Bitcoin has plunged under $42,000 as on-chain information exhibits the miners have continued their current selloff, distributing one other 1,000 BTC.

Bitcoin Miners Proceed To Make Outflows From Their Reserve

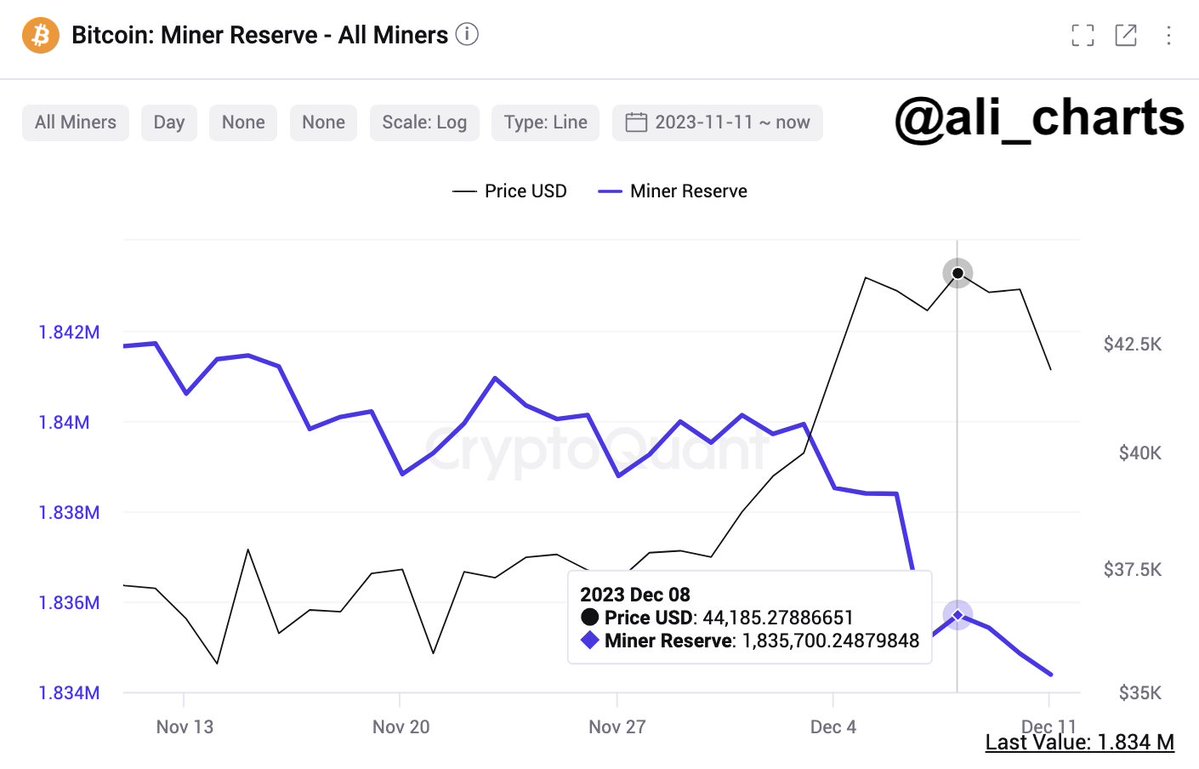

As identified by analyst Ali in a post on X, miners have participated in some extra promoting since Friday. The indicator of curiosity right here is the “miner reserve,” which retains observe of the whole quantity of Bitcoin that miners are carrying of their wallets.

When the worth of this metric goes up, it implies that these chain validators are including extra cash to their provide at present. Such accumulation from this group can naturally positively impression the BTC value.

Then again, a decline within the indicator implies the miners are withdrawing a web quantity of the cryptocurrency from their wallets proper now. Since one of many principal explanation why this cohort would switch their cash out is for promoting, this sort of development could have bearish implications for the asset.

Now, here’s a chart that exhibits the development within the Bitcoin miner reserve over the previous month:

The worth of the metric seems to have been sliding down in current days | Supply: @ali_charts on X

As displayed within the above graph, the Bitcoin miner reserve began observing a pointy decline earlier this month when the cryptocurrency first broke previous the $44,000 mark.

The miners had participated in a notable amount of selling round these highs, however it will seem that their urge for food for distribution wasn’t satiated with this selloff alone as they’ve participated in some extra promoting throughout the previous few days.

Since Friday, these chain validators have made web withdrawals of about 1,000 BTC. This stack of cash could be price virtually $42 million on the present asset value.

It’s not sure if these withdrawals have been made for promoting functions. Nonetheless, given the rally, it isn’t onerous to guess that this cohort has been leaping on the profit-taking alternative with each these withdrawals and those they made earlier.

Bitcoin stagnated when the final selloff from this group happened, and it seems that the cryptocurrency has registered a big decline as this newest one has occurred.

Although, whereas the miners would have performed an element on this plunge, they’re nonetheless unlikely to be the only real instigator behind it, as the dimensions of their promoting isn’t too nice within the grand scheme of issues.

Miners are a bunch who need to do selloffs on the common to maintain themselves, as they’ve fixed working prices like electrical energy payments related to their operations.

As such, they’re a supply of fixed promoting stress within the Bitcoin market, though the dimensions of their promoting isn’t something the sector can’t readily take up more often than not.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $41,700, up 1% up to now week.

The worth of the coin seems to have registered a big drawdown over the past 24 hours | Supply: BTCUSD on TradingView

Featured picture from Brian Wangenheim on Unsplash.com, charts from TradingView.com, CryptoQuant.com