Marathon Digital and Riot Platforms, sensing the potential for elevated demand, have made strategic strikes to fortify their positions available in the market.

Within the final 24 hours, Marathon Digital Holdings Inc (NASDAQ: MARA) has witnessed a exceptional 105 million shares in buying and selling quantity, surpassing established blue-chip shares akin to Tesla Inc (NASDAQ: TSLA), Apple Inc (NASDAQ: AAPL), and Amazon.com Inc (NASDAQ: AMZN), based on data from Yahoo Finance.

Marathon Digital Shares Data Rising Buying and selling Exercise

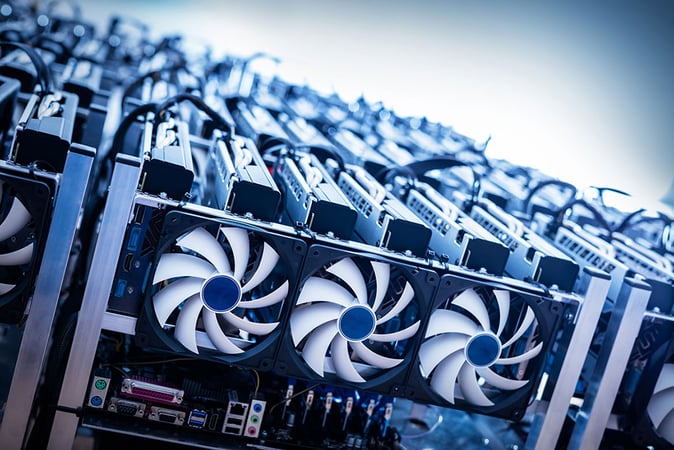

Marathon Digital’s distinctive buying and selling volumes are a part of a broader development within the crypto mining sector. The push to increase operations forward of the expected spot Bitcoin ETF approval and the Bitcoin halving in April has prompted mining companies to bolster their capacities and acquire consideration from traders.

The SEC is slated to determine on the Bitcoin ETF by January 10, 2024, and if permitted, it’s anticipated to set off a exceptional inflow of capital into the market. Main asset administration companies akin to BlackRock Inc (NYSE: BLK) and Grayscale Investments are among the many main candidates for the spot Bitcoin ETF, additional fueling constructive sentiment.

Including to the constructive outlook is the upcoming Bitcoin halving occasion scheduled for April 2024. This cyclical prevalence, taking place roughly each 4 years, entails a halving of the speed at which new Bitcoin is launched into circulation.

The target is to create shortage and preserve a excessive demand for the cryptocurrency. Historic data point out that earlier halving occasions have persistently triggered worth surges, and the upcoming one is predicted to be no exception. Traders are eyeing this occasion with anticipation as a possible catalyst for additional good points within the crypto market.

Riot Platforms Inc (NASDAQ: RIOT), one other key participant within the Bitcoin mining house, has additionally seen a notable uptick in buying and selling volumes, securing the sixth spot on the charts with over 42 million shares traded within the final day.

Marathon and Riot’s Strategic Strikes

In the meantime, Marathon Digital and Riot Platforms, sensing the potential for elevated demand, have made strategic strikes to fortify their positions available in the market. Marathon lately introduced a $179 million funding in two mining facilities, including a further 390 megawatts of mining capability to its current 584-megawatt output. Riot Platforms, to not be outdone, acquired $291 million price of Bitcoin mining rigs, marking the most important enhance within the agency’s hash fee in its historical past.

Whereas Bitcoin has skilled exceptional development in 2023, with a acquire of over 163% for the reason that starting of the 12 months, shares in Bitcoin miners have outperformed even the main cryptocurrency. Marathon Digital and Riot Platforms have posted staggering good points of 767% and 452%, respectively, year-to-date, based on knowledge from TradingView. The efficiency of those shares highlights the rising recognition of the significance of mining operations inside the broader crypto ecosystem.

Whether or not this development will proceed depends upon regulatory choices, market dynamics, and the unpredictable nature of the crypto panorama. Traders and fans alike will likely be intently watching developments within the coming weeks because the crypto market navigates these important junctures.