The CEO of on-chain analytics agency CryptoQuant has defined why the provision shock because of the Bitcoin halving may very well be vital this time.

The Motive Why Bitcoin Halving May Finish Up Being Important

In a brand new post on X, CryptoQuant CEO and founder Ki Younger Ju has talked about how the US-based Bitcoin miners are behaving up to now within the leadup to the upcoming halving.

The “halving” right here refers to a periodic occasion for Bitcoin during which the cryptocurrency’s block rewards are completely slashed in half. This occasion happens each 4 years; the subsequent one is estimated to occur this April.

The block rewards are the BTC rewards miners obtain as compensation for including blocks to the community. Since these rewards often make up for many of the miners’ income (because the transaction charges have traditionally remained low for the coin), the halvings profoundly influence mining economics.

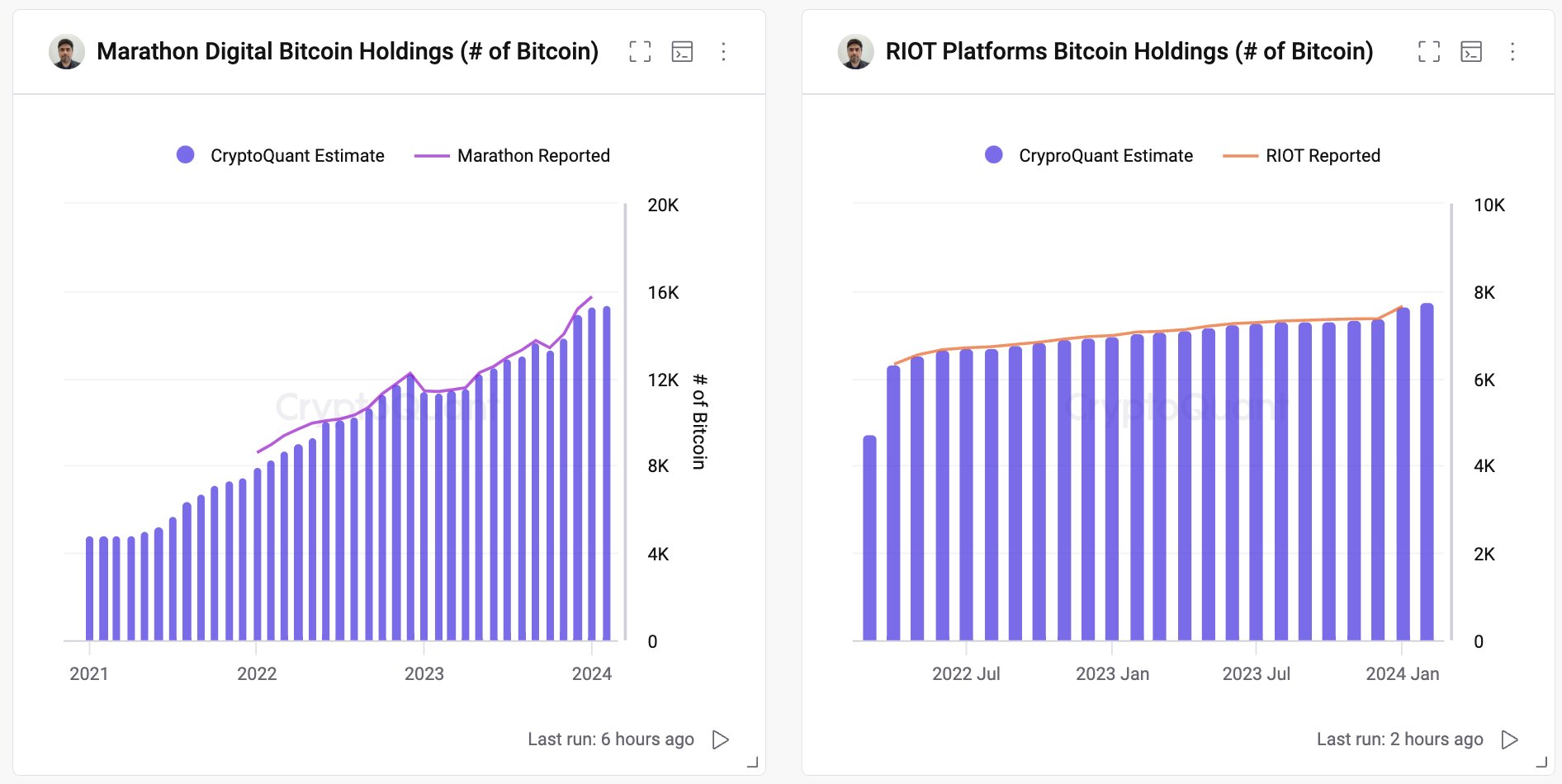

It might seem that regardless of the halving developing quickly, the US public mining firms have determined to HODL their Bitcoin for now as an alternative of promoting it.

Appears to be like just like the holdings of each of those miners has trended up just lately | Supply: @ki_young_ju on X

“U.S. publicly traded mining companies are retaining their Bitcoin holdings without showing significant selling pressure, as seen by their wallet activities,” notes Ju.

The CryptoQuant CEO explains why these miners are holding onto their cash for now: the provision shock impact halving occasions have on cryptocurrency.

“Bitcoin halving is a supply shock event where the new supply gets reduced by half,” says the analyst. “If demand remains the same while supply decreases, the price goes up.”

The asset has felt this provide shock impact to a point all through the cycles, however in accordance with Ju, the impact may very well be notably vital this time round.

It’s because massive gamers like Blackrock and different spot ETF suppliers are within the house now, and these entities need to buy their Bitcoin via well-regulated means.

Because the mining firms, which may very well be one of many sources to acquire Bitcoin for these establishments, are maintaining their holdings tight for now, these mega whales would have a restricted quantity of provide in the stores from.

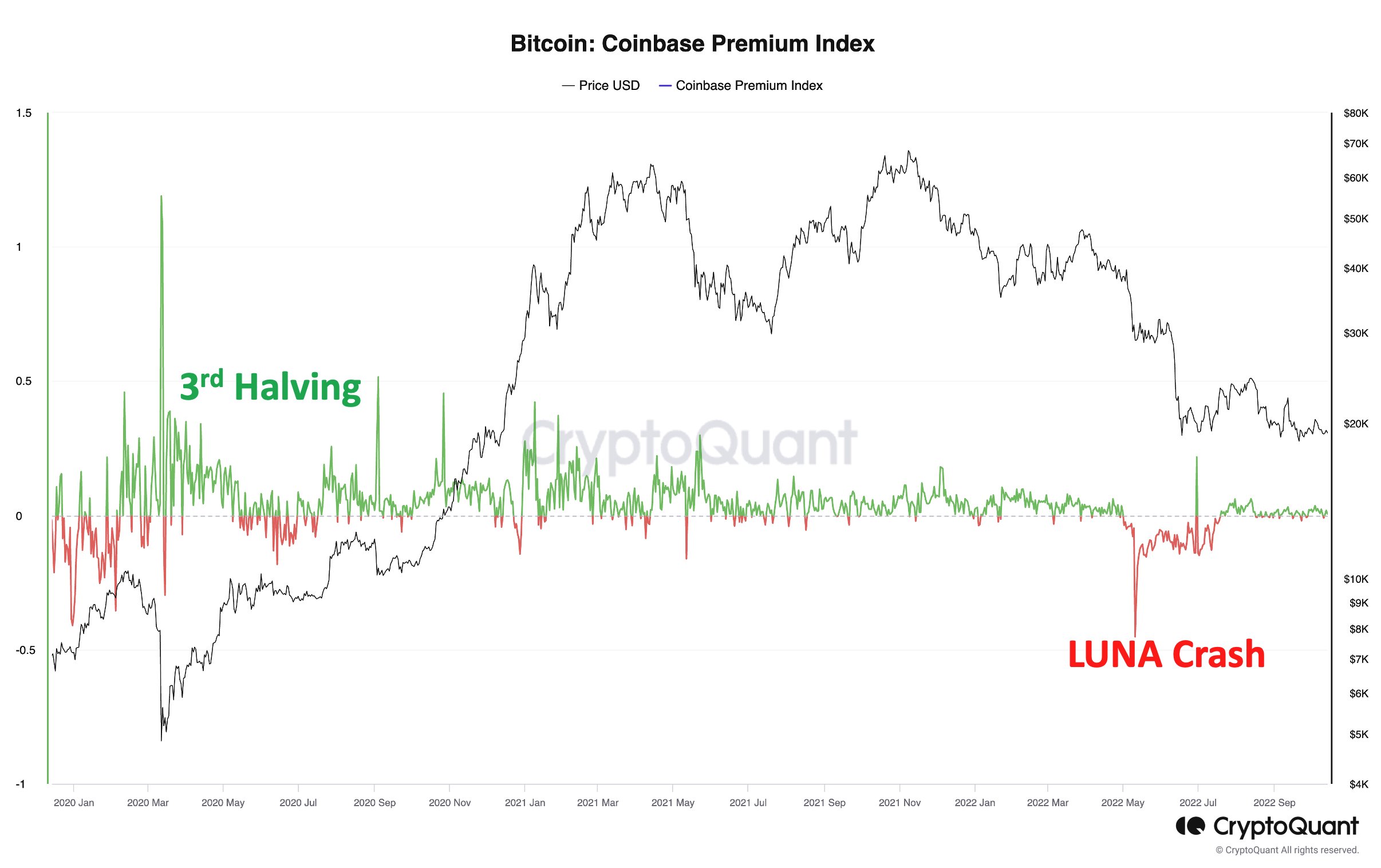

An indicator that will assist sign whether or not these establishments have began making use of vital shopping for strain may be the Coinbase Premium Index. This metric retains monitor of the share distinction between the BTC costs listed on cryptocurrency exchanges Coinbase and Binance.

Coinbase is thought to be the popular platform of US institutional merchants, so the optimistic premium (that’s, the value is larger on the platform than on Binance) can suggest the presence of comparatively excessive shopping for strain from these massive gamers.

“I expect the CB premium to stay positive for a few months after the next halving, as it did during the 2020-2021 bull run following the March 2020 halving,” says the CryptoQuant founder.

The pattern within the Coinbase Premium Index over the previous BTC cycle | Supply: @ki_young_ju on X

BTC Value

Bitcoin has been caught inside a variety just lately, as its value is at the moment floating across the $42,900 stage.

The worth of the coin seems to have been consolidating sideways in the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Vasilis Chatzopoulos on Unsplash.com, charts from TradingView.com, CryptoQuant.com