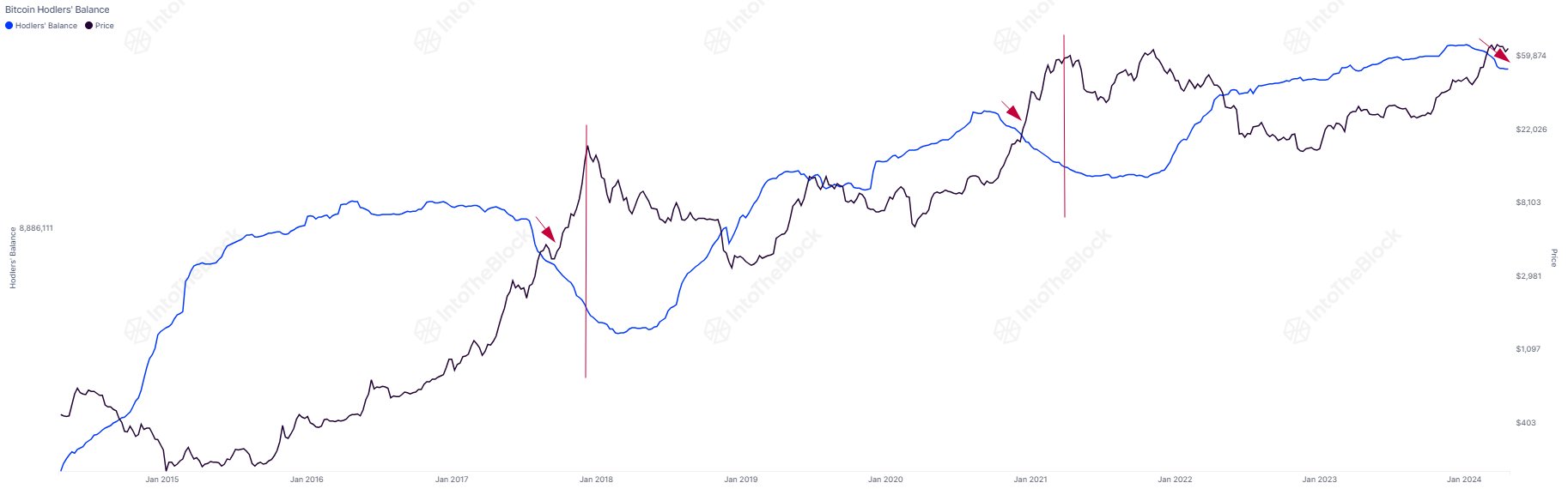

The market intelligence platform IntoTheBlock has identified a Bitcoin sample that might counsel there’s nonetheless loads of time to go within the cycle.

Bitcoin Lengthy-Time period Holder Sample May Recommend Bull Market Isn’t Over But

In a brand new post on X, IntoTheBlock mentioned a sample that the whole holdings of Bitcoin long-term holders have usually adopted throughout bull markets previously.

The “long-term holders” (LTHs) seek advice from traders who’ve been holding their cash for longer than a 12 months (as outlined by IntoTheBlock; different analytics corporations use a distinct cutoff) with out having offered or moved them on the blockchain.

Statistically, the longer an investor holds onto their cash, the much less probably they develop into to promote at any level. As such, the LTHs, who maintain for important intervals, are thought of the unyielding part of the market.

The LTHs additionally show this resilience in follow, as they hardly ever promote regardless of no matter could also be occurring within the wider market. Not too long ago, nevertheless, these traders have been taking part in a selloff.

Provided that this occasion isn’t precisely a standard one, it may be one thing to notice. Under is the chart shared by the analytics agency that reveals the development the mixed holdings of the traders on this cohort have adopted over the previous couple of years.

The worth of the metric seems to have been heading down in latest days | Supply: IntoTheBlock on X

Because the graph reveals, Bitcoin LTHs collected in the course of the 2022 bear market and the 2023 restoration rally, however not too long ago, their holdings have turned in the direction of the draw back.

One thing to remember is {that a} one-year delay is of course hooked up to purchasing from this group, as solely traders who’ve held for at the very least a 12 months might be a part of the cohort.

Which means when the LTH holdings go up, it doesn’t counsel that purchasing is occurring within the current however reasonably that it occurred a 12 months in the past, and these cash have matured sufficient to qualify for the cohort.

Nevertheless, the identical doesn’t apply to promoting, because the cash’ age immediately resets again to zero as quickly as these traders take away them from their wallets. As such, the latest downtrend would replicate a selloff that’s occurring within the current.

“Data indicates that these seasoned holders initiated their sales in January and accelerated in late March,” notes IntoTheBlock. Apparently, the chart highlights {that a} comparable sample was noticed over the last two bull runs.

It might seem that these HODLers have a tendency to begin promoting when the Bitcoin bull run begins correctly and proceed to promote past the highest. Going by this sample, the intelligence platform suggests, “there is plenty of time remaining when compared to previous cycles.”

BTC Worth

On the time of writing, Bitcoin has been floating round $64,400, which is up over 1% previously week.

Seems to be like the worth of the coin has registered a plunge over the previous day | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, IntoTheBlock.com, chart from TradingView.com

![The Significance of Advertisements to Huge Tech Manufacturers [Infographic]](https://whizbuddy.com/wp-content/uploads/2024/01/1704211207_bG9jYWw6Ly8vZGl2ZWltYWdlL2JpZ190ZWNoMy5wbmc-600x435.jpg)