Bitcoin is once again caught in a tight battle between bulls and bears as selling pressure and uncertainty weigh on the market. The leading cryptocurrency has struggled to establish a clear direction, with buyers working to hold the price above the critical $110,000 level while sellers aggressively defend resistance near $113,000. This standoff has left BTC in a narrow range, fueling speculation over whether the next decisive move will be a breakout or a breakdown.

Despite the choppy price action, key onchain data from Maartunn paints a more optimistic picture beneath the surface. According to his analysis, Bitcoin’s network fundamentals remain strong and continue to improve, even as price volatility dominates short-term sentiment. Metrics tracking network activity and adoption suggest that the recent swings are more reflective of broader market dynamics—such as liquidity shifts and macroeconomic uncertainty—rather than Bitcoin losing momentum on its own.

This divergence highlights the complexity of the current market phase: while the chart shows hesitation, the underlying network signals resilience and long-term growth. As bulls and bears wrestle for control at these levels, Bitcoin’s strengthening foundation could ultimately provide the catalyst for a more sustained move once external pressures ease.

Bitcoin Difficulty And Mining Costs Signal Resilient Fundamentals

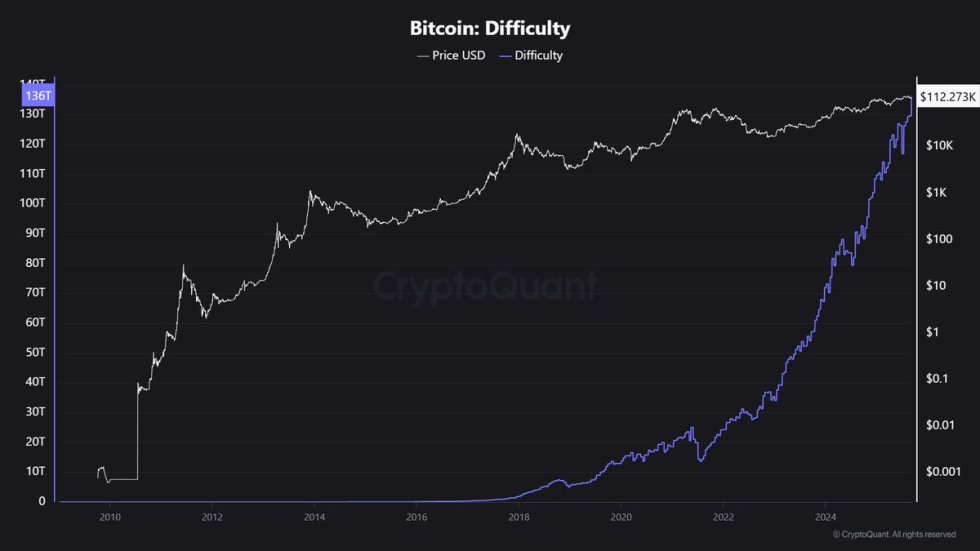

According to Maartunn, Bitcoin’s network remains in remarkable health despite recent price uncertainty. One of the clearest signs of this strength is Bitcoin Difficulty, which continues to push new all-time highs. Difficulty adjusts every two weeks based on the level of mining activity, and consistent increases reflect that miners are dedicating more computational power to secure the network.

This persistent climb underscores confidence in Bitcoin’s long-term value and highlights the resilience of its decentralized infrastructure, even as the market faces turbulence.

Alongside this, the average cost of mining a single Bitcoin now stands at approximately $99,100. This figure is important, as it represents the breakeven level for many miners. With BTC currently trading just above $112,000, miners are still operating profitably, but the margin for comfort is narrowing. Should the price dip significantly below $100,000, miner capitulation risks could rise, potentially adding temporary selling pressure to the market.

However, network fundamentals continue to suggest strength rather than weakness. The steady climb in Difficulty, combined with sustained miner commitment, indicates that participants are betting on higher prices ahead. Historically, periods where mining costs approach market value have preceded strong upward moves, as Bitcoin tends to rebound to maintain mining incentives.

Looking ahead, the combination of rising Difficulty and resilient miner activity supports the case for Bitcoin extending its push higher in the coming months. While short-term volatility may keep traders on edge, the network’s health signals that the foundation for a more sustained uptrend is firmly in place. This dynamic highlights why on-chain fundamentals remain one of the most reliable indicators of Bitcoin’s long-term trajectory, even when price action appears uncertain.

Short-Term Price Consolidation

Bitcoin is currently trading near $112,311 after a period of choppy consolidation, as shown in the 4-hour chart. The price has been struggling to gain momentum, oscillating between support around $110,000 and resistance near $114,000. The 50 SMA ($111,272) and 100 SMA ($110,773) are acting as immediate dynamic supports, while the 200 SMA at $113,860 continues to cap upside moves, reinforcing the short-term bearish bias.

The chart highlights that BTC remains in a compressed range after its recent decline from local highs above $123,000. Bulls have managed to defend the $110,000 zone multiple times, signaling strong demand at lower levels, yet momentum has not been sufficient to break through key resistance. For a bullish reversal, BTC needs to reclaim and consolidate above the 200 SMA, which would pave the way toward $116,000 and eventually the major resistance at $123,217.

A clean break below $110,000 could trigger a sharper correction, exposing $108,000 and possibly lower supports. Overall, the short-term outlook remains neutral to cautious: Bitcoin is holding ground, but until it breaks above the 200 SMA, the risk of continued sideways or downward action persists.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.