Bitcoin has witnessed a plunge below the $51,000 stage in the course of the previous day, right here’s what’s doubtlessly behind this decline based on on-chain information.

Bitcoin Has Slipped Below The $51,000 Degree Throughout The Previous Day

Yesterday, Bitcoin had noticed a pointy surge to the touch the $53,000 stage and set a brand new excessive for the 12 months, however the rally was short-lived, because the cryptocurrency quickly adopted up with a pointy plunge all the best way right down to below the $51,000 mark.

Shortly after this plummet, although, the coin shortly rebounded again above $52,000, giving buyers hope that the the drop was maybe solely short-term. Since then, nevertheless, the asset has as soon as once more seen a drawdown in the direction of the identical lows, because the beneath chart exhibits.

BTC has gone down a web quantity prior to now day | Supply: BTCUSD on TradingView

Attributable to these crimson returns, Ethereum has managed to outperform Bitcoin on each the each day and weekly timeframes (ETH is even in 5% earnings for the latter interval). The altcoins, although, have nonetheless carried out notably worse than the unique cryptocurrency.

Now, what’s driving this decline for the asset? There are prone to be many components concerned, however one such main purpose may lie on this on-chain improvement.

BTC Whales Have Participated In A Giant Selloff Lately

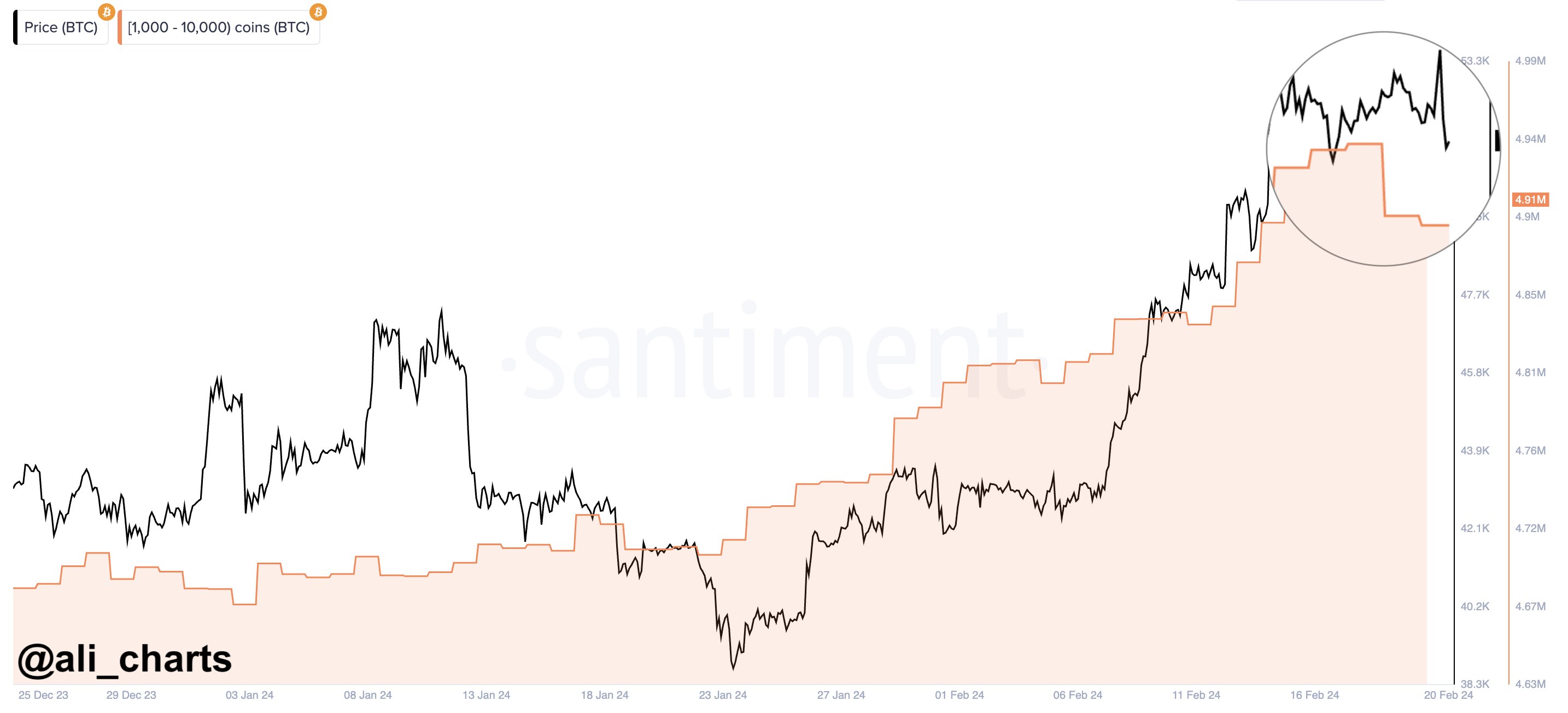

As identified by analyst Ali in a post on X, the BTC whales have offered massive just lately. The “whales” are outlined as entities on the community which are holding between 1,000 and 10,000 BTC.

Since their holdings are so giant, the whales will be influential beings available in the market, and as such, their actions will be value monitoring. The beneath chart exhibits the development within the mixed holdings of those humongous Bitcoin buyers over the previous couple of months:

The worth of the metric appears to have gone down in latest days | Supply: @ali_charts on X

From the graph, it’s seen that the holdings of the Bitcoin whales had been on the rise for the reason that begin of the 12 months, till a few days again, the place the metric’s worth rotated.

This is able to recommend that these humongous buyers had been accumulating all through the rally that ultimately ended up taking the coin above $52,000, however now it appears these buyers have lastly determined to take some earnings.

On this selloff, the Bitcoin whales have shed a complete of 30,000 BTC from their holdings, value greater than $1.53 billion on the present change charge of the cryptocurrency.

It is a vital quantity, so it’s potential that this selling pressure could no less than partially be behind the most recent drawdown that BTC has noticed. It ought to be famous, although, that not all whales that amassed just lately have offered but, because the holdings are nonetheless notably above the January ranges.

It now stays to be seen whether or not the opposite whales would observe within the lead of those sellers and declare their earnings, or if they may proceed to carry robust, believing that Bitcoin would ultimately flip itself round.

Featured picture from Shutterstock.com, Santiment.web, chart from TradingView.com