On-chain information suggests the promoting stress from the Bitcoin miners and HODLers has been drying up, an indication that might be constructive for the asset.

Bitcoin LTHs Cease Promoting, Whereas Miner Distribution Slows Down

As defined by analyst James Van Straten in a post on X, two BTC teams specifically have been a supply of main sell-side stress out there not too long ago: the long-term holders (LTHs) and miners.

The LTHs discuss with the buyers who’ve been holding their cash since greater than 155 days in the past. These holders are thought of the resolute aspect of the sector, as they not often promote no matter no matter is occurring within the wider market.

The rally to the new all-time high this yr, nevertheless, managed to entice even these HODLers into promoting their cash and harvesting the earnings that that they had earned over their lengthy holding time.

Based on Straten, although, the selloff from these buyers has petered out not too long ago. “LTHs have been relatively flat for the past few weeks, as BTC ranges, which is a good sign that profit-taking is subsiding,” notes the analyst.

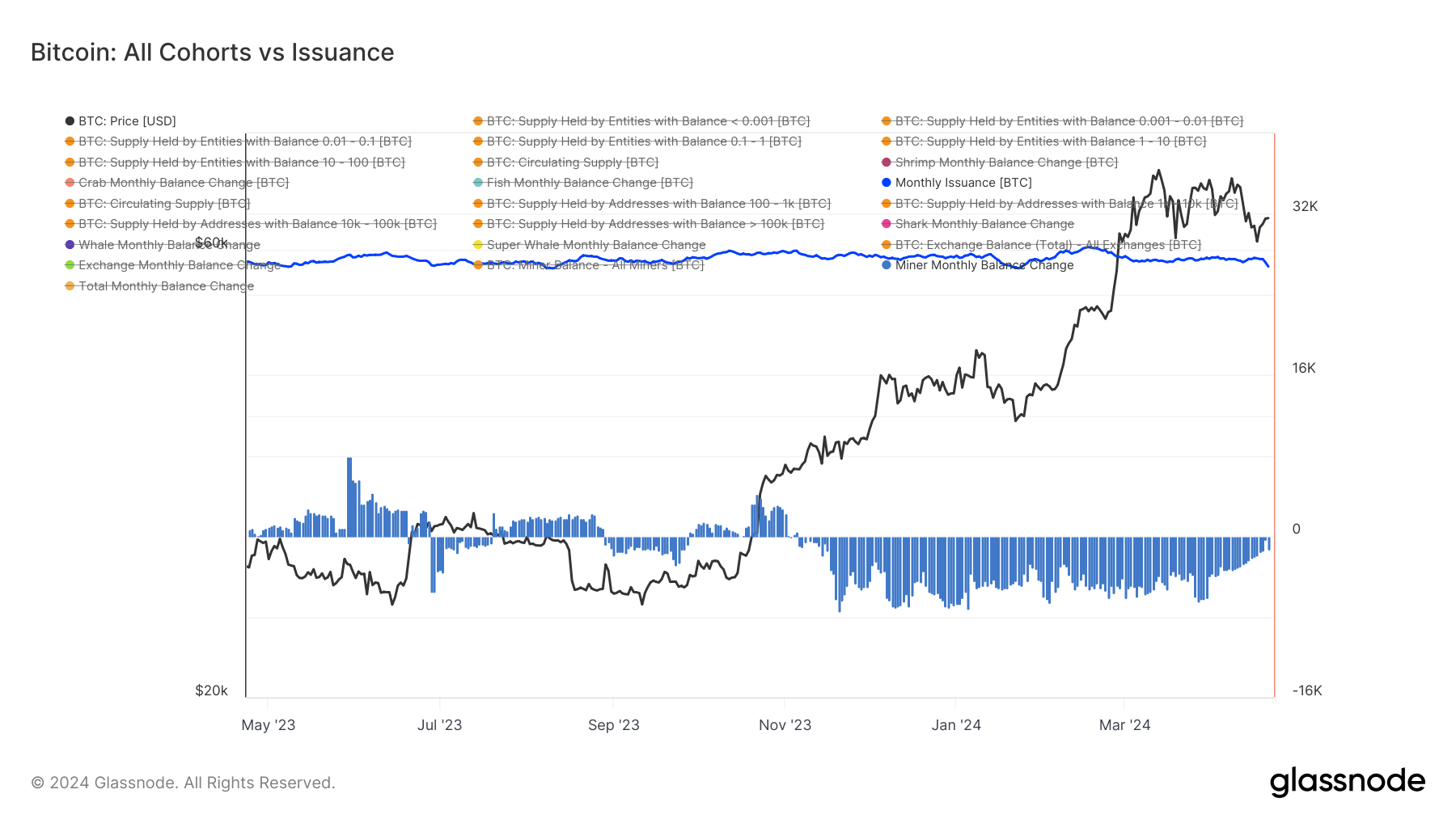

Not like the LTHs, nevertheless, the miners, which symbolize the opposite main supply of promoting stress out there, have nonetheless continued to distribute not too long ago. Nonetheless, because the chart under would recommend, the promoting from these chain validators has a minimum of been happening in scale.

The worth of the metric appears to have been changing into much less unfavorable in current days | Supply: @jvs_btc on X

The graph reveals the information for the month-to-month steadiness change for the miners as an entire. This cohort had become a vendor again in November and had saved up the promoting at a roughly constant fee over the following few months, because the month-to-month steadiness change had maintained across the identical notable crimson values.

Just lately, nevertheless, the metric has been trending up and though it’s nonetheless unfavorable, the newest worth has been concerning the lowest for the reason that selloff started, because the miners bought simply 1,300 BTC over the previous 30 days.

The analyst means that this group may even flip right into a internet accumulator quickly, as “the halving forces miners to become more efficient. Weak miners purged, less selling into the market.” The halving right here naturally refers back to the periodic occasion on the BTC community the place block rewards are completely slashed in half.

The block rewards are what miners obtain for fixing blocks on the community and function the principle part of their income, so these occasions have vital penalties for this group. Halvings happen roughly each 4 years and the newest one occurred just some days again.

With promoting stress from these two cohorts, who had been actively distributing not too long ago, now drying up, Bitcoin maybe might lastly have the ability to regain its bullish push from earlier, a minimum of to a point.

BTC Value

Bitcoin has been making some restoration from its current lows, however the general image is that the asset remains to be consolidating inside its current vary because it trades round $66,600.

The worth of the asset has been caught in sideways motion for a couple of weeks now | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, Glassnode.com, chart from TradingView.com