On-chain knowledge exhibits the proportion of Bitcoin quantity occupied by the exchanges has shot as much as all-time excessive ranges. Right here’s what it may imply.

Bitcoin Change Quantity Dominance Has Elevated To 76.4%

Based on knowledge from the on-chain analytics agency Glassnode, the trade quantity dominance has been at excessive ranges not too long ago. The “exchange volume dominance” refers back to the share of the overall Bitcoin on-chain volume flowing out and in of all centralized exchanges.

Usually, traders use these platforms at any time when they need to take part in shopping for or promoting actions. Thus, when the exchanges observe a excessive quantity, it means that BTC customers are actively serious about buying and selling proper now.

However, low values of the trade quantity dominance indicate transactions between self-custodial entities are at the moment the dominant type of motion on the blockchain.

This might counsel that the traders choose to commerce by over-the-counter (OTC) means or another utility of the blockchain involving peer-to-peer (P2P) transactions is what the traders are engaged in.

There’s additionally one other chance: the community as a complete is inactive, so whereas exchanges are seeing lesser dominance, the volumes outdoors aren’t exceptionally excessive, both.

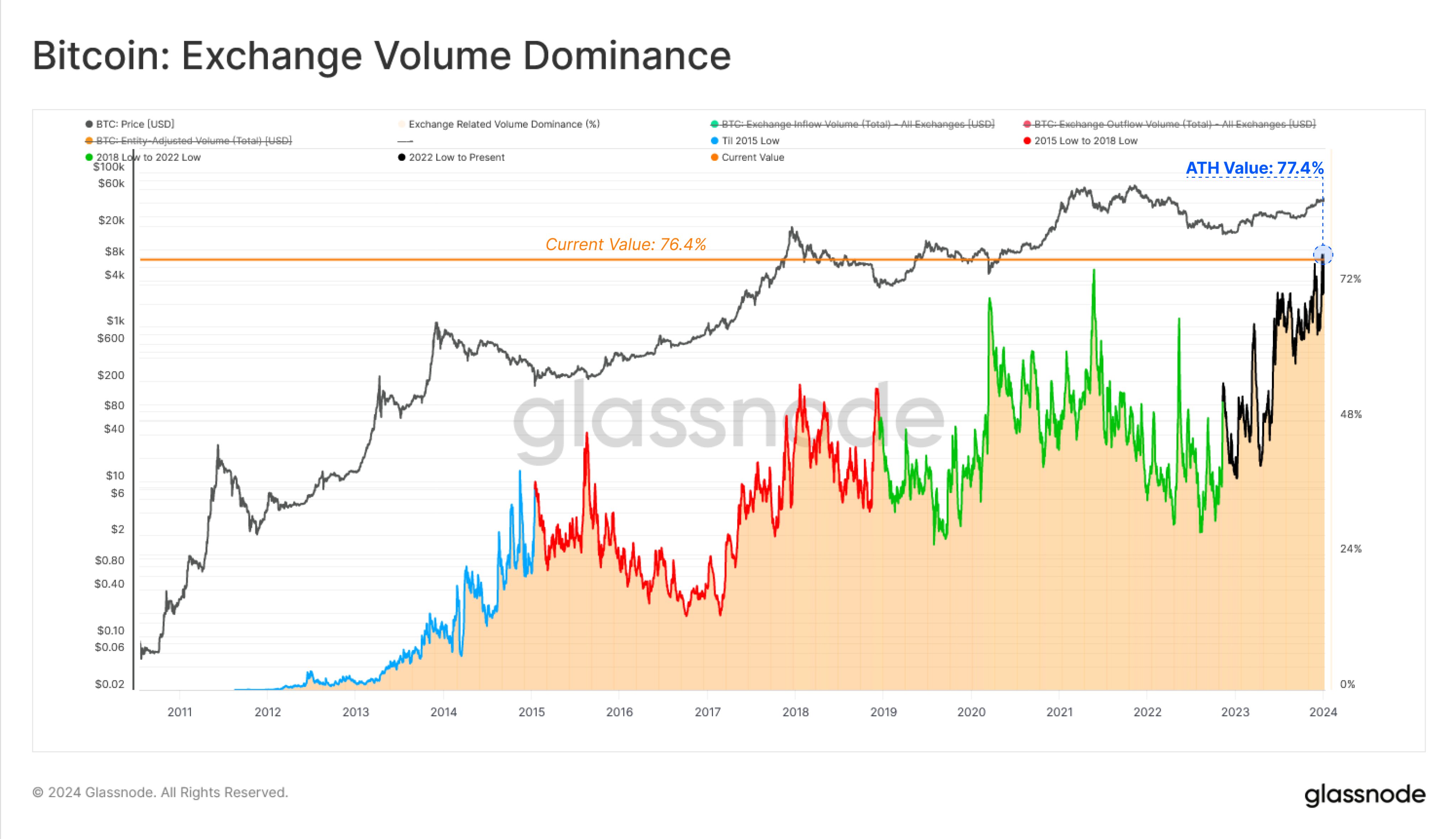

Now, here’s a chart that exhibits the development within the Bitcoin trade quantity dominance over the historical past of the cryptocurrency:

The worth of the metric appears to have been going up in current days | Supply: Glassnode on X

As displayed within the above graph, the Bitcoin trade quantity dominance had been comparatively excessive in the course of the second half of 2023, however the indicator has spiked particularly excessive not too long ago.

Throughout the peak of this newest surge, the indicator managed to set a brand new all-time excessive (ATH) of 77.4%. Presently, the metric is floating at barely decrease ranges of 76.4%.

The chart exhibits that the trade quantity dominance has traditionally noticed giant spikes alongside selloffs within the asset. These spikes have often been occasions that diverged removed from the norm, although, whereas the current spike has solely taken the indicator to ranges not too increased than the previous development.

This newest curiosity in transferring cash into and out of exchanges has come because the BTC ETF deadline is simply across the nook, which many count on to finish in approval from the US SEC.

Throughout the previous day, there has additionally been a fake ETF announcement on SEC’s own X handle, ensuing within the account turning into compromised. The information additionally triggered fairly a response from the market, so, unsurprisingly, the exchanges have been busy processing withdrawals and deposits.

As soon as the ETF resolution is handed, the merchants will possible once more make a big variety of strikes, thus additional propping the trade quantity dominance at these excessive ranges.

BTC Value

Following its decline over the last 24 hours, Bitcoin is right down to about $45,100. The beneath chart exhibits the volatility the asset has gone by throughout this era.

Seems like the value of the coin is on its technique to erase its current positive factors | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com