Bitcoin (BTC) on-chain transaction charges are dividing opinion as the price of sending BTC skyrockets.

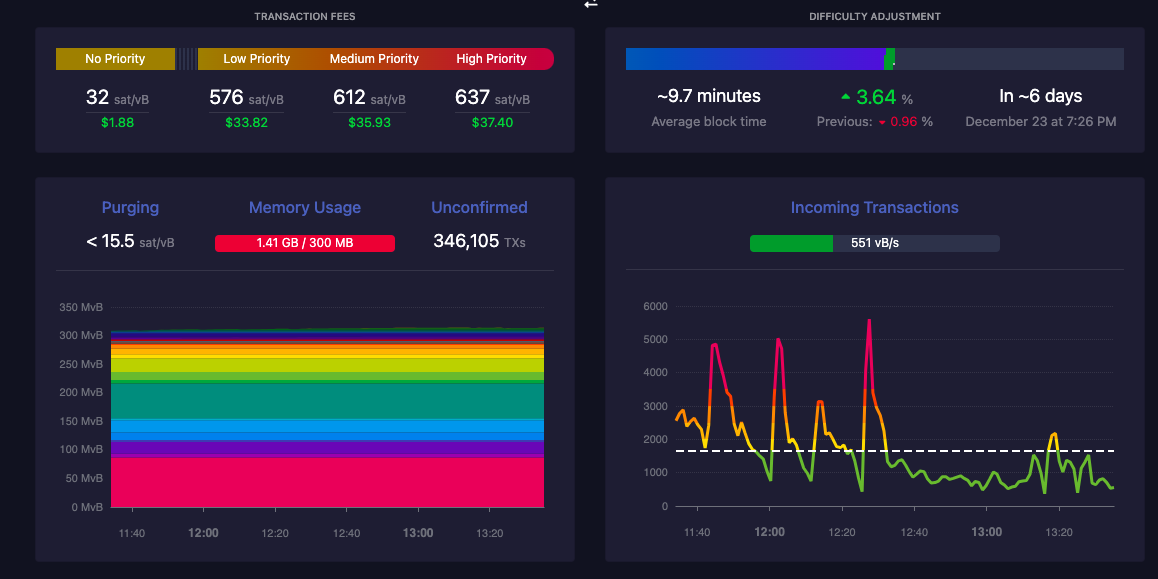

Data from the statistics useful resource BitInfoCharts places the common transaction payment at almost $40 as of Dec. 17.

Commentators: Excessive Bitcoin charges are inevitable

The newest wave of Bitcoin Ordinals inscriptions has resulted in elevated transaction charges for all community customers — however some imagine that they’re right here to remain.

Per BitInfoCharts, it presently prices simply over $37 to ship BTC on-chain — the very best common determine since April 2021.

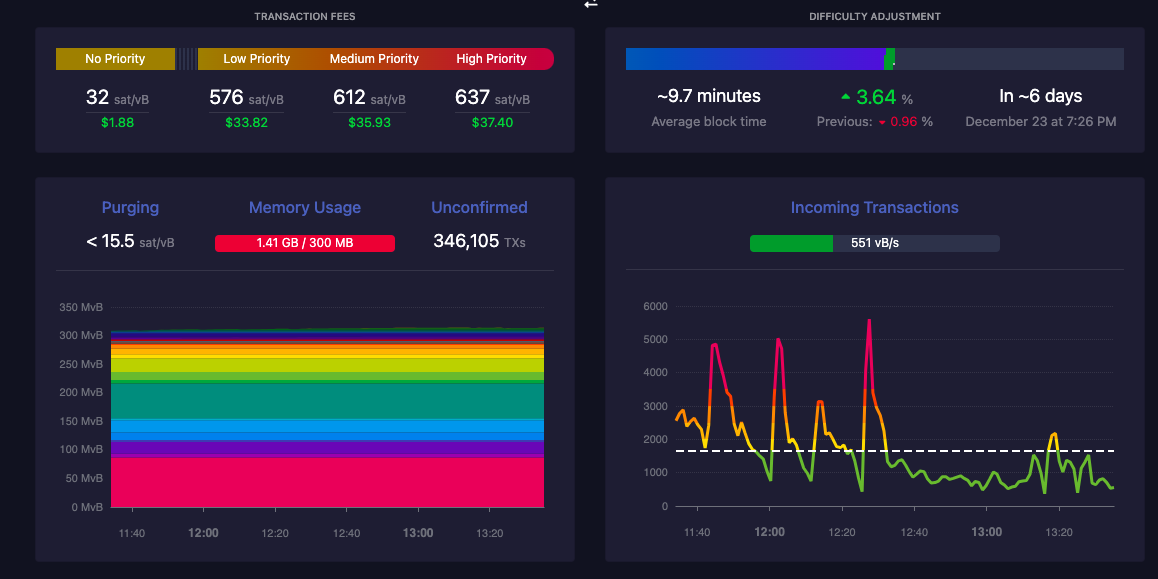

Further figures from Mempool.space present that Bitcoin’s mempool — the scale of the unconfirmed on-chain transaction backlog — is huge, leading to transactions with an connected payment of even $2 having no on-chain precedence.

Virtually 350,000 transactions are ready to be confirmed on the time of writing.

As informal on-chain spending turns into unviable for a lot of smaller traders, a heated debate amongst Bitcoin proponents continues.

Whereas many are offended on the affect of Ordinals on charges, widespread Bitcoin figures argue that double-digit transaction prices are merely a style of issues to come back. These desirous to defend themselves have to embrace so-called layer-2 options such because the Lightning Community, which is particularly designed to cater to mass adoption.

“Fees are currently artificially and temporarily high due to JPEG clownery, but it is nothing more than a glimpse into the future. Scaling doesn’t happen on L1,” widespread commentator Hodlonaut wrote in one among many posts on the subject on X (previously Twitter) on Dec. 16.

Persevering with, Hodlonaut argued that demanding low charges for “Level 1” transactions is “not just ignorant, it feeds into an attack on bitcoin.”

This displays on the very composition of Bitcoin itself as a competition-based community gaining worth over time as proof-of-work intends. Protecting charges low is contradictory, and as arduous forks of the Bitcoin community particularly supposed to supply that profit have proven, doesn’t appeal to worth.

“Why is it critical to onboard someone to L1 with sub $1 fees, if they can’t afford to move the funds in five years anyway? Go to bcash or another centralized pipe dream already,” Hodlonaut added, referring to 1 such offshoot, Bitcoin Money (BCH).

Miners take pleasure in finest USD revenues in two years

Elsewhere, well-known commentator Beautyon reiterated that regardless of the charges, Bitcoin continues to operate as supposed.

Associated: Navigating this bull market and securing revenue might be harder than it appears

“If Ordinals bring the high on chain world to everyone earlier than expected, it will act like a scythe cutting down everyone who did not accept a Layer 2 solution to the network fee problem,” a part of a current X put up stated.

“Many users will be confused, upset and ready to abandon Bitcoin. There will be no recourse for them, obviously, because there is no one to blame, no one to seek compensation from; after all this is the normal state of the network. The rules are being followed, and those are the rules you agreed to, Bored Apes!”

That perspective is shared by Bitcoin veteran Adam Again, co-founder of Bitcoin and blockchain expertise agency Blockstream.

For him, the reply likewise lies in increasing layer-2 capabilities as a substitute of counting on something past miner payment incentives.

“You can’t stop JPEGs on bitcoin,” he concluded.

“Complaining will only make them do it more. Trying to stop them and they’ll do it in worse ways. The high fees drive adoption of layer2 and force innovation. So relax and build things.”

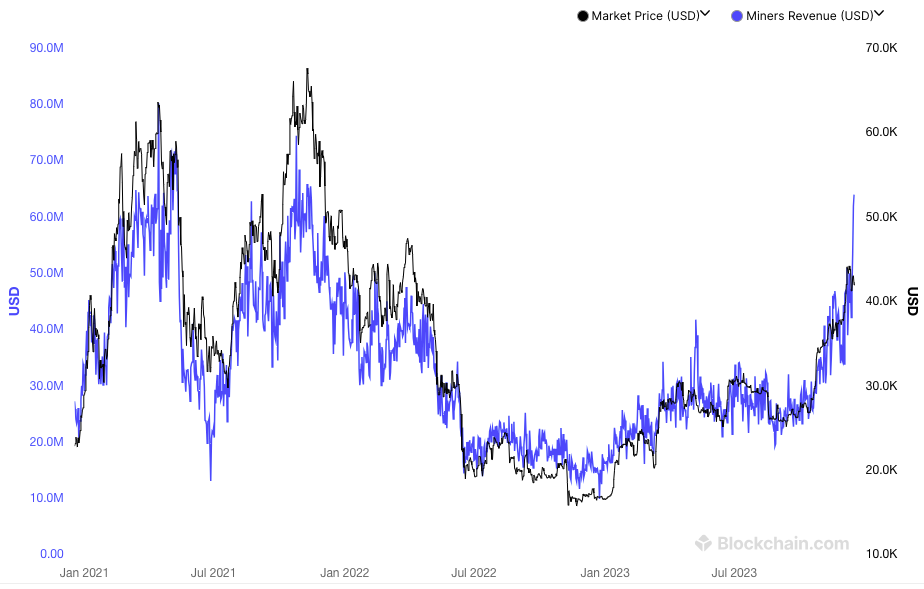

Information from Blockchain.com shows miners’ income — the sum complete of block subsidies and charges in USD — hitting ranges final seen when Bitcoin hit its present $69,000 all-time excessive in November 2021.

BTC/USD traded at round $42,000 towards the Dec. 17 weekly shut, per information from Cointelegraph Markets Professional and TradingView.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.