, implying it’s considerably leveraged with a Debt-to-Equity ratio of 75.0%. Moreover, it also means BIIB’s enterprise value is $39.9 billion.

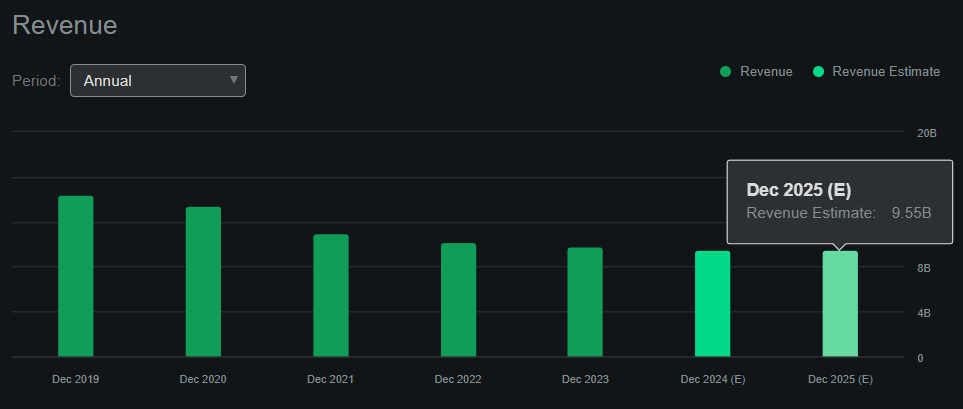

Lackluster revenue growth. (Source: Seeking Alpha.)

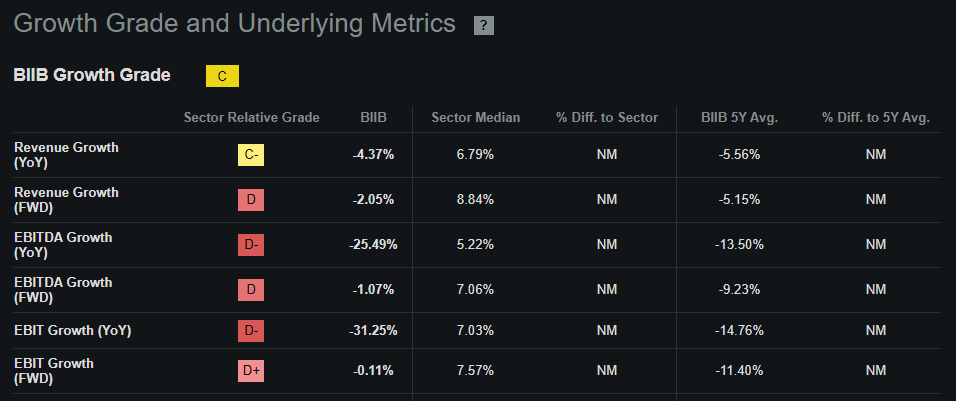

The latest quarterly EBIT was $464.8 million, with depreciation and amortization of $147.5 million (from its 10-Q cash flow statement). Annualizing that quarterly EBITDA of $612.3 million implies an annual EBITDA run rate of $2.5 billion. I won’t assume growth for this figure because, according to Seeking Alpha’s dashboard on BIIB, its sales are forecasted to remain relatively flat YoY into 2025. Hence, this suggests that BIIB trades at an EV/EBIT ratio of 16.0. For comparison, its sector median EV/EBITDA multiple is 15.8, so BIIB appears in line with that market multiple. However, BIIB’s EBITDA growth of -25.5% is noticeably subpar compared to 5.2% for its sector.

Source: Seeking Alpha.

Through different angles of analysis, I think BIIB’s upside potential seems capped and somewhat expensive. I also don’t believe the company is in danger, as it has positive EBIT and EBITDA, so the business seems self-sustainable. However, it’s not trading at a compelling valuation, especially considering its muted growth and competitive prospects. Therefore, I rate BIIB a “hold.”

Lean Neutral: Risk Analysis

The underlying business is safe for the long term. I estimate its quarterly cash flows were $432.3 million by adding its CFOs and Net CAPEX. Annualizing that figure implies $1.7 billion in yearly positive cash flow. Moreover, Leqembi may pick up despite its disappointing initial rollout figures, which could provide some extra growth. This is why I believe the biggest risk to BIIB at this juncture lies in its valuation, which appears above average. On the other hand, I don’t see any significant risk catalysts that could trigger a substantial downside for BIIB. Its business appears relatively stable at this stage.