Key Notes

- Bitcoin exchange reserves have fallen to historic lows near 2.76M BTC.

- Long-term holders and institutions continue withdrawing BTC from exchanges.

- Analysts expect a possible breakout toward $100K heading into Christmas.

Bitcoin

BTC

$90 554

24h volatility:

1.3%

Market cap:

$1.81 T

Vol. 24h:

$44.74 B

is once again trading at the $90,000 range with a 2% drop in 24 hours, raising short-term concerns.

However, analysts claim that BTC is quietly entering the early stages of a supply squeeze, a setup that has historically led to massive price rallies.

Meanwhile, exchange balances have fallen, and long-term holders are accumulating as the market watches whether Bitcoin can capitalize on this tightening supply heading into the Christmas period.

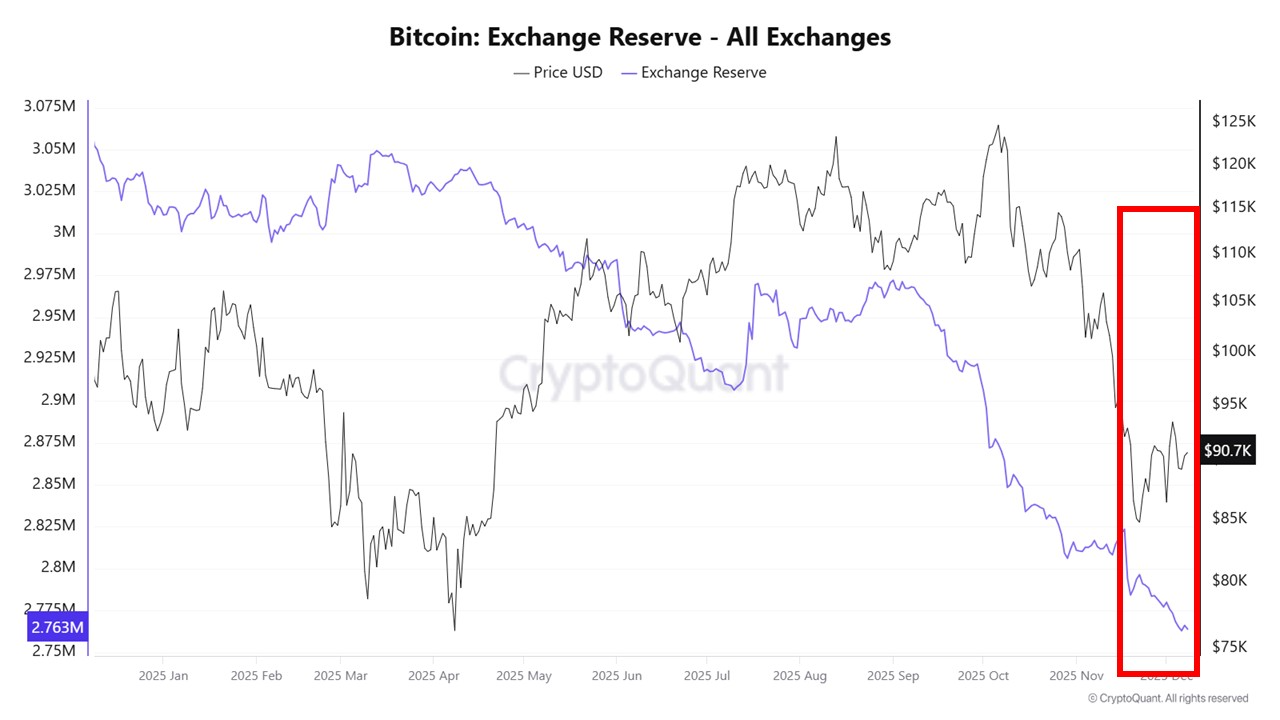

Exchange reserves hit historic lows

On-chain data from CryptoQuant shows Bitcoin entering one of its lowest liquid supply phases in history. Despite the recent pullback, centralized exchanges now hold only about 2.76 million BTC.

The decline shot up through November and December, while Bitcoin continued to bleed to multi-month lows.

Traditionally, falling prices trigger higher exchange inflows as traders prepare to sell. But, the opposite has occurred this year.

BTC exchange reserve | Source: CryptoQuant

Long-term holders and institutions have been withdrawing coins into custody, reducing the amount of supply available for immediate sale. CryptoQuant analysts predict that this pattern could evolve into a full supply shock if the current pace continues.

On the other hand, Santiment data shows a massive reduction in exchange supply across the past year. Roughly 403,200 BTC have left exchanges over the period, a 2.09% drop in total circulating supply held on trading platforms.

📊 As Bitcoin’s market value hovers around $90K, crypto’s top market cap continues to see its supply moving away from exchanges. Over the past year, there has been:

📉 A net total of -403.2K $BTC moving off exchanges

📉 A net reduction of -2.09% of $BTC‘s entire supply moving… pic.twitter.com/Y0JTC880Np— Santiment (@santimentfeed) December 8, 2025

For Bitcoin, fewer coins on exchanges reduce the probability of swift, large-scale sell-offs. Santiment said that as Bitcoin hovers near $90,000, the ongoing supply decline represents significant demand.

One year ago, exchanges held about 1.8 million BTC. Today, the figure is closer to 1.2 million, Santiment’s chart showed.

Analysts track a potential christmas breakout

Analyst Michael van de Poppe shared a chart indicating that Bitcoin continues to follow a bullish structure. If buyers hold the current range and prevent a deeper correction, price could push toward the $100,000 mark before Christmas, he said.

So far, so good. #Bitcoin is still following the bullish path.

It’s all depending on the open in the U.S., if that’s going to be causing the standard correction, then it’s time to buy the dip.

Main thesis: we break up from here and we’ll start attacking $100K pre-Christmas… pic.twitter.com/23lENQhzPd

— Michaël van de Poppe (@CryptoMichNL) December 9, 2025

Bitcoin Vector added that the macro liquidity backdrop may be turning in Bitcoin’s favor. They point out that earlier setups with similar characteristics led to full-blown rallies, making BTC the next crypto to explode.

Last time this setup appeared, BTC delivered over 390% upside.

This time the structure is different, but we’re starting from an environment that precedes liquidity expansion.

And when liquidity turns, risk assets take the lead.https://t.co/QumOLmrHfc pic.twitter.com/U28lYN7JiM

— Bitcoin Vector (@bitcoinvector) December 8, 2025

Bitcoin hyper raises $29.2m as investors shift focus

Bitcoin Hyper (HYPER) has begun to draw attention as some large Bitcoin holders turn their focus toward other emerging projects. The project’s presale has raised $29.2 million amid growing interest in networks that address long-standing limits within the Bitcoin ecosystem.

Bitcoin Hyper is designed to deal with issues such as slow transaction speeds, higher fees, and the lack of built-in smart contracts. The project proposes a faster Layer 2 system that processes activity through an upgraded virtual machine before settling it on Bitcoin’s main chain.

This approach is meant to keep settlement secure while improving day-to-day performance.

Hyper token utility and presale details

The HYPER token serves several roles within the network. It is used to pay gas fees, can be staked, and provides access to certain features across the platform. These functions place the token at the center of Bitcoin Hyper’s ecosystem.

The presale price is currently set at $0.013395. The team will increase the HYPER token price in a few hours. For those who wish to participate, check out our guide on how to buy Bitcoin Hyper.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

A crypto journalist with over 5 years of experience in the industry, Parth has worked with major media outlets in the crypto and finance world, gathering experience and expertise in the space after surviving bear and bull markets over the years. Parth is also an author of 4 self-published books.