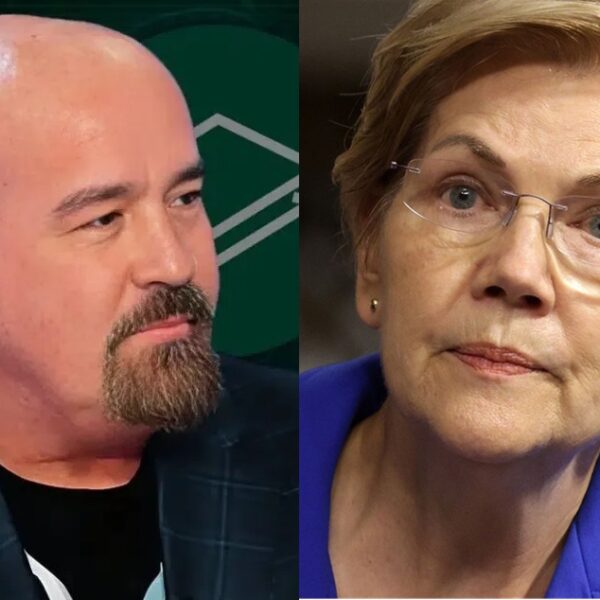

In a transfer that despatched ripples by the Bitcoin neighborhood, famend investor and Shark Tank persona Kevin O’Leary doused the flames of hype surrounding the latest approval of Spot Bitcoin ETFs, labeling them “practically useless” for institutional buyers.

However amidst his skepticism, O’Leary supplied a ray of sunshine for Bitcoin’s long-term prospects, predicting a major value surge by 2030.

O’Leary: ETFs Payment Considerations, Predicts Shakeout

O’Leary’s main gripe with Spot ETFs? Charges. He argues that the fees levied by issuers, even with momentary waivers, render them an unattractive proposition for classy buyers who can merely maintain Bitcoin straight.

Kevin O’Leary on Bitcoin ETF 👇 pic.twitter.com/p0avcOEV7N

— Altcoin Day by day (@AltcoinDailyio) January 12, 2024

Whereas acknowledging the ETFs’ milestone standing for the US crypto scene, O’Leary doesn’t foresee a gold rush for these devices. He predicts a Darwinian shakeout, with solely two or three main gamers, doubtless established giants like Constancy and BlackRock, rising victorious as a result of their huge distribution networks.

Regardless of his private reservations, O’Leary acknowledges the regulatory inexperienced mild as a vital step ahead for the crypto business. He expresses hope that the ETFs will pave the way in which for additional regulatory developments, significantly round stablecoins like USDC, which might unlock wider adoption of digital cost programs.

BTC market cap at the moment at $839.16 billion. Chart: TradingView.com

O’Leary’s Bullish But Measured Bitcoin Forecast

Shifting gears to Bitcoin’s future, O’Leary paints a bullish image, albeit a measured one. He initiatives a tripling of Bitcoin’s price by 2030, inserting it comfortably inside the $150,000-$250,000 vary.

Nevertheless, he pours chilly water on ARK Make investments founder Cathie Wooden’s extra excessive prediction of a $1.5 million price tag by the identical date. Such a meteoric rise, O’Leary contends, would necessitate a significant financial meltdown – a situation he doesn’t see unfolding.

O’Leary’ cautious optimism displays a nuanced perspective on the burgeoning crypto panorama. He acknowledges the potential of Spot ETFs as a stepping stone for broader institutional involvement, however emphasizes the necessity for value-driven funding selections.

In the meantime, his religion in Bitcoin’s long-term trajectory aligns with many analysts who see the digital asset maturing right into a mainstream retailer of worth.

Nevertheless, O’Leary’ skepticism serves as a invaluable counterpoint to the unbridled enthusiasm typically surrounding new developments within the crypto house.

His emphasis on charges and regulatory hurdles reminds buyers to mood their expectations and conduct thorough due diligence earlier than diving into the unstable world of digital property.

Because the mud settles on the Spot ETF saga, one factor stays clear: Kevin O’Leary’ voice continues to resonate within the funding world, providing a mix of pragmatism and optimism that serves as a invaluable information for navigating the ever-evolving crypto terrain.

Featured picture from iStock