On-chain knowledge exhibits the Bitcoin miners have simply witnessed their second highest income day in all the historical past of the cryptocurrency.

Bitcoin Miners Simply Raked In Nearly $76 Million In Whole Income

As identified by CryptoQuant head of analysis Julio Moreno in a brand new post on X, the BTC miners have just lately seen day by day whole revenues near the all-time file.

The “daily revenue” right here refers to a measure of the mixed revenue that the Bitcoin miners are making from block rewards and transaction charges (each in USD) daily.

The block rewards are what miners obtain as compensation for fixing blocks on the community, whereas the transaction price is what they get for dealing with particular person transactions.

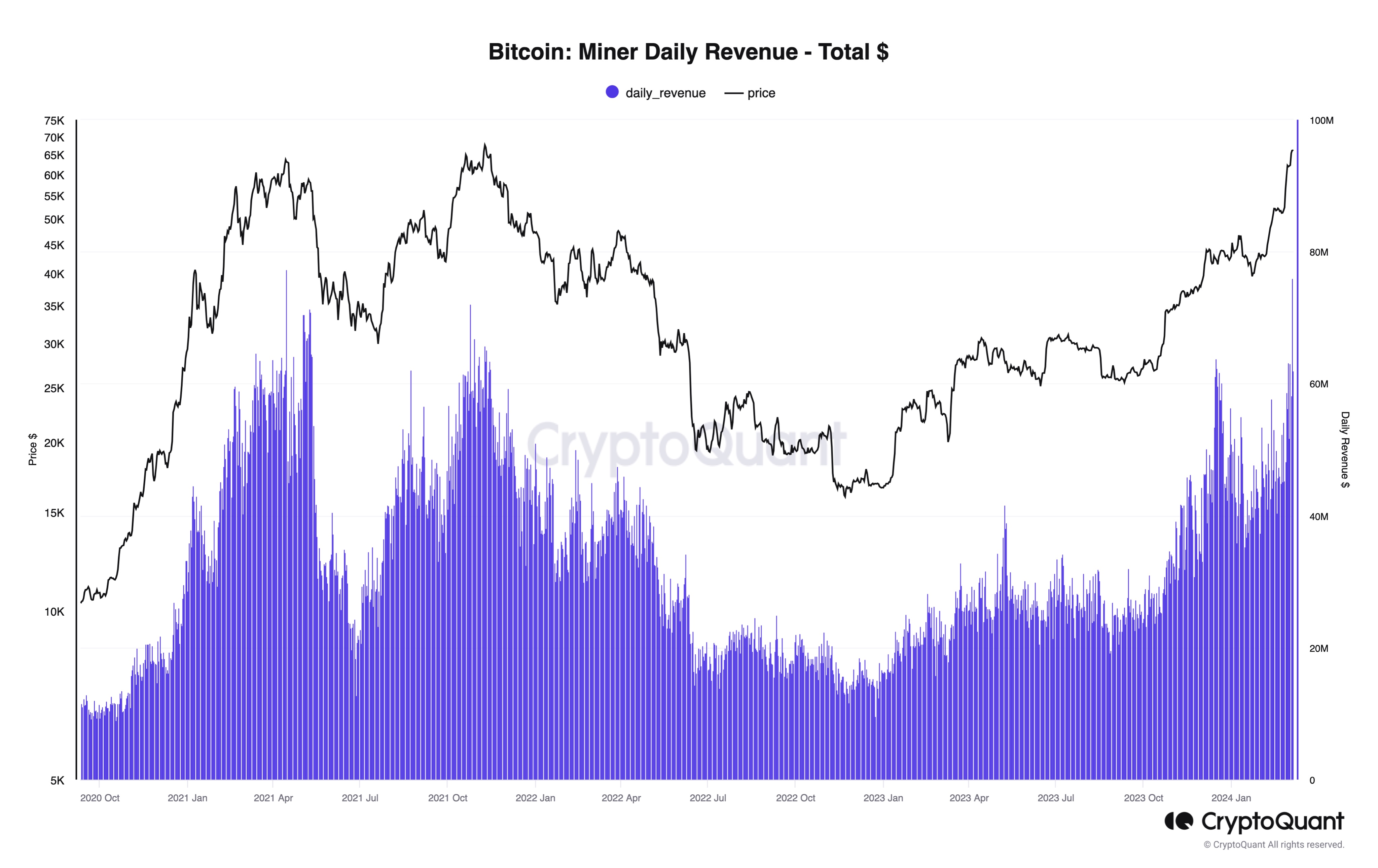

Now, here’s a chart that exhibits the pattern within the day by day income for the Bitcoin miners over the previous few years:

The worth of the metric seems to have registered a spike in current days | Supply: @jjcmoreno on X

As displayed within the above graph, the Bitcoin miner income has noticed an enormous spike just lately. Throughout this rise, the miners earned $75.9 million inside a 24-hour window.

This wasn’t too far off from the $77.3 million all-time excessive of the metric set again in April 2021. In reality, this newest spike was better than any spike noticed in all the historical past of the cryptocurrency, aside from this file itself.

Now, what’s the explanation behind this sharp surge within the Bitcoin miner income? One have a look at the chart makes it clear that the BTC rally to an all-time excessive would have been the primary driver.

The impact of the rally, nevertheless, differs between the 2 elements of the overall miner income. For the block rewards, any improve within the value has a linear impact, because the USD worth of those rewards additionally goes up alongside it.

Provided that Bitcoin has sharply risen just lately, it’s not sudden that the block rewards would have additionally shot up in worth. For the transaction charges, although, the connection isn’t so easy.

The overall charges depends on the quantity of site visitors that the blockchain is receiving at the moment. Visitors does are likely to rise throughout rallies, as extra curiosity is pushed to the cryptocurrency, thus elevating the community charges.

Nevertheless it’s not at all times clearcut how a lot exercise the blockchain would mild up with when a rally occurs. On prime of that, there are different, and infrequently stronger, elements that may drive the transaction charges, like demand for a community utility just like the Inscriptions.

The transaction charges has notably risen with the most recent rally, however the absolute worth hasn’t been too excessive, in keeping with knowledge from YCharts.

The info for the overall BTC transaction charges over the previous three months | Supply: YCharts

On the day of the current income spike, the transaction charges stood at virtually $7 million. Clearly, although, this was solely simply over 10% of the overall income. Thus, the block rewards have been the primary driver behind the current improve within the Bitcoin miner income.

Whereas miners are having fun with excessive revenues proper now, the following halving, an occasion the place their block rewards will completely be slashed in half, is scheduled to happen subsequent month.

With present revenues being block-reward-heavy, Bitcoin miners could quickly face a pointy drop of their incomes, except the value can proceed its sharp trajectory to make up for it, or in some way, the transaction charges can shoot as much as shut the hole.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $67,100, up 7% previously week.

Seems like the value of the asset has seen a pointy uptrend over the previous month | Supply: BTCUSD on TradingView

Featured picture from Brian Wangenheim on Unsplash.com, YCharts.com, CryptoQuant.com, chart from TradingView.com