On-chain knowledge exhibits the Bitcoin community has been fairly low cost just lately, because the transaction price per block has been close to cycle lows.

Bitcoin Miners Have Been Receiving Low Charges Just lately

As analyst James Van Straten identified in a brand new post on X, the BTC transaction price has been floating round cycle lows just lately. The “transaction fee” right here naturally refers back to the price that customers should connect with their transfers on the Bitcoin blockchain as a reward for the miner who processes them.

This metric’s worth is mostly immediately associated to the visitors that the community is observing. In occasions of excessive exercise, transactions can keep caught for lengthy intervals within the mempool, because the community solely has a restricted capability to deal with strikes.

Customers who’re in a rush might go for higher-than-average charges throughout such intervals in order that the miners prioritize their strikes. Throughout particularly congested intervals, the typical price can blow up as many senders compete with one another to get transfers by way of first.

When there’s little visitors on the blockchain, although, the customers don’t have a lot incentive to pay a big price, so the typical on the community tends to remain low in such intervals.

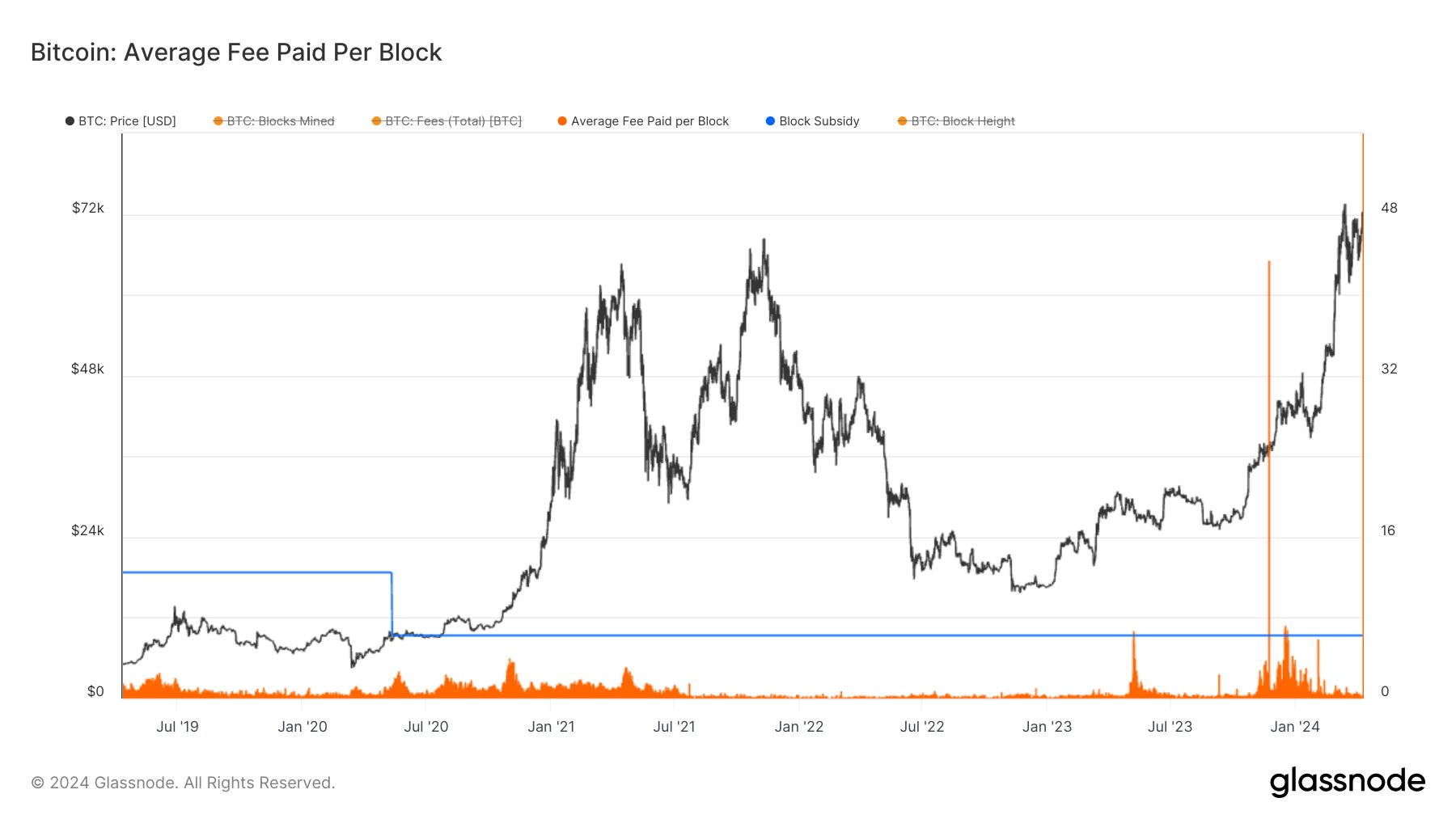

One solution to gauge the pattern within the transaction price over a protracted interval is to measure the typical price paid to the miners per block. The chart under exhibits how this metric’s worth has modified for the Bitcoin community over the previous few years.

The worth of the metric appears to have been fairly low in current days | Supply: @jvs_btc on X

Because the graph exhibits, the Bitcoin common price paid per block has been fairly low just lately. This means that the miners haven’t been incomes a lot from charges.

In the identical chart, knowledge for the block subsidy (the entire quantity of rewards that miners obtain per block) has additionally been displayed. It might seem that it has traditionally been fairly uncommon for the transaction charges to match these rewards and on the present lows, the price can be solely a fraction of them.

The block subsidy and transaction charges mixed make up for the whole income of the Bitcoin miners, however because of the imbalance between them, the previous has been the primary supply of earnings for the miners.

Whereas this has labored for these chain validators, it won’t be the case eternally. The BTC provide is proscribed, so miners finally run out of block subsidies.

However even earlier than that, there’s a rather more imminent risk posed by the halvings, periodic occasions the place block rewards get completely reduce in half. Halvings happen each 4 years, with the following one developing in about 9 days.

At current, the BTC block subsidy is 6.25 BTC per block, however this halving would cut back it to three.125 BTC. With each subsequent halving, this reward would solely shrink additional, which means the primary supply of earnings for the miners would proceed to get squeezed.

As such, the long-term future for the miners would lie within the transaction charges. This previous yr, the price has matched the block reward in a number of situations, primarily fueled by the Inscription mania. Maybe functions just like the Inscriptions can be what is going to drive the charges sooner or later as nicely.

Straten has recognized an fascinating sample within the charges’ pattern. It might seem that charges picked up earlier than the final halving and continued to rise after it. The analyst expects one thing much like play out this time as nicely.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $69,400, up greater than 3% over the previous week.

Seems like the worth of the asset has gone down just lately | Supply: BTCUSD on TradingView

Featured picture from Brian Wangenheim on Unsplash.com, Glassnode.com, chart from TradingView.com