Bitcoin is confronting a pivotal moment after failing to break the crucial $110,000 level. Despite bullish control over the market, BTC finds itself trapped in a period of cautious consolidation. Bulls are actively defending support levels, yet an aggressive push into new territory—often referred to as price discovery—remains elusive. Investors and analysts are now closely watching for a catalyst that could ignite the next phase of upward momentum.

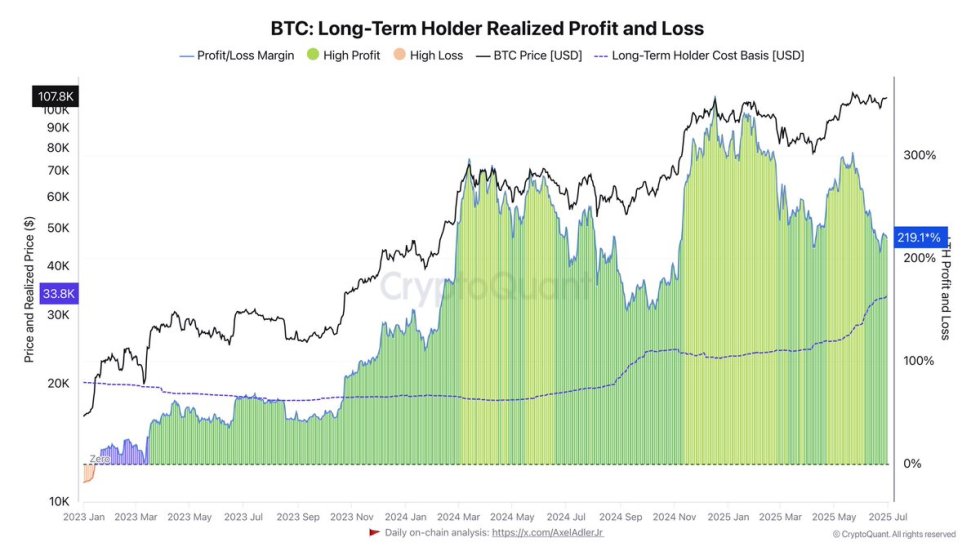

Top analyst Darkfost recently highlighted a concerning trend: the unrealized profits of long-term holders (LTH) are steadily declining. Data reveals that these profits are now nearing levels last observed during the October 2024 correction. This decline suggests that the market is slowly erasing some of the gains accumulated during previous rallies, potentially signaling a cooling off or cautious reassessment of Bitcoin’s current pricing.

While Bitcoin’s inherent strength and historical resilience continue to inspire confidence, the inability to achieve a decisive breakthrough above $110K casts a shadow over near-term prospects. The balance between bullish control and hesitancy has created an environment of uncertainty. As traders await a clear signal or external catalyst, the coming days will be crucial in determining whether Bitcoin can reclaim upward momentum or revert to further consolidation.

Bitcoin Faces A Make-Or-Break Week

Bitcoin is holding above the $105,000 mark after several days of heightened volatility and indecision. While bulls remain in control of the broader trend, the market continues to consolidate below the $112,000 all-time high—a level that has become a psychological and technical barrier. This sideways phase began in May and has yet to resolve in either direction. With the US stock market reaching new record highs, many analysts believe Bitcoin and altcoins could follow if momentum continues.

This week may prove decisive. A confirmed breakout above $112,000 could signal the start of Bitcoin’s next leg higher. However, failure to do so risks a retracement back to the $100,000 level—or lower—potentially shaking short-term holders and increasing selling pressure.

According to Darkfost, on-chain data reveals a key signal: the unrealized profits of long-term holders (LTH) are steadily declining and now approaching levels last seen during the October 2024 correction. The average unrealized profit, measured by the MVRV ratio, currently stands at around 220%. While this may appear high, it’s significantly lower than the 300% and 350% levels seen during the March and December 2024 market tops.

The realized price for LTHs is now around $39,000, indicating that while profits remain solid, the market is far from euphoric. For BTC to revisit similar profitability levels observed at prior peaks, it would need to climb to approximately $140,000. This suggests that, despite consolidation, there could still be meaningful upside potential if momentum returns.

BTC Range-Bound Below $109K

Bitcoin continues to trade in a tight range between $103,600 and $109,300, showing signs of consolidation after weeks of volatility. As seen on the daily chart, BTC has repeatedly failed to close above the $109,300 resistance, a key level that has capped upward momentum since early June. At the same time, the $103,600 support remains intact, reinforcing the idea of a well-defined range. The price currently hovers around $106,500, just above the 50-day moving average (blue line), which has acted as dynamic support during the recent pullbacks.

Volume remains relatively low, which reflects indecision across the market. Traders appear to be waiting for a clear breakout from this range to confirm the next directional move. A successful daily close above $109,300 could open the door for a rally toward new all-time highs, while a breakdown below $103,600 might trigger a deeper correction toward the 200-day SMA around $96,000.

The convergence of the 50, 100, and 200-day SMAs below the current price shows that the broader trend remains bullish. However, the lack of momentum above $110K reinforces the importance of this resistance level. Until BTC decisively breaks out, the market will likely remain choppy and directionless in the short term.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.