On-chain data shows the Bitcoin Hash Ribbons are signaling that the miners are still under immense pressure as their capitulation continues.

Bitcoin Hash Ribbons Are Yet To Signal End Of Miner Capitulation

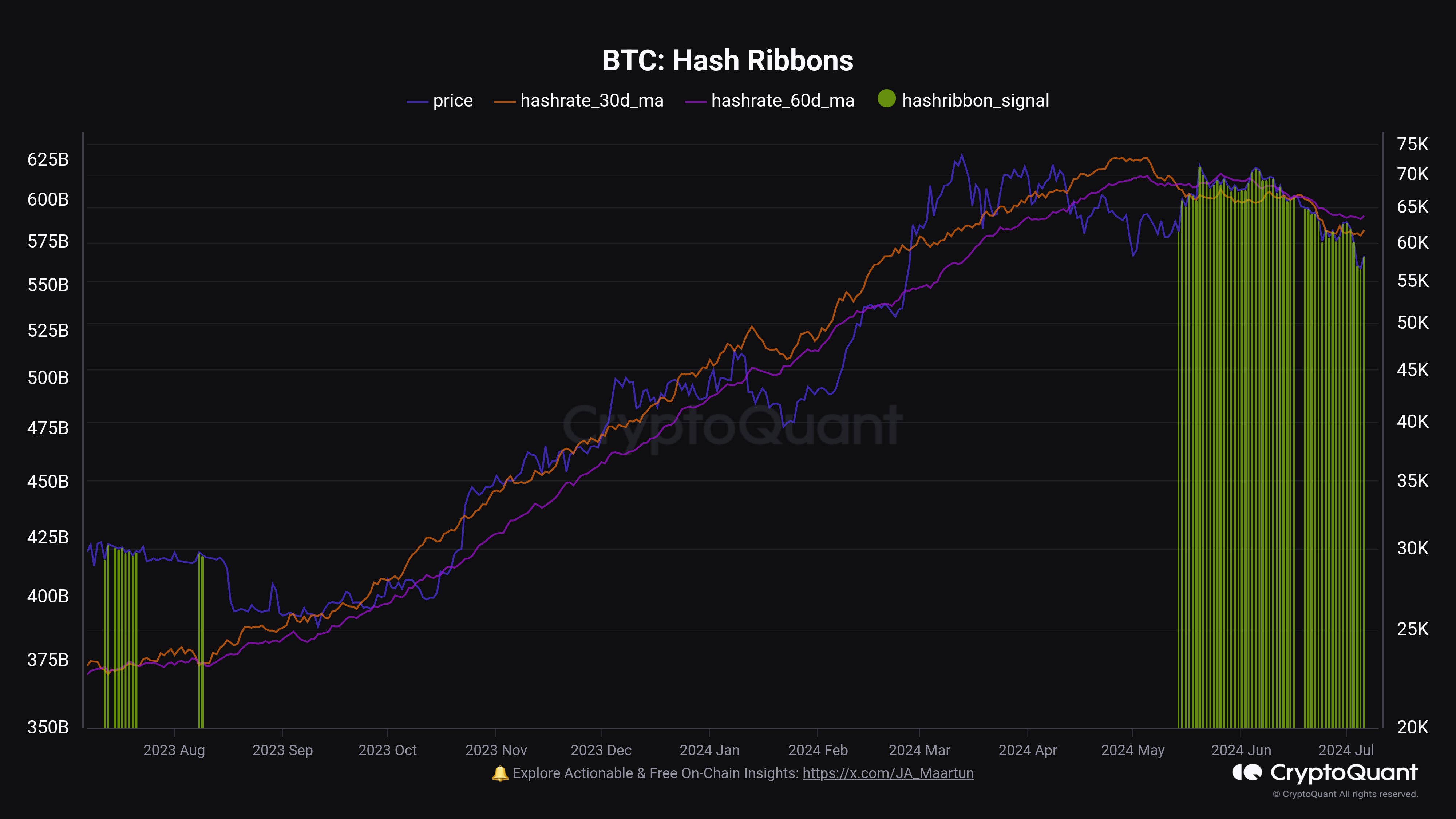

In a post on X, CryptoQuant community manager Maartunn has shared what the latest trend in the Bitcoin Hash Ribbons has been looking like. The “Hash Ribbons” here refer to two moving averages (MAs) of the Bitcoin mining hashrate.

The mining hashrate measures the total computing power the miners have currently connected to the BTC network. This metric may be considered a reflection of the situation among these chain validators.

When the value of the hashrate goes up, it means new miners are joining the network and old ones are expanding their facilities. Such a trend implies these chain validators are now finding the network attractive.

On the other hand, the indicator registering a decline suggests some miners have decided to disconnect from the blockchain, potentially because they are finding it unprofitable to mine on.

Miners have an important role in the network, and these trends, if happening on a large scale, could have potential implications for Bitcoin. The Hash Ribbons indicator helps identify whether a shift in miner behavior is part of a larger pattern.

The two ribbons relevant to the indicator are the 30-day and 60-day MAs of the hashrate. When the former crosses under the latter, the miners can be considered going through capitulation. Similarly, a crossover of the opposite type implies this cohort is back to being comfortable.

Now, here is a chart that shows the trend in the Bitcoin Hash Ribbons over the past year:

The two lines seem to have witnessed a cross recently | Source: @JA_Maartun on X

As is visible in the above graph, the 30-day MA of the Bitcoin mining hashrate crossed below the 60-day MA back in May, signaling the start of miner capitulation.

This development in the Hash Ribbons was a confluence of the asset’s bearish momentum and the fourth Halving. The “Halving” refers to a periodic event occurring every four years that slashes BTC’s block rewards in half.

Miners primarily make their revenue through the block rewards, so it’s easy to see how the Halving would drastically affect these chain validators’ finances.

These rewards are given out in BTC, so the USD exchange rate of the asset going down means a further reduction in the dollar revenue for the miners. Given these developments, it makes sense that miners have been disconnecting from the chain recently.

Last month, the Hash Ribbons briefly saw a crossover of the opposite type, but the indicator has since again been signaling capitulation. It’s hard to say how long it would be before miners see the pressure let off.

BTC Price

At the time of writing, Bitcoin is trading at around $56,200, down more than 10% over the last seven days.

Looks like the price of the asset hasn't made much recovery yet | Source: BTCUSD on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com