On-chain knowledge exhibits the Bitcoin switch quantity stays considerably decrease than that noticed at comparable costs through the 2021 bull run peak.

Bitcoin Complete Switch Quantity Has So Far Hit A Excessive Of Simply $118 Billion

As identified by CryptoQuant writer Axel Adler Jr in a post on X, the overall switch quantity of this bull run hasn’t been capable of attain anyplace close to the height of the earlier one.

The “total transfer volume” right here refers back to the complete quantity of Bitcoin that’s changing into concerned in transactions on the community day by day. The metric is measured when it comes to the US Greenback (USD).

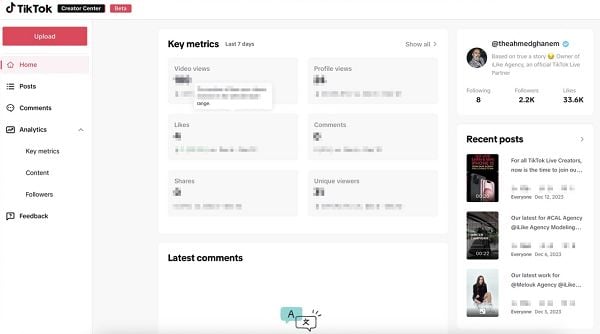

Under is the chart shared by the analyst that exhibits the pattern on this indicator over the past couple of cycles:

The worth of the metric seems to have been using an uptrend in current months | Supply: @AxelAdlerJr on X

From the graph, it’s seen that the Bitcoin complete switch quantity has been going up over the previous couple of months. That is regular habits for rallies, because the community tends to turn out to be extra lively throughout such intervals on account of an inflow of recent customers and repositioning from among the present holders.

The alternative is often the case in bear markets, as prolonged drawdowns and lengthy stretches of boring consolidation all end result within the basic buyers steering away from the cryptocurrency.

As is obvious within the chart, the indicator’s worth had additionally naturally been rising through the 2017 and 2021 bull runs. On the peak of the latter rally round November 2021, the BTC complete switch quantity had set a excessive of round $740 billion. Which means, at that time, the blockchain was processing the motion of capital value $740 billion per day. This peak continues to be the all-time excessive (ATH) for the metric.

In its newest rally, BTC has not too long ago managed to set a model new value ATH, and it’s nonetheless buying and selling not removed from these highs. Regardless of this, although, the height within the complete switch quantity noticed thus far is simply $118 billion. That is solely round 16% of the ATH worth registered on the peak of the 2021 bull run, whereas the worth ranges witnessed not too long ago have been corresponding to again then. What this means is that the demand for buying and selling on the community is way much less at present than again then.

Because the chart exhibits, when the 2021 bull run first surpassed the ATH set within the 2017 bull run, its quantity attained comparable ranges as through the earlier peak. Why, then, is the present bull run totally different on this sample?

A possible issue might be the presence of the Bitcoin spot exchange-traded funds (ETFs) this time round. The spot ETFs, which discovered approval again in January, purchase and maintain BTC, and permit their customers to achieve oblique publicity to the cryptocurrency in a mode that’s acquainted to conventional buyers.

The spot ETFs have introduced vital demand into the asset, however these new buyers are totally different from the same old holders of the cryptocurrency who actively take part within the community.

The contemporary demand by means of the spot ETFs is all “off-chain,” so to talk, as those holding their cash are the funds themselves, which means that these new buyers can’t precisely make on-chain manipulations that might find yourself reflecting on the switch quantity.

BTC Worth

Bitcoin had recovered again above the $69,000 degree yesterday, however it could seem that the asset has already misplaced these positive factors because it’s now buying and selling round $66,600 once more.

Seems to be like the worth of the asset has been general shifting sideways in the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from iStock.com, CryptoQuant.com, chart from TradingView.com