Information exhibits over $668 million in cryptocurrency lengthy contracts have been squeezed following Bitcoin’s crash underneath the $68,000 stage.

Bitcoin Has Registered A Drop Of seven% In The Final 24 Hours

Proper after setting a recent all-time excessive (ATH) not too removed from the $74,000 stage, the Bitcoin value has reversed its trajectory sharply through the previous day.

The beneath chart exhibits how the digital asset has carried out not too long ago.

The worth of the asset seems to have plunged during the last day | Supply: BTCUSD on TradingView

As is seen within the graph, Bitcoin rapidly recovered again in the direction of the $72,400 mark halfway via the crash, however the retrace was solely short-term, because the coin quickly resumed its drawdown and dived underneath the $67,000 stage.

Since this low, BTC has made a slight restoration again to $67,600, which means that it has skilled a decline of just about 7% within the final 24 hours. As is usually the case, Ethereum (ETH) and the altcoins have additionally adopted within the lead of the unique cryptocurrency, witnessing crashes of their very own.

With all this sharp value motion across the market, forceful closure of contracts, or ‘liquidations,’ are certain to have piled up on the spinoff facet of the sector. Certainly, knowledge confirms this.

Crypto By-product Market Has Seen $813 Million In Liquidations At present

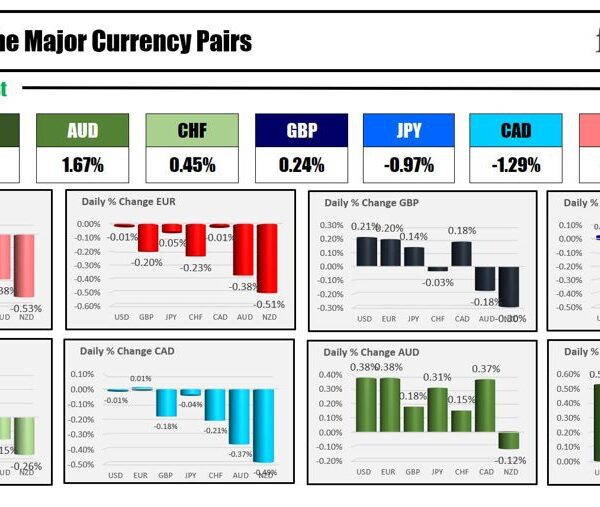

Based on knowledge from CoinGlass, the cryptocurrency spinoff market has noticed complete liquidations amounting to a whopping $813 million through the previous 24 hours.

The desk beneath exhibits the related numbers associated to this newest liquidation flush.

The huge liquidations which have occurred over the previous day | Supply: CoinGlass

As displayed above, round $663 million of those liquidations concerned lengthy contracts, which means that this facet of the market contributed an amazing 81% of the entire flush. This traces up with the worth motion, as belongings throughout the sector have plunged throughout this era.

Mass liquidation occasions like right this moment’s are popularly referred to as “squeezes.” In these occasions, liquidations cascade collectively like a waterfall and amplify the sharp value transfer that triggered them. As longs took a lot of the beating within the newest squeeze, it could be categorized as a “long squeeze.”

As for a way the assorted particular person symbols contributed to this squeeze, the desk beneath exhibits the information for this breakdown.

The breakdown of the liquidations throughout the assorted symbols | Supply: CoinGlass

Unsurprisingly, Bitcoin and Ethereum, the 2 largest cryptocurrencies by market cap, are primary and two, respectively. Solana (SOL) is the altcoin with the most important quantity of liquidations at $41 million.

SOL is the one coin among the many prime belongings that has managed robust constructive returns over the last 24 hours, and it’s additionally among the many finest performers for the previous week. This robust efficiency could also be why it has extra speculative curiosity behind it than the opposite alts proper now.

Featured picture from Shutterstock.com, CoinGlass.com, chart from TradingView.com