Cryptocurrency exchange Binance has opened Bitcoin Options writing to all, allowing retail traders to sell risk for the first time.

Binance Opens Up Bitcoin Options Writing Access

In a website announcement, Binance has revealed expanded Bitcoin Options offerings for its users. Options refer to a type of derivatives contract that grants investors the right to buy or sell the associated asset at a set price on or before a pre-determined date.

Options contracts can be of two types. A “call” gives the holder the right to buy the asset and typically corresponds to a bullish bet. Meanwhile, a “put” grants the right to sell, often signaling a bearish sentiment.

On Binance, retail users could so far only buy Bitcoin Options contracts, but following the latest launch, they can now also “write” the contracts. That is, they can now create and sell them to other traders.

Whenever a trader writes a contract, the buyer has to pay a premium in exchange. This premium represents an upfront income for the writer and gives the purchaser the right to exercise the option under the agreed terms.

If the market moves in the favor of the contract holder, the writer may be forced to take an unfavorable trade and incur a loss. On the other hand, if the purchaser loses the bet, the option expires unused and the writer keeps the premium as profit.

Binance is the largest cryptocurrency exchange in the world in terms of trading volume, so Options writing being available to all users could mark a notable shift in the sector. “This expansion allows users to take advantage of more flexible and strategic trading opportunities, including expressing market views, managing risk, and enhancing yield through Options selling strategies,” said the platform.

In order to access Options writing, traders will need to upgrade their accounts to the Options Long & Short Sell trading mode. For now, only BTC is available to all users, while ETH, BNB, XRP, SOL, and DOGE remain restricted to selected traders.

In some other news, there was a significant movement of dormant Bitcoin during the weekend, as CryptoQuant author Maartunn has pointed out in an X post.

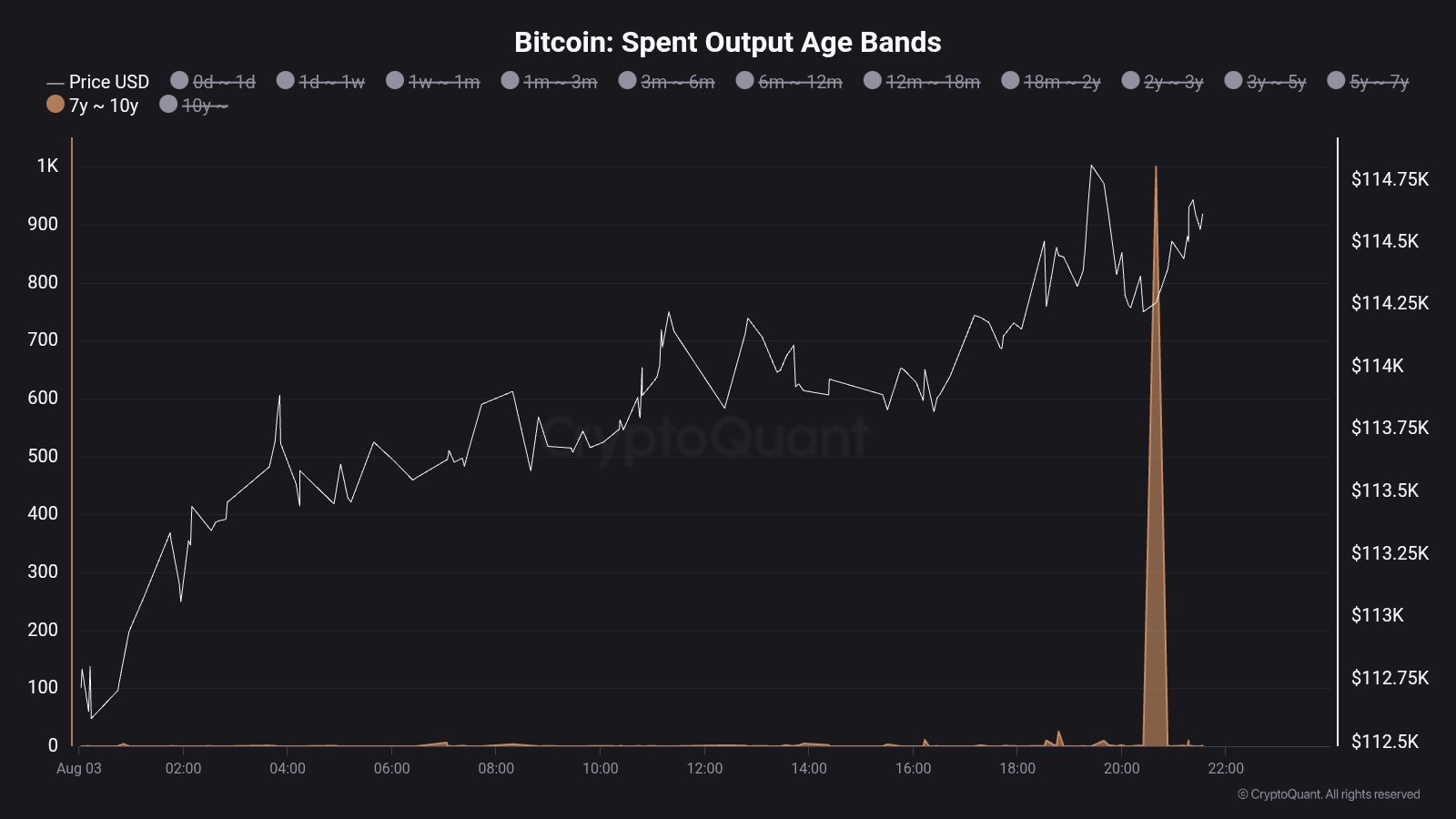

Looks like the 7 years to 10 years age band has seen a spike | Source: @JA_Maartun on X

With this transaction, the network saw the movement of 1,000 BTC inactive since between seven and ten years ago, worth $114 million today. In another post, the analyst has explained using a chart what relevance transfers involving dormant tokens like this one have for the market.

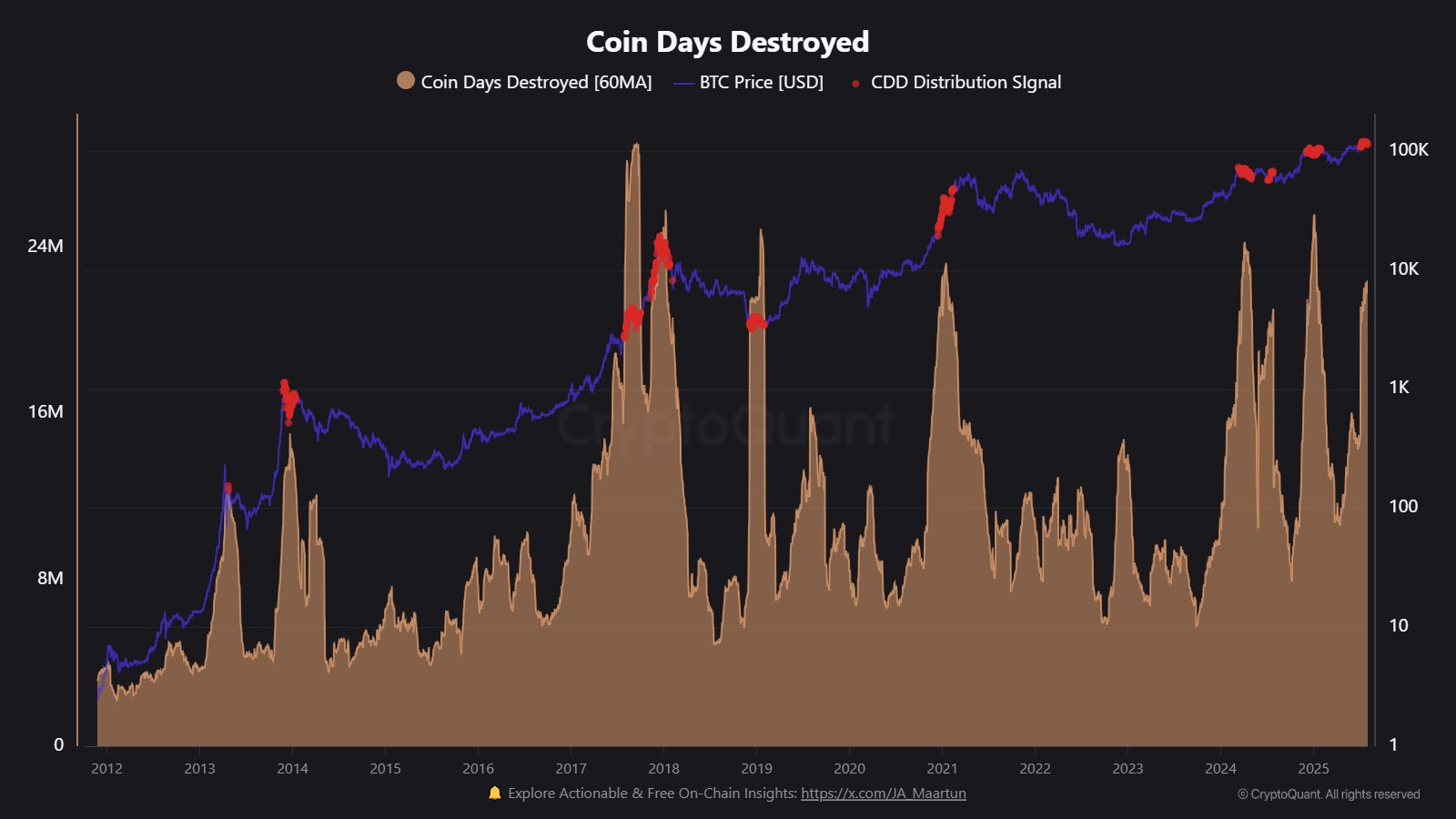

The trend in the CDD over the asset's history | Source: @JA_Maartun on X

From the graph, it’s visible that spikes in transfers of old Bitcoin have historically reflected elevated distribution on the network.

BTC Price

Bitcoin has broken out of its recent sideways range with a downward move that has brought its price to $114,300.

The price of the coin seems to have plunged over the last few days | Source: BTCUSDT on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.