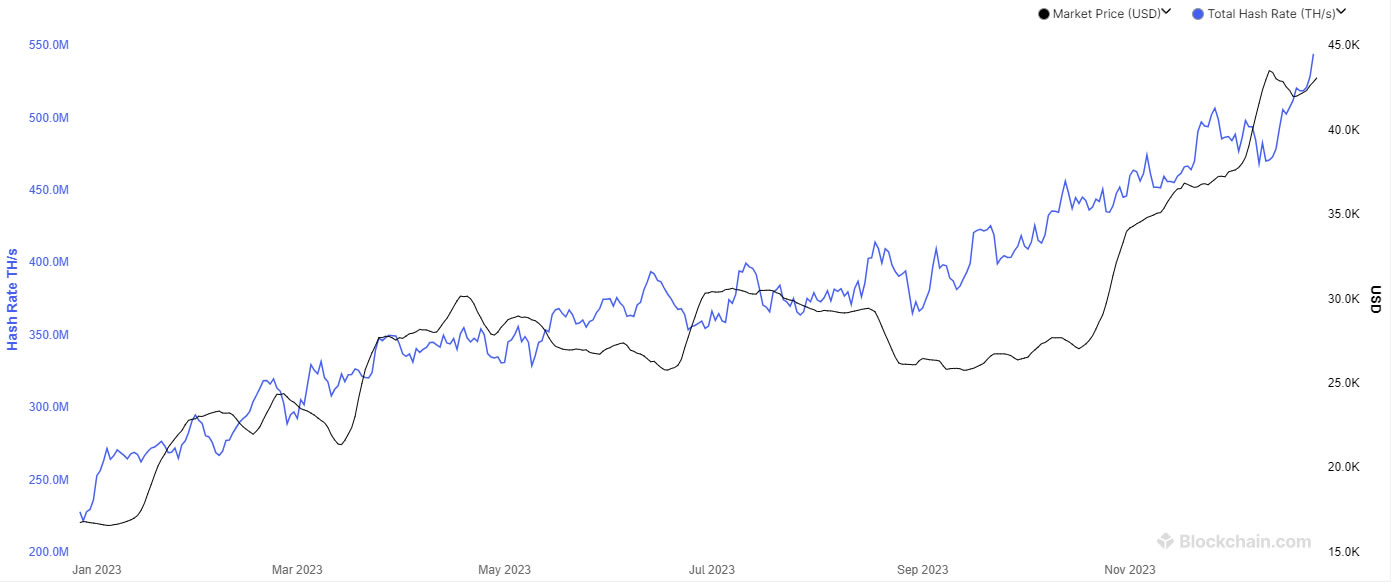

In 2023, the Bitcoin hashrate has surged by a staggering 130% which reveals rising competitors and lowered profitability for miners.

The computing energy of the Bitcoin community, also referred to as the mining hashrate, hit a report excessive on Christmas Day, including to the challenges confronted by miners within the wake of declining profitability.

Blockchain.com reported that on December 25, Bitcoin’s hash charge achieved an unprecedented stage of 544 exahashes per second (EH/s), a knowledge level corroborated by Bitinfocharts, which recorded a median hash charge peak over the weekend.

This improvement happens in opposition to the backdrop of a considerable improve in community hash charges all year long, surging by 130% since January.

-

Picture: Blockchain.com

- Throughout the identical timeframe that BTC hash charges have surged, the asset’s value has intently adopted swimsuit, experiencing a acquire of over 150% since January 1, 2023.

- Will Clemente, co-founder of Reflexivity Analysis, analyzed the hash charge on a logarithmic scale and remarked, “The summer 2021 China mining ban is barely a blip.” He added, “Imagine fading the most secure decentralized open-source monetary network on the planet, couldn’t be me.”

Whereas a excessive hash charge could also be helpful for theoretical value fashions like implied hash-adjusted value, it poses challenges for miners who now face elevated competitors to safe the subsequent block. The hash value, a metric indicating profitability, has declined up to now week as a consequence of a waning curiosity in BRC-20 ordinal inscription. As of now, the hash value stands at $0.09 per terahashes per second per day, according to HashrateIndex.

Profitability has skilled a 34% decline since reaching its peak of $0.136/TH/s/day on December 17, 2023. Hash value tends to surge during times of elevated demand, resulting in elevated transaction charges, as seen within the latest frenzy of inscriptions.

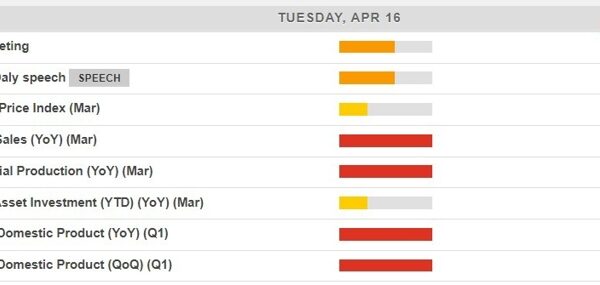

Bitcoin ETF Replace Deadline

In one other improvement, these searching for approval for a spot Bitcoin exchange-traded fund (ETF) should full their filings throughout the subsequent few days to stick to the upcoming deadline set by the US Securities and Alternate Fee (SEC).

The SEC has stipulated that candidates for spot Bitcoin ETFs should submit closing S-1 amendments by December 29, as reported by Reuters, primarily based on data from public memos and people accustomed to the discussions.

The anticipated approval of a Bitcoin spot ETF by the SEC is a pivotal development, poised to draw important institutional capital. If realized in 2024, specialists venture over $240 billion flowing into Bitcoin within the first yr post-approval. This inflow, coupled with diminished promoting stress from miners, might drive a considerable value surge, probably pushing Bitcoin into six-figure territory. Regardless of the constructive outlook, considerations persist about heightened volatility with elevated involvement of conventional market gamers in Bitcoin’s dynamics.

Including to the intrigue is Bitcoin’s impending block reward which is scheduled for April 2024. This occasion halves the bitcoins rewarded to miners, decreasing provide issuance. Traditionally, such halvings have sparked important value surges, creating a good supply-demand imbalance in favor of patrons.