Spot Bitcoin Alternate-Traded Funds (ETFs) noticed one more record-breaking day yesterday, with inflows reaching a brand new each day all-time excessive (ATH). This surge in funding comes at a time when Coinbase, the main US crypto alternate and custodian for eight of the ten spot ETFs, experiences its BTC reserves at their lowest since 2015, signaling a possible provide shock within the close to future.

Bitcoin ETFs Proceed To Smash Data

James Seyffart, a Bloomberg ETF analyst, supplied an in depth update on the report day, February 28, stating, “UPDATE: We have a new record inflow for the Cointucky Derby Bitcoin ETFs! [BlackRock’s] IBIT took in a record $612 million on its own. On a net basis, the group took in $673 million. This beats the day 1 record of $655 million. (still waiting on BTCO) Also, IBIT crossed $9 billion in assets.”

The information shared by Seyffart additional illustrates the aggressive dynamics throughout the Bitcoin ETF area. Whereas BlackRock’s IBIT led the cost with substantial inflows, Grayscale confronted re-accelerating outflows, totaling $216 million yesterday. In distinction, Constancy’s FBTC ETF recorded a formidable influx of $245 million.

WhalePanda, a famous determine within the crypto group, provided perception into the day’s occasions, emphasizing the size of BlackRock’s inflows and the anticipated volatility available in the market. “We had an insane $676.8 million of inflows […]. Fidelity is going to hit $5 billion inflows either today or tomorrow, with Blackrock well on its way to $10 billion.”

He added, “The supply is super thin up here, so expect more violent moves to both sides from here on. Once we hit ATH it wouldn’t surprise me to see $10k moves to either side in a day,” cautioning buyers towards complacency within the bullish market.

Eric Balchunas, one other Bloomberg analyst, highlighted the buying and selling quantity related to these inflows, noting, “RIDIC: the New Nine doubled their volume record (set Monday) with just about $6b traded […] IBIT led with $3.3b of it, Fidelity did $1.4b (both double their previous records).”

Balchunas’s feedback make clear the sheer market exercise pushed by these ETFs, surpassing earlier benchmarks and indicating a large demand for Bitcoin funding autos. Notably, that is natural, as per Balchunas. “I asked around to some mkt makers and most say this volume is largely a function of natural demand vs algo/arb type volume. Word is wirehouse platforms are seriously looking at adding them soon. I’m sure pressure is mounting for them.”

Bitcoin Provide Shock Incoming

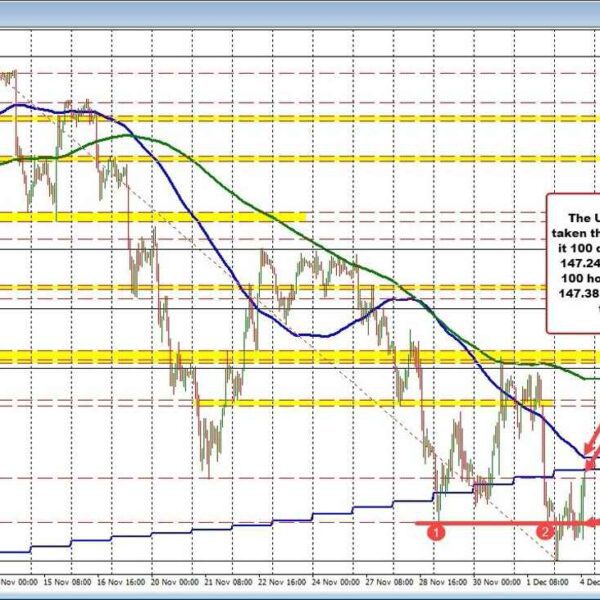

Mason Jappa, CEO and founding father of Blockware, contextualized the inflows throughout the broader market dynamics, significantly specializing in the reducing BTC supply on exchanges like Coinbase.

“Coinbase’s current Bitcoin supply continues to trend downwards (this is the lowest their BTC supply has been since 2015). This paired with the halving coming up paints a very interesting supply shock being realized as we speak,” Jappa famous. This pattern is crucial, as lowered provide on exchanges, coupled with rising demand, might precipitate vital worth actions.

Coinbase’s function because the custodian for main Bitcoin ETFs, together with BlackRock‘s iShares Bitcoin Trust (IBIT), ARK 21Shares Bitcoin ETF (ARKB), Bitwise Bitcoin ETF (BITB), as well as Grayscale (GBTC), adds a layer of strategic importance to the exchange’s reserve ranges.

The current correlation between Coinbase’s spot premium and Bitcoin’s worth actions means that as ETFs proceed to attract on the alternate’s reserves, the market might witness tighter provide and heightened worth volatility. Remarkably, with the halving on the horizon and alternate reserves dwindling, the market is doubtlessly on the cusp of a major provide shock.

At press time, BTC traded at $62,487.

Featured picture created with DALL·E, chart from TradingView.com