Listed below are the buying and selling volumes on IBIT, which is Blackrock’s bitcoin ETF and is destined to be the winner of the low-cost spot race:

- Day 1 – 38m shares

- Day 2 – 23m shares

- Day 3 – 13.65m shares with 35 minutes of buying and selling to go

The average volatility in bitcoin at present may be a few of that however bitcoin is up 1.3% at present after a poor begin, so that ought to have pulled in some dip patrons.

We must wait to see the Day 3 inflows however based mostly on the volumes, it is not wanting good. It is a comparable story with the opposite 9 new bitcoin ETFs with volumes all under half of Day 1 and a few of them already wanting dead-on-arrival, notably WisdomTree’s providing with simply 17k shares traded at present.

The continued query stays: What is going to occur to all of the bitcoin locked up in GBTC. It is now buying and selling at only a 1.5% low cost to NAV whereas charging 1.5% in charges (in comparison with round 0.2% for others). Presumably cash ought to stream to the low-cost ETFs however perhaps I am placing an excessive amount of religion in an environment friendly market.

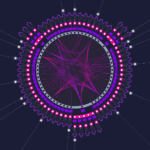

As for bitcoin, it continues to coil on the low finish of the current vary. Hold an eye fixed out for a much bigger transfer quickly.

Bitcoin hourly