On-chain information suggests the Bitcoin HODLers have remained stalwart lately, not promoting regardless of the rally past the $44,000 degree.

Bitcoin Lengthy-Time period Holders Have Ignored The Newest Rally

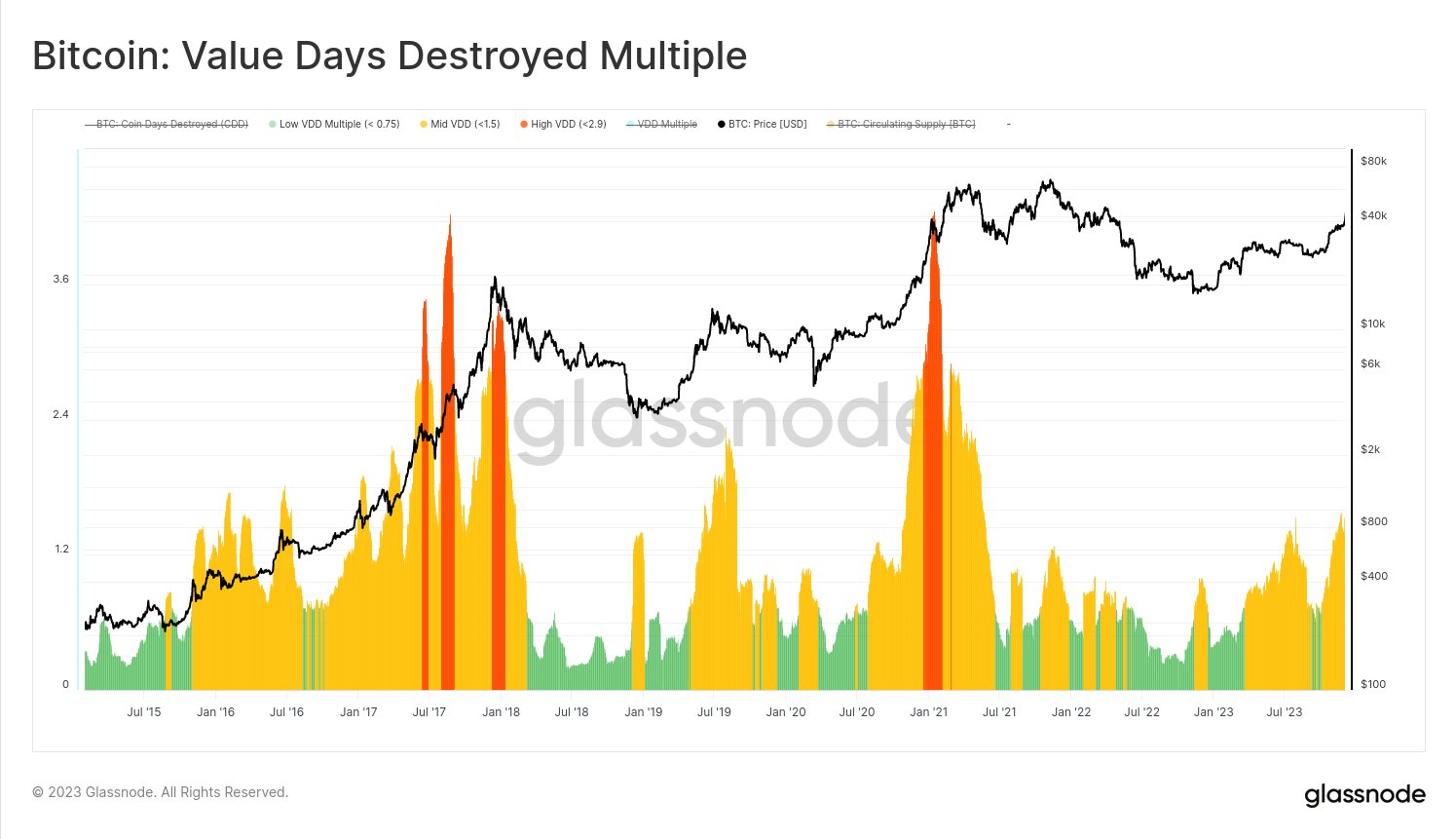

As Glassnode lead on-chain analyst Checkmate defined in a post on X, the outdated BTC palms aren’t even promoting at ranges much like 2019 but. The related indicator right here is the “Value Days Destroyed Multiple,” which is predicated on one other metric known as the “Coin Days Destroyed” (CDD).

In on-chain evaluation, a coin day represents the quantity that 1 BTC accumulates after sitting nonetheless on the blockchain for 1 day. When a coin that has been dormant for some time lastly strikes, its coin days counter would naturally reset again to zero, and the coin days it had been carrying earlier can be “destroyed.”

The CDD measures the destruction of coin days which might be going down throughout the blockchain. Thus, when this metric spikes, many dormant cash have simply been moved to the community.

For the reason that HODLers carry many coin days, the indicator observing a spike often signifies that these resolute palms have determined to maneuver their cash, probably for promoting.

One other type of the indicator is known as the “Value Days Destroyed” (VDD), which is calculated by multiplying the CDD by the present spot value of the cryptocurrency.

The Bitcoin long-term holders typically don’t promote even in instances of serious profit-taking alternatives, so it may be worrying when these buyers do take to promoting. The chart beneath exhibits these diamond palms’ response to the present value rally.

Seems to be like the worth of the metric is not too excessive for the time being | Supply: @_Checkmatey_ on X

Within the graph, the “VDD Multiple” information is displayed, a metric that compares the 30-day and 365-day transferring averages of the Bitcoin VDD. The chart exhibits that the a number of has noticed some progress lately and has hit yellow values, representing a mildly heated market.

This is able to recommend that the BTC HODLers have been spending greater than traditional lately, which isn’t stunning contemplating the sharp surge within the asset’s value.

The indicator’s worth remains to be removed from what was the norm throughout earlier bull runs, nevertheless, because the metric spiked in the direction of the crimson overheated zone throughout them. The metric has, in reality, not even hit the identical values as in the course of the restoration rally that kicked off in April 2019, as is seen within the graph.

Curiously, the biggest spike within the VDD A number of in the course of the 2021 bull run coincided with Bitcoin breaking the $44,000 degree, the identical mark the asset has simply reclaimed with its newest rise. “HODLers are not relinquishing their coins. They demand higher prices,” notes the Glassnode lead.

BTC Worth

Bitcoin has registered a rise of over 14% in the course of the previous week, because the asset is now floating across the $44,100 degree.

The worth of the coin seems to have shot up throughout the previous few days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, Glassnode.com