On-chain information exhibits that Bitcoin and Dogecoin have managed to high the charts concerning holder profitability. Right here’s what the rating seems like.

Bitcoin & Dogecoin Are Amongst Cash With Highest Investor Profitability Ratio

In a brand new post on X, the market intelligence platform IntoTheBlock talked about how holder profitability compares between a few of the high layer-1 networks within the sector.

Right here, holder profitability refers back to the whole proportion of buyers or addresses on a given cryptocurrency community which might be at present carrying some internet unrealized positive aspects.

This metric works by going via the transaction historical past of every deal with on the blockchain to seek out the typical value at which it acquired its cash. If this common price foundation for any holder is lower than the present spot value of the asset, then the investor is assumed to be holding earnings.

The indicator sums up all such addresses and finds what proportion of the entire they make up for. Naturally, the buyers with their price foundation larger than the present value are counted underneath losses as a substitute, and people with the 2 being equal are thought of to be simply breaking even.

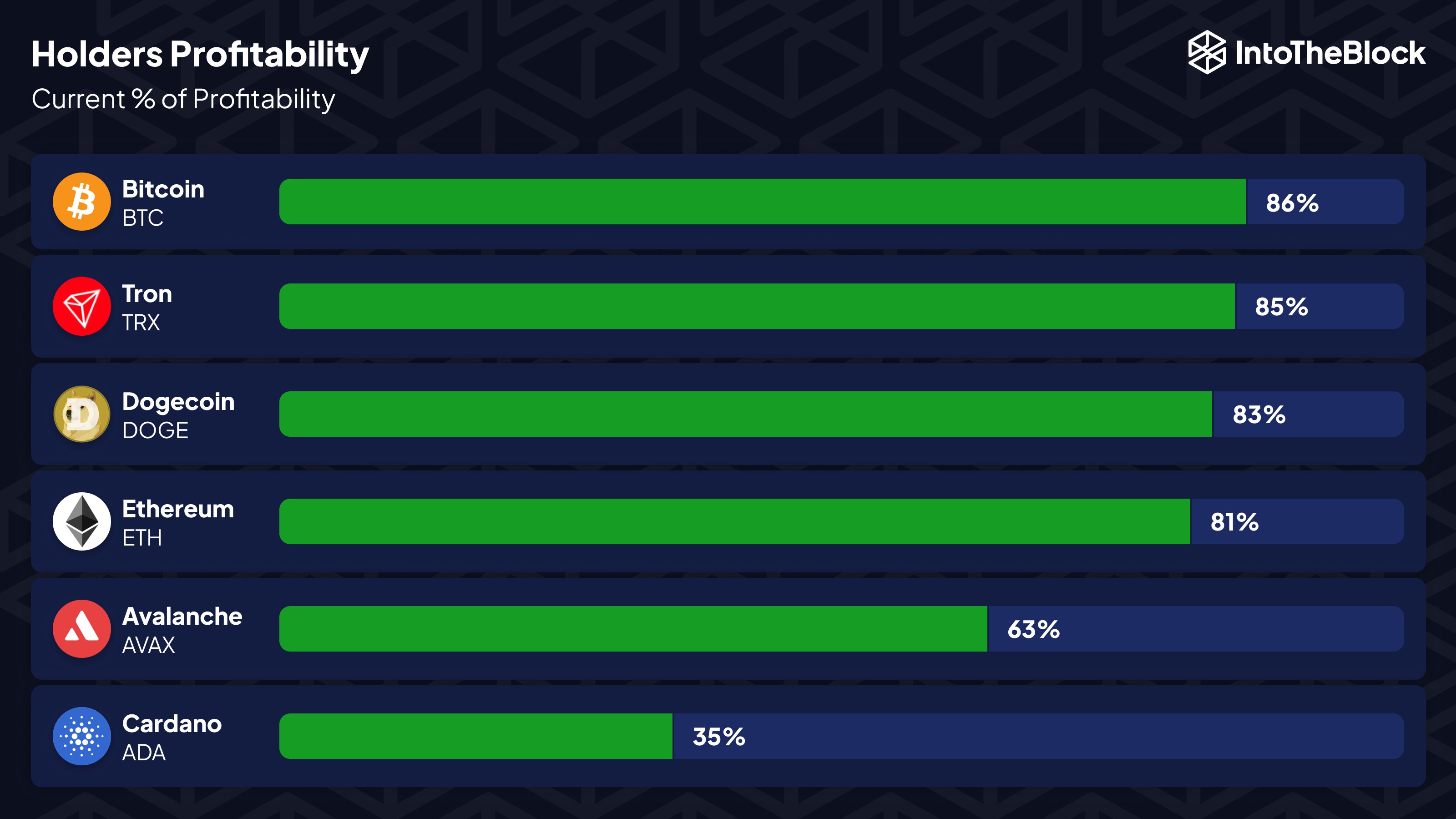

Now, here’s what the holder profitability seems like throughout six high cash: Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Cardano (ADA), Avalanche (AVAX), and Tron (TRX).

The rating of those high property primarily based on their respective holder profitability | Supply: IntoTheBlock on X

Because the graph exhibits, Bitcoin is at present the primary cryptocurrency when it comes to holder profitability, with 86% of its addresses within the inexperienced. Tron is second with 85%, whereas Dogecoin is third with 83%.

These property have crushed Ethereum on this metric regardless of the asset being the second largest within the community primarily based in the marketplace cap. Although, at 81% profitability, ETH isn’t too far behind.

The state of affairs seems a lot worse for the Avalanche and Cardano buyers, with the latter community being particularly dire. 63% of AVAX buyers are in revenue proper now, so at the least most of them are within the inexperienced, however the identical can’t be stated about ADA, as simply 35% of holders float above water.

Usually, the buyers in earnings usually tend to take part in promoting at any level, so the danger of mass selloffs can enhance as holder profitability will increase.

Cash like Bitcoin and Dogecoin have profitability at excessive ranges, however this isn’t unusual for bull markets. Profitability can keep much more excessive in such durations, so the present ranges could also be barely cooled off.

Like how tops have traditionally been extra possible to type at excessive profitability ranges, bottoms can happen when a low proportion of the buyers are within the inexperienced, as profit-sellers exhaust at this stage.

Going by this, Cardano’s low profitability (and likewise Avalanche’s, to a level) could also be a constructive signal for the worth, because it suggests there could possibly be notable potential for a rebound.

BTC Value

Bitcoin has retraced the restoration it had made earlier within the week as its value has now slid down in direction of $63,200.

The value of the asset seems to have plunged over the previous day | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, IntoTheBlock.com, chart from TradingView.com