On-chain knowledge reveals that Bitcoin miners have been collaborating in promoting just lately. Right here’s why this cohort is doing this, based on a quant.

Bitcoin Miners Have Been Transferring To Exchanges Not too long ago

As defined by an analyst in a CryptoQuant Quicktake post, a big shift has been occurring within the Bitcoin mining panorama because the cryptocurrency approaches its subsequent halving occasion.

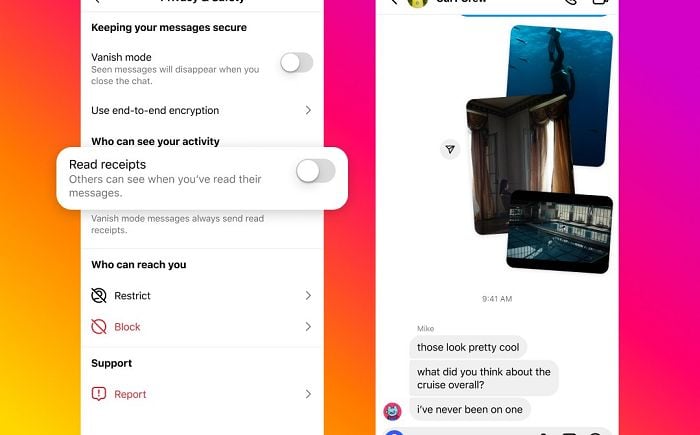

Beneath is the chart shared by the quant, which reveals the pattern in a couple of totally different indicators associated to the BTC miners over the previous few years.

The pattern within the totally different miner-related metrics | Supply: CryptoQuant

The primary indicator on the chart is the “miner reserve,” which retains monitor of the full quantity of Bitcoin that’s at present sitting within the mixed wallets of all miners.

The adjustments on this metric can naturally inform us in regards to the strikes that these chain validators are making proper now. As is seen within the graph, the miner reserve has gone by a notable drawdown just lately.

This pattern means that the miners have been transferring a internet variety of cash out of their wallets. This might be for any variety of functions, however promoting is definitely a probable possibility.

An indicator that will maybe verify that some promoting has certainly been occurring is the “miner to exchange flow,” which measures the quantity the miners are transferring to centralized exchanges.

Typically, miners deposit their cash to those platforms for promoting functions. As is clear from the chart, this cohort has seen a spike in such transactions just lately.

So, why have the miners been collaborating in a selloff just lately? “It’s a strategic move,” says the analyst. “Typically, miners realize profits ahead of a halving event to cover operational costs and prepare for future investments.”

Halvings are periodic occasions the place the “block rewards” on the Bitcoin community are minimize precisely in half completely. Block rewards discuss with the rewards that miners obtain for mining blocks on the blockchain, they usually function their major income.

Because of this the halvings have a profound influence on the financials of those chain validators. These occasions happen each 4 years, and the subsequent one is meant to happen in just some months time. As soon as the halving is in, the competitors for rewards will clearly intensify.

“To stay competitive in this evolving landscape, miners are compelled to invest in new, more efficient mining equipment and technologies,” notes the quant. “Selling a portion of their Bitcoin reserves provides the necessary capital for these investments.”

The selloff from the miners is of course one thing that might be detrimental for the worth within the quick time period. This promoting strain might even be one of many components behind why the cryptocurrency’s value has been struggling just lately.

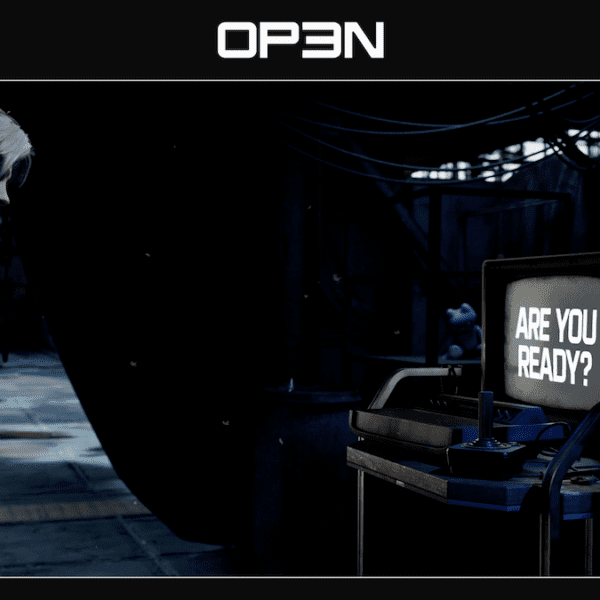

BTC Value

Bitcoin has loved a 4% uplift through the previous 24 hours and has now recovered again above the $41,000 mark.

The value of the asset appears to have noticed a pointy surge through the previous day | Supply: BTCUSD on TradingView

Featured picture from Brian Wangenheim on Unsplash.com, charts from TradingView.com, CryptoQuant.com