Key Notes

- Bitcoin price hits new all-time high above $125,500 as ETF inflows exceed $3.2 billion in one week.

- CryptoQuant’s Coinbase Premium Index remains positive for 30 consecutive days, signaling persistent institutional accumulation.

- Analysts predict that BTC could test $150,000 if bullish momentum holds after nine consecutive green days.

Bitcoin price advanced to fresh all-time highs of $125,580 on Sunday, October 5, propelled by a five-day buying frenzy that drew $3.2 billion in inflows from Bitcoin ETFs last week.

On-chain data shows the Coinbase Premium Index has trended positive for 30 consecutive days since September 7, highlighting sustained US institutional demand despite volatility. According to Cryptoquant, index measures price differences between Coinbase’s corporate and regulated US investors and other global exchanges.

Bitcoin Coinbase Premium Index | Source: CryptoQuant

As of this report, the Coinbase Premium Index stands at +0.06, after last printing negative at -0.007 on September 7.

This consistent premium reflects aggressive accumulation among institutional buyers throughout the late September dip, when BTC briefly corrected from $124,500 to $108,683 before entering its current rebound phase.

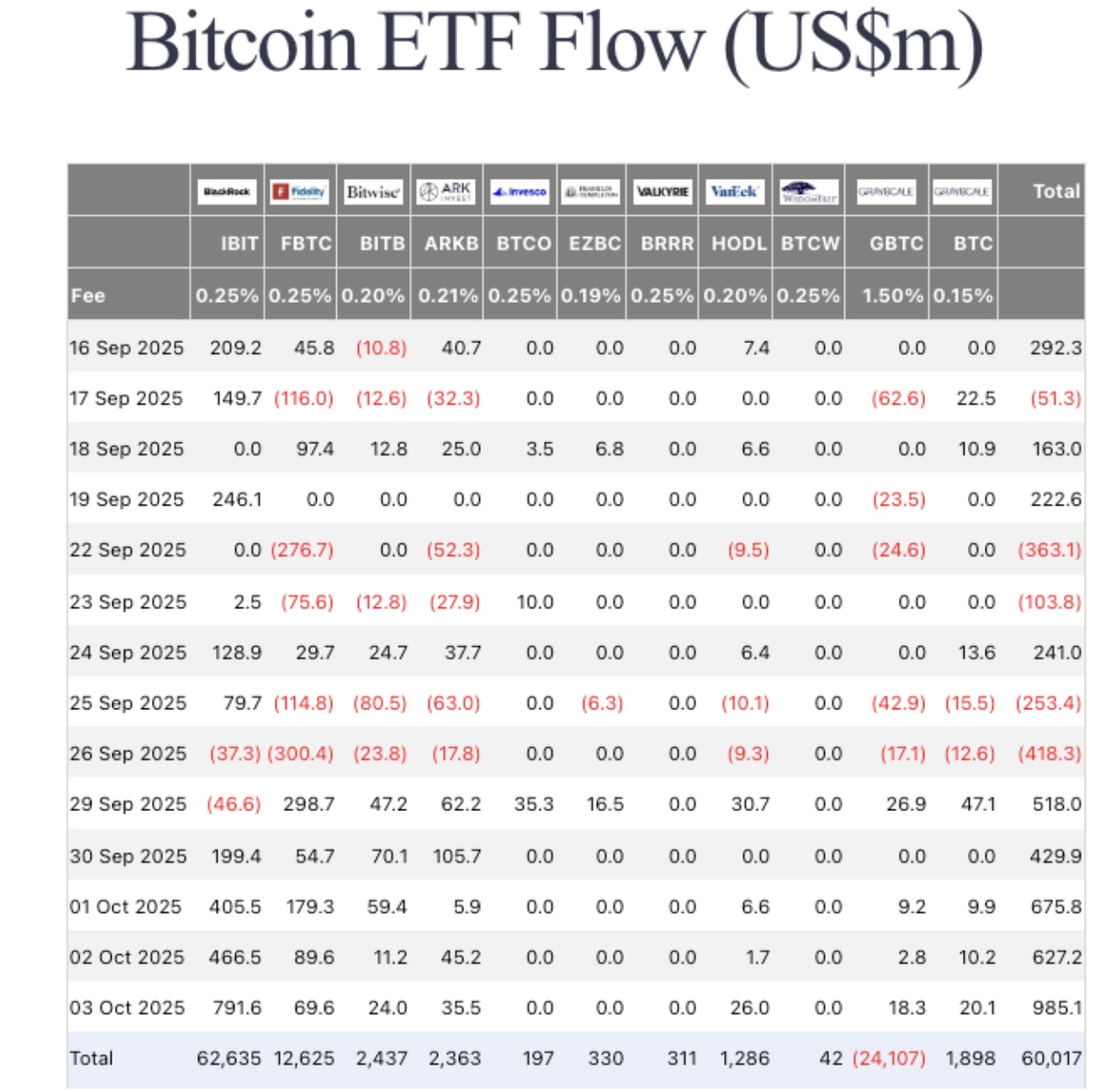

Bitcoin ETFs net $3.64 billion in second-highest weekly inflows | Source: FarsideInvestors

During that correction, ETF inflows remained resilient. According to Farside Investors, spot Bitcoin ETFs closed trading on Friday with inflows of $986 million. ETFs recorded total inflows of $3.24 billion to hit a second-highest weekly inflows since inception in January 2024.

The steady rise in ETF inflows and dominant on-chain activity validates strong institutional demand even as short-term investors and day traders locked in profits at the mid-September peaks.

Bitcoin Price Forecast: Can Bulls Push Toward $150K?

Bitcoin price has closed green in nine of its last ten trading days, boosted by strong institutional demand. The current breakout above $125,000 positions BTC firmly above all critical short-term resistance points.

Bitcoin (BTC) Technical Price Analysis | Source: TradingView

After clearing a death cross at $118,461 during the late-September retreat, BTC has now entered price discovery, consolidating above the 5-day, 8-day, and 13-day moving averages.

The Parabolic SAR below $113,000 also suggests buyers are likely to muster strong support at key resistance levels if a short-term correction occurs.

On the upside, Bitcoin price could advance toward the next target $130,000, followed by a psychological push toward $150,000 before year-end. However, an RSI nearing 70 hints that short-term overbought conditions could trigger mild retracements before the next leg up.

Pepe Node Presale Gains Momentum as Bitcoin Sets New Highs

As Bitcoin’s record-breaking rally reignites bullish sentiment, early-stage projects like Pepe Node are also drawing investor interest.

The meme-inspired platform offers up to 864% staking rewards, allowing users to build virtual meme coin mining rigs, merge nodes for enhanced yields, and earn tokenized bonuses.

Currently priced at $0.0010, the Pepe Node presale has raised $1.16 million of its $1.3 million target. With Bitcoin entering a new price discovery phase, investors are increasingly exploring projects like Pepe Node that offer higher upside potential.

Participants can still join through Pepe Node’s official website before the next presale price tier unlocks.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.