Knowledge reveals the Bitcoin Open Curiosity has set a brand new all-time excessive (ATH) because the cryptocurrency’s value has surged above $72,000.

Bitcoin Open Curiosity Has Shot Up Not too long ago

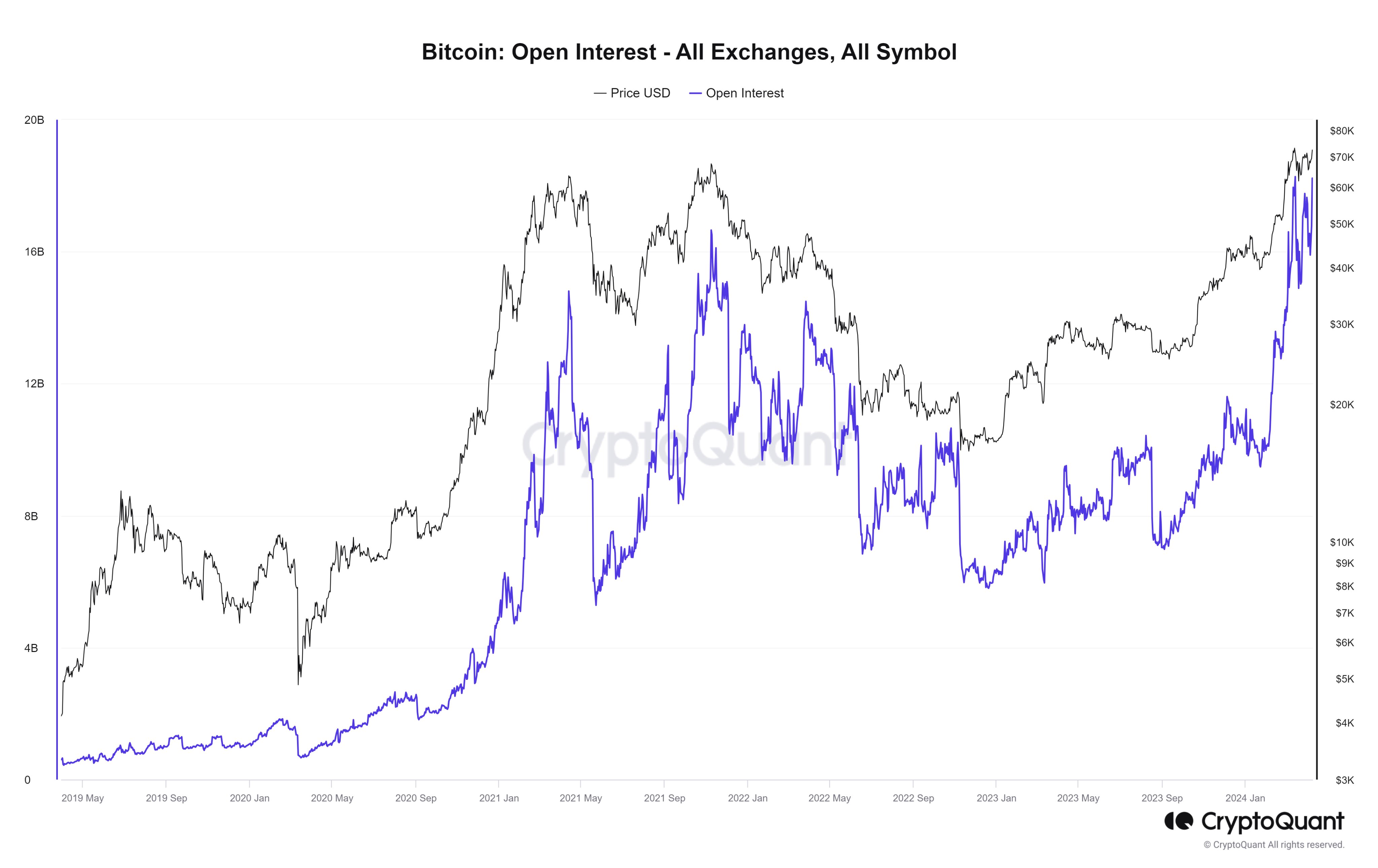

CryptoQuant Netherlands group supervisor Maartunn defined in a post on X that the BTC Open Curiosity has simply reached a brand new ATH. The “Open Interest” is an indicator that tracks the entire quantity of Bitcoin by-product contracts presently open on all exchanges.

When the worth of this metric rises, buyers will open extra positions within the by-product market proper now. Usually, the entire leverage out there will increase when this pattern happens. As such, the asset could also be extra prone to grow to be risky following a rise within the Open Curiosity.

Alternatively, the indicator happening implies the buyers both are closing up positions of their very own volition or are getting forcibly liquidated by the platform with which their place is open. For the reason that leverage would lower on this scenario, the worth would possibly grow to be extra secure.

Now, here’s a chart that reveals the pattern within the Bitcoin Open Curiosity over the previous few years:

The worth of the metric appears to have been going up in latest days | Supply: CryptoQuant

As displayed within the above graph, the Bitcoin Open Curiosity has registered sharp development not too long ago and has elevated to a brand new ATH of round $18.2 billion. This surge has come as the worth of the cryptocurrency has additionally rallied.

This pattern isn’t something uncommon, as value jumps often appeal to a considerable amount of consideration to the cryptocurrency, and with it comes a brand new spherical of hypothesis on the by-product facet.

The earlier ATH of the indicator was achieved final month when Bitcoin set a value file past the $73,000 stage. As talked about earlier than, although, the rising indicator can result in extra volatility within the value.

In principle, this volatility can go both means, however latest peaks within the metric have coincided with native tops within the value. The chart reveals that the earlier Open Curiosity ATH additionally unwound in a fast decline for the asset.

It’s arduous to say if BTC will comply with an analogous destiny this time round, however what could be mentioned is that it might most likely grow to be extra risky going ahead if these excessive Open Curiosity ranges persist.

As talked about, the earlier Open Curiosity ATH led to a pointy downswing for Bitcoin. Throughout such value swings, a considerable amount of liquidations naturally happen.

Such liquidations, although, solely feed additional into the worth transfer that brought on them, thus elongating it. This then results in much more liquidations, and the cycle continues.

This cascade of liquidations is called a “squeeze.” The newest value rally has additionally triggered huge quantities of liquidations, as shorts throughout the cryptocurrency sector have taken a $108 million beating.

The liquidation information within the cryptocurrency sector for the previous 24 hours | Supply: CoinGlass

BTC Value

On the time of writing, Bitcoin is buying and selling at round $71,500, up 5% during the last week.

Seems like the worth of the coin has been rising not too long ago | Supply: BTCUSD on TradingView

Featured picture from André François McKenzie on Unplash.com, CoinGlass.com, CryptoQuant.com, chart from TradingView.com