Information reveals that round $533 million in crypto lengthy contracts have been flushed down as Bitcoin crashed under the $63,000 stage.

Bitcoin Has Continued Its Current Downtrend Throughout The Previous Day

Since setting a brand new all-time excessive (ATH) above the $73,800 mark, Bitcoin’s fates have modified because the digital asset has switched to experiencing bearish momentum as an alternative.

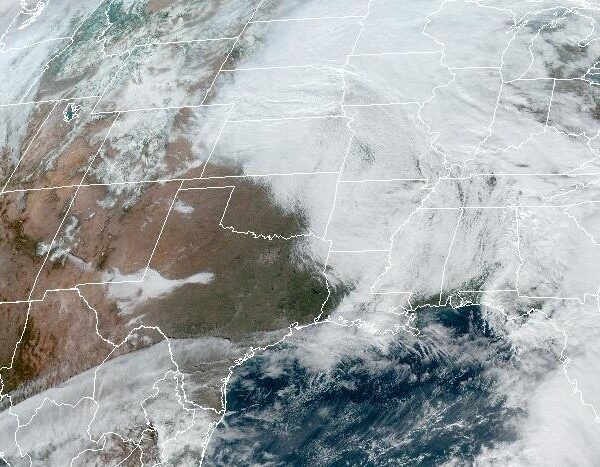

The coin has prolonged this newest drawdown within the final 24 hours, dropping its worth by greater than 7%. The chart under reveals the cryptocurrency’s current efficiency.

The asset's worth has been slipping down since setting a brand new file | Supply: BTCUSD on TradingView

Because the graph reveals, Bitcoin has plunged to the $62,600 stage for the primary time in a number of weeks. Which means BTC has declined by over 15% because the ATH.

Whereas BTC’s efficiency prior to now day has been dangerous, the remainder of the sector has carried out even worse on common, with some cash even dipping into double-digit losses.

Due to all this volatility, the derivative side of the market has seen a shakeup as liquidations have piled up on the assorted exchanges.

Crypto By-product Market Has Seen Large Liquidations In The Previous Day

A contract is claimed to be “liquidated” when it amasses losses of a selected diploma, resulting in the platform with which it’s open stepping in and forcibly closing it off.

In keeping with information from CoinGlass, many such liquidations have occurred within the cryptocurrency sector over the last 24 hours. The desk under breaks down this market flush.

The leverage flush that has occurred out there through the previous day | Supply: CoinGlass

It could seem that just about $657 million in cryptocurrency spinoff contracts have been liquidated prior to now day. On condition that the value motion out there at this time has been closely in direction of the draw back, it’s not stunning that the overwhelming majority of this flush concerned lengthy contracts.

Extra particularly, the lengthy facet of the market has suffered $533 million in liquidations, whereas the brief facet has been dealt a $123 million blow. Greater than 80% of the liquidations have concerned these betting on a bullish end result for the asset.

By way of the person symbols, Bitcoin and Ethereum have once more been on the prime of the charts, with $191 million and $134 million in liquidations, respectively.

The breakdown of the liquidations by image | Supply: CoinGlass

Out of the altcoins, Solana (SOL) and Dogecoin (DOGE) have stood out with their $39 million and $14 million liquidations, respectively. Their giant flushes could also be partially on account of their sharper drops than the opposite alts.

The chart under reveals that regardless of the excessive liquidations, the Bitcoin Open Curiosity remains to be at comparatively excessive ranges.

Speculative curiosity within the cryptocurrency nonetheless seems to be excessive | Supply: CoinGlass

The “Open Interest” measures the entire variety of BTC-related contracts on the spinoff market. Typically, the coin is extra more likely to present volatility when this metric is excessive, so sharp worth motion could proceed till the indicator cools off extra.

Featured picture from Shutterstock.com, CoinGlass.com, chart from TradingView.com