On-chain information exhibits the variety of Bitcoin addresses is declining, an indication that the traders could also be making the change in direction of the brand new spot ETFs.

Bitcoin Holders Have Declined By 40,000 Since The Begin Of 2024

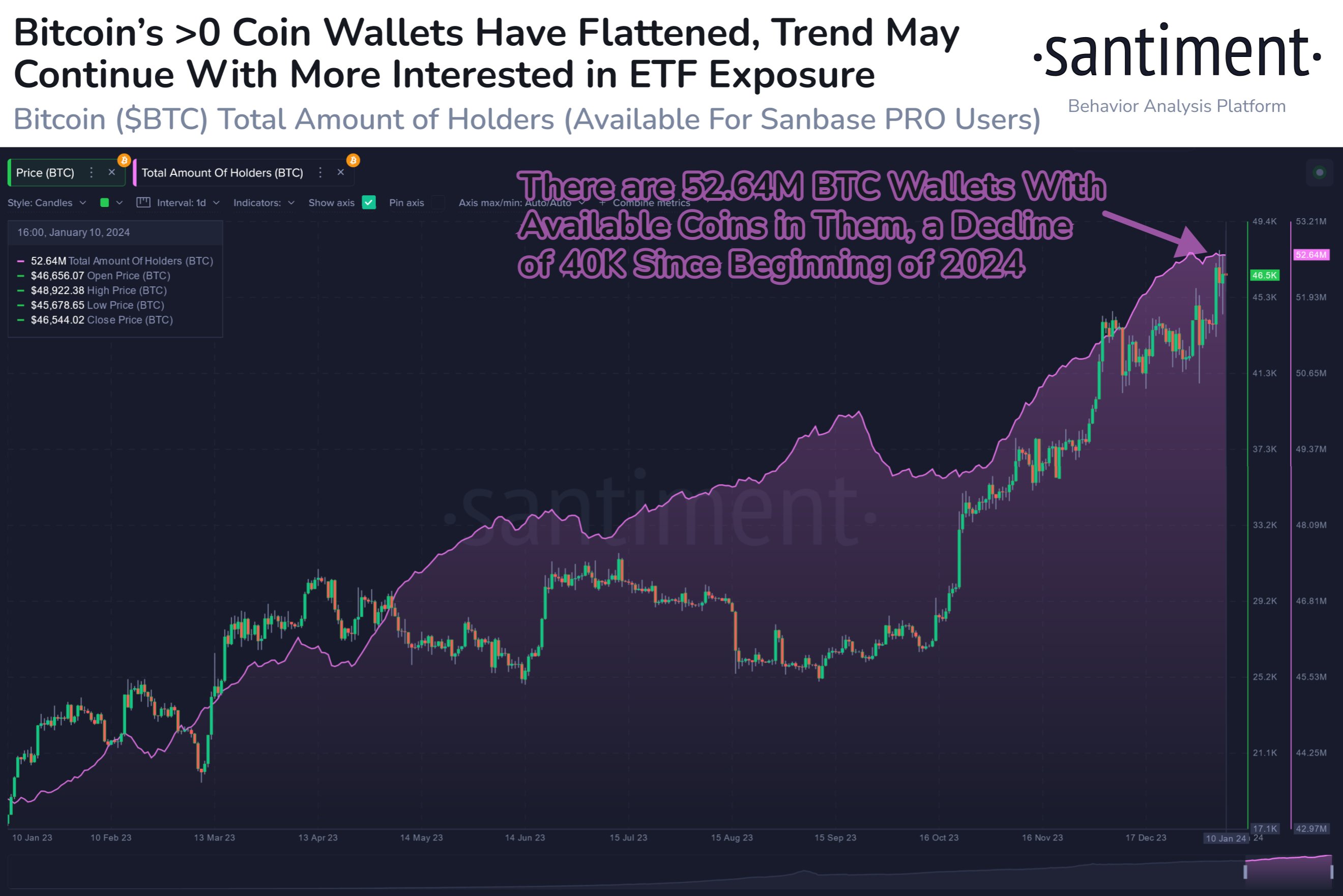

Based on information from the on-chain analytics agency Santiment, the BTC complete quantity of holders metric has gone by means of a shift of pattern just lately. The “total amount of holders” retains observe of the overall variety of addresses on the Bitcoin blockchain which might be carrying some non-zero stability.

When this indicator’s worth drops, it will possibly imply that a number of the holders of the cryptocurrency have determined to exit the market, as they’re cleansing out their wallets. Such a pattern might also come up out of traders consolidating their wallets, though this isn’t prone to occur on any important scale.

However, the metric’s worth improve can suggest that the adoption of the asset is selecting up as recent traders are opening up new addresses and shopping for the coin.

Some holders additionally desire to open new addresses every time they obtain recent transactions, because it offers higher privateness. Naturally, these merchants would additionally contribute in direction of an increase within the complete quantity of holders.

Now, here’s a chart that exhibits the pattern within the Bitcoin complete quantity of holders over the previous 12 months:

The worth of the metric seems to have slowed down in current days | Supply: Santiment on X

As displayed within the above graph, the overall variety of Bitcoin holders had been rising at a notable tempo throughout the closing couple of months of 2023, suggesting that adoption of the cryptocurrency was seemingly happening.

Because the begin of 2024, although, the indicator has switched its pattern to that of principally flat motion, with its worth even registering a slight internet decline of 40,000 throughout this era.

The reason behind this pattern shift could lie within the Bitcoin spot exchange-traded funds (ETFs). ETFs consult with monetary devices that assist enable traders to realize publicity to an asset with out having to truly personal stated asset straight.

ETFs commerce on conventional exchanges, so traders unfamiliar with cryptocurrencies (which require data of how wallets and transactions work) may discover the ETFs to be a neater approach to achieve publicity to BTC’s value actions.

The spot ETFs for the digital asset had been finally approved by the US SEC on January tenth, however the majority of the market had been anticipating this resolution since some time in the past.

Thus, it’s potential that the decline within the quantity of BTC holders could have been due to traders ditching the asset in order that they might go along with the ETFs as soon as they had been accredited.

Santiment notes that Bitcoin might proceed to see this decline in addresses, as extra traders make this change. The analytics agency notes, although, that that is prone to not have any affect on the asset’s value.

BTC Worth

Regardless of the ETF approval, Bitcoin is but to see any internet uplift, because the asset’s value continues to commerce sideways across the $45,900 stage.

BTC has gone stale in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.internet