On-chain knowledge exhibits the Bitcoin long-term holders have ended 2023 with robust perception as their provide has blasted previous the all-time excessive.

Bitcoin Lengthy-Time period Holders Finish 2023 On Sturdy Accumulation

As identified by CryptoQuant Netherlands neighborhood supervisor Maartunn in a brand new post on X, the BTC long-term holders have ended 2023 by repeatedly setting new all-time highs (ATHs).

There are various methods the traders will be grouped primarily based on on-chain knowledge, with one standard methodology being by means of holding time. The Bitcoin market is broadly divided into two cohorts utilizing this standards: the “short-term holders” and “long-term holders.”

The cutoff of 155 days is used for separating the 2 teams. Any handle holding its cash for lower than this era is put contained in the STH cohort, whereas the remainder of the holders belong to the LTH group.

Statistically, the longer an investor retains their cash nonetheless, the much less seemingly they grow to be to promote or transfer them on the blockchain. As such, the LTHs make up for the extra cussed facet of the sector.

Whereas the STHs are fickle-minded and panic-sell every time there’s some motion within the wider market, the LTHs have a tendency to remain silent by means of crashes and rallies alike.

The instances that these diamond palms do promote will be ones to look at for, nevertheless. One option to monitor the actions of the LTH group is thru the mixed provide its members are holding of their wallets presently.

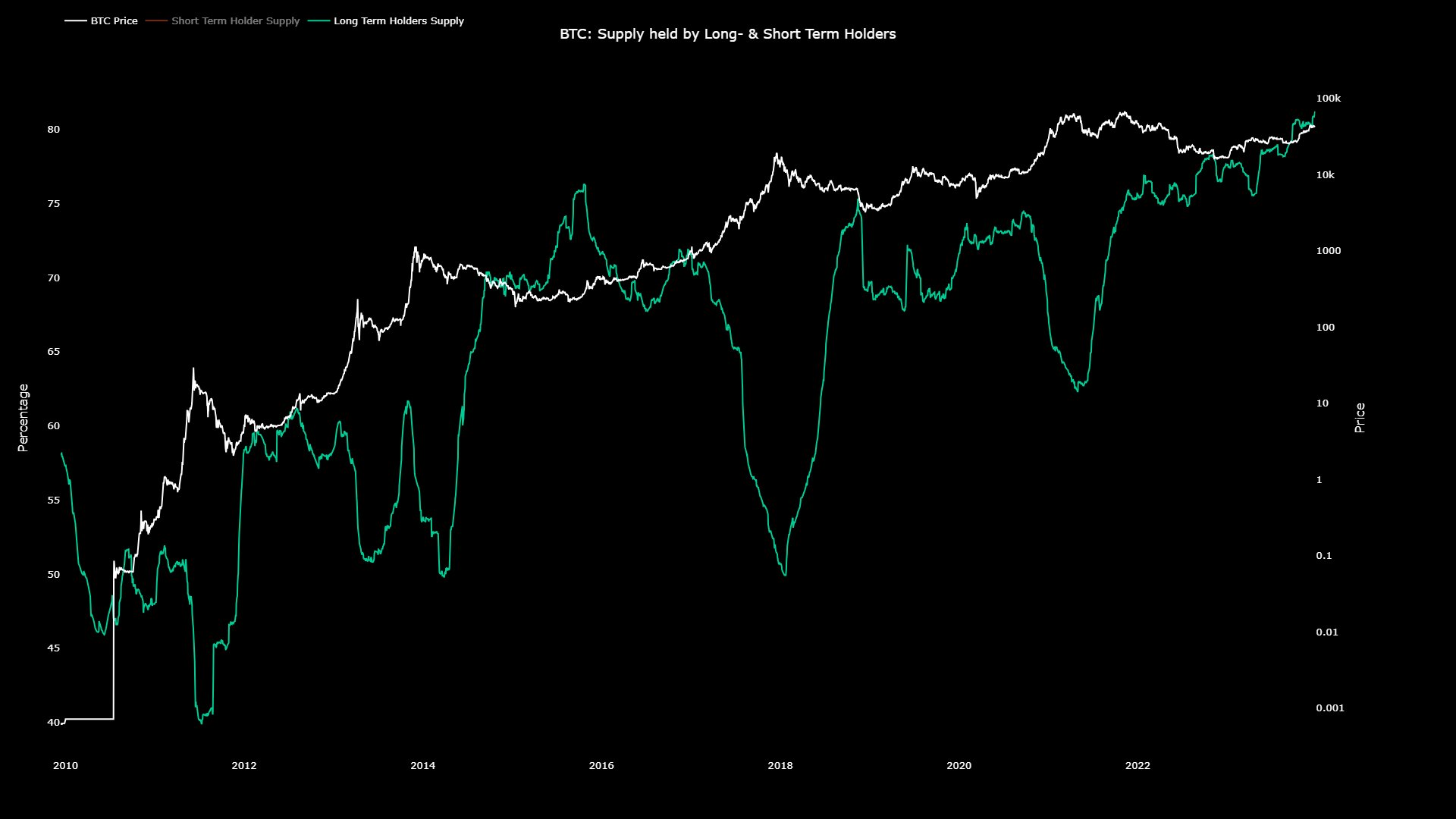

Here’s a chart that exhibits the development on this Bitcoin indicator all through the cryptocurrency’s historical past:

The worth of the metric seems to have been sharply going up in current weeks | Supply: @JA_Maartun on X

The above graph exhibits that the Bitcoin LTH provide noticed an general uptrend in 2023. The rise within the proportion of the entire circulating provide held by these HODLers was particularly sharp on the finish of the yr, because it set consecutive new ATHs.

Following the newest spike, the LTHs are nearing management of 80% of the availability. Such a big a part of the availability being locked within the wallets of those diamond palms is of course a constructive signal for the asset’s long-term outlook.

One thing to bear in mind, although, is the truth that this indicator has a 155-day delay hooked up to it. Any rises in it don’t recommend that purchasing is occurring now, however fairly that it occurred 155 days in the past, and people cash have efficiently matured into the cohort.

There is no such thing as a such delay hooked up to promoting, although, as cash immediately go away the group when they’re transferred on the community. The chart exhibits that the LTHs have traditionally participated in vital promoting when bull rallies warmth up as they harvest their bear-market accumulation income.

Primarily based on this sample, any substantial declines within the metric’s worth may very well be ones to control, as they could sign such a starting of heated bullish momentum for Bitcoin.

BTC Value

Bitcoin has gone stale just lately, as its value nonetheless trades across the $42,700.

Seems to be just like the asset has been transferring sideways just lately | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com