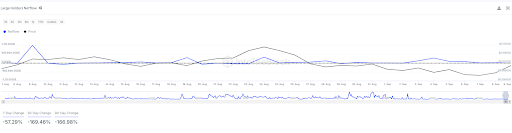

Recent market analysis has revealed a significant shift in Bitcoin capital flow from short-term holders (STH) to long-term holders (LTH).

Particularly, according to CryptoQuant analyst IT Tech, short-term investors have been selling off their positions amid recent market volatility, while long-term investors continue to accumulate.

The Current Trend In Short And Long-Term Holders

Short-term holders have seen a significant decline in their net positions over the past two weeks, according to the CryptoQuant analyst. Many of these investors have exited the market, either taking profits or cutting their losses, indicating uncertainty about Bitcoin’s short-term price direction.

IT Tech highlighted that the drop in STH positions further illustrates the reduced risk appetite of these investors. This behavior reflects a common trend where less confident investors react to price swings by reducing their exposure.

In contrast, long-term holders appear to seize the opportunity created by the recent market volatility. IT Tech’s analysis shows an increase in LTH net positions, suggesting that these investors view the current price levels as attractive for accumulation.

IT Tech noted:

Accumulation as a Bullish Signal: Green areas on the net position chart indicate that LTH are increasing their holdings, which is a bullish signal for the market, as LTH are often seen as more stable and confident in their investments.

The analyst added that the net position increase in LTH also indicates a broader market trend where investors with a longer outlook are capitalizing on Bitcoin’s current valuation. By increasing their holdings, long-term holders are betting on future growth.

What The Shifting Capital Means For Bitcoin

Regarding the overall implication of this capital shift, IT Tech disclosed that the shift from short-term to long-term holders presents a mixed outlook for the Bitcoin market. The analyst noted:

LTH Accumulation: Increased accumulation by LTH could lead to price stabilization and position the market for a potential rebound, while STH sell-offs may create short-term downward pressure on BTC prices.

However, according to the latest data shown by IT Tech, the implication for the LTH accumulation appears to be the one currently winning in the market.

The analyst concluded: “The data shows a clear capital flow from weak hands (STH) to strong hands (LTH), signaling a market stability.’

Featured image created with DALL-E, Chart from TradingView