Going by the occasions of October 16, when Bitcoin (BTC) costs briefly spiked to over $30,000 earlier than retracing on information that the USA Securities and Trade Fee (SEC) had falsely permitted the primary Bitcoin Trade Traded Fund (ETF), it’s extremely probably that the coin could rally to over $1 million with the whole crypto market cap rising to over $15 trillion.

This outlook is per the estimation of Alessandro Ottaviani, who took to X, predicting how BTC and crypto would look within the subsequent few years as soon as the stringent SEC approves the advanced by-product.

Is Bitcoin Prepared For Worth Good points In direction of $1 Million?

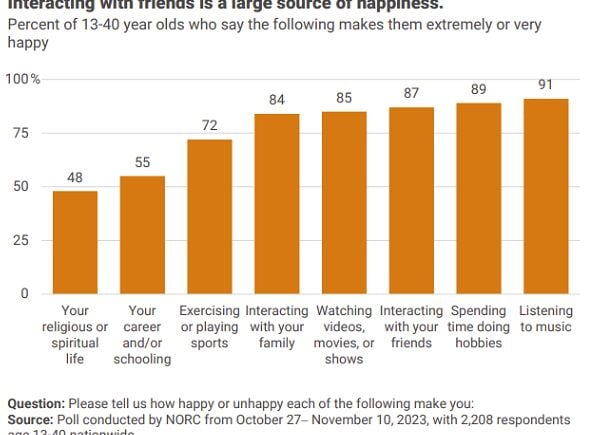

Ottaviani, who claims to be versed in Austrian economics, stated the whole market cap of Bitcoin swelled by over $50 billion on October 16 following the pretend information. At this ratio, the analyst estimates that roughly $500 million of capital flew to Bitcoin, assuming a ratio of 100:1.

Suppose the identical ratio is maintained, primarily based on different estimates by Steven Schoenfield, the previous managing director at BlackRock, who predicts that BTC may doubtlessly obtain between $150 billion and $200 billion throughout the subsequent three years.

The overall market capitalization will in all probability exceed $15 trillion in that case. Bitcoin costs will broaden to over $1 million at this valuation, practically 40X from present spot charges.

BTC charts, costs stay agency and edging larger, buoyed by October 16’s spike. Regardless that there was a retracement from the over $30,000 registered at peaks, costs are steady and above yesterday’s shut.

From a technical perspective, the growth of costs on October 16 represented a bullish breakout. As it’s, costs are trending above September highs and at round October 2023 ranges.

BTC Has Resistance At $32,000

Whether or not patrons will preserve the upside momentum, driving costs in the direction of essential resistance ranges at $30,000 and $32,000 within the close to time period, is but to be seen. candlestick association within the each day chart, swing merchants could think about costs to retest October 16 highs as the primary goal. Additional development continuation may raise BTC to July 2023 highs at $32,000, doubtlessly opening up extra alternatives for beneficial properties above $35,000.

Potential triggers for this upswing are numerous. Many market analysts are bullish that approving a spot Bitcoin ETF may set off demand.

Establishments would have a method of gaining publicity to Bitcoin in a regulated method. Accordingly, as Schoenfield places it, this can “double or triple the quantity of [assets under management] in present Bitcoin merchandise.”

Characteristic picture from Canva, chart from TradingView