New York Group Bancorp, Inc. (NYSE: NYCB) shares plummeted by 45% as we speak after a dividend minimize and an sudden loss on earnings. And as historical past has confirmed, when banks are bleeding, Bitcoin typically is a beneficiary. This time isn’t any completely different, with BTCUSD making new report highs towards the NYCB inventory value.

New York Group Bancorp Shares Endure 45% One-Day Collapse

In March of 2023, Bitcoin made an enormous transfer from its backside vary on the heels of a collapse in the banking system. Again then, Signature, Silicon Valley, and Silvergate every noticed intensive financial institution failures. The shares of every financial institution sank forward of the failures, tipping off the market that one thing was awry. Silvergate, particularly, was later acquired by New York Group Bancorp within the aftermath.

Now it’s New York Group Bancorp that noticed its share tank by 45% in a strong pre-market selloff. The promoting stress was pushed by a 71% discount in quarterly dividend payouts to shareholders, from $0.17 to $0.05. Two dangerous loans additionally added to a stunning earnings loss. The shares of different regional banks suffered as effectively.

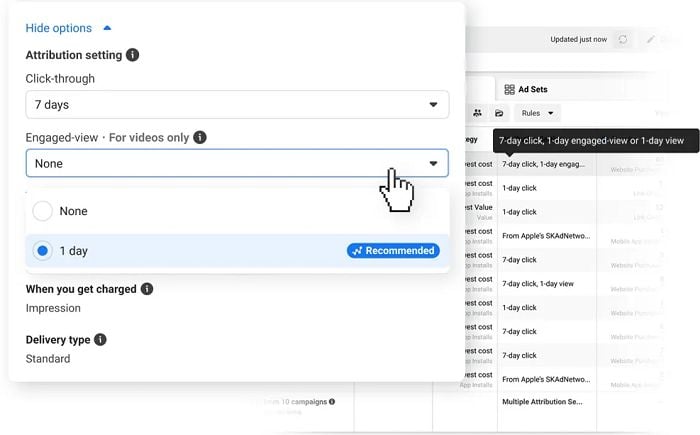

A brand new report excessive towards NYCB | BTCUSD on TradingView.com

Bitcoin Units New ATH Document In opposition to Regional Financial institution

With extra hassle hitting regional banks as we speak, BTCUSD has made a brand new all-time excessive when priced in shares of NYCB. Contemplating the carnage within the conventional financial institution, this isn’t all that stunning. Nonetheless, it’s probably a notable improvement. Up to now, every time a brand new all-time excessive was made, Bitcoin saved making new highs month after month for roughly a full 12 months.

If Bitcoin stays bullish for round a 12 months, 2024 might show to be probably the most fascinating years for the cryptocurrency market ever.

Previous ATHs led to a sustained bull run | BTCUSD on TradingView.com

One other Victory For Satoshi Nakamoto

BTC was designed by Satoshi Nakamoto to permit people to decide out of the normal banking system, which has been in hassle for the reason that 2008 Nice Monetary Disaster. Hidden inside the Genesis Block of the Bitcoin blockchain is a headline from The Instances that reads “Chancellor on brink of second bailout for banks” in reference to a sequence of bailouts following the disaster.

15 years later, Bitcoin was simply permitted for a spot ETF, enabling widespread mainstream entry into the digital asset. If the banking system reveals additional weak spot, wealth could proceed to circulation into the BTC market cap by the best way of those new ETF wrappers.