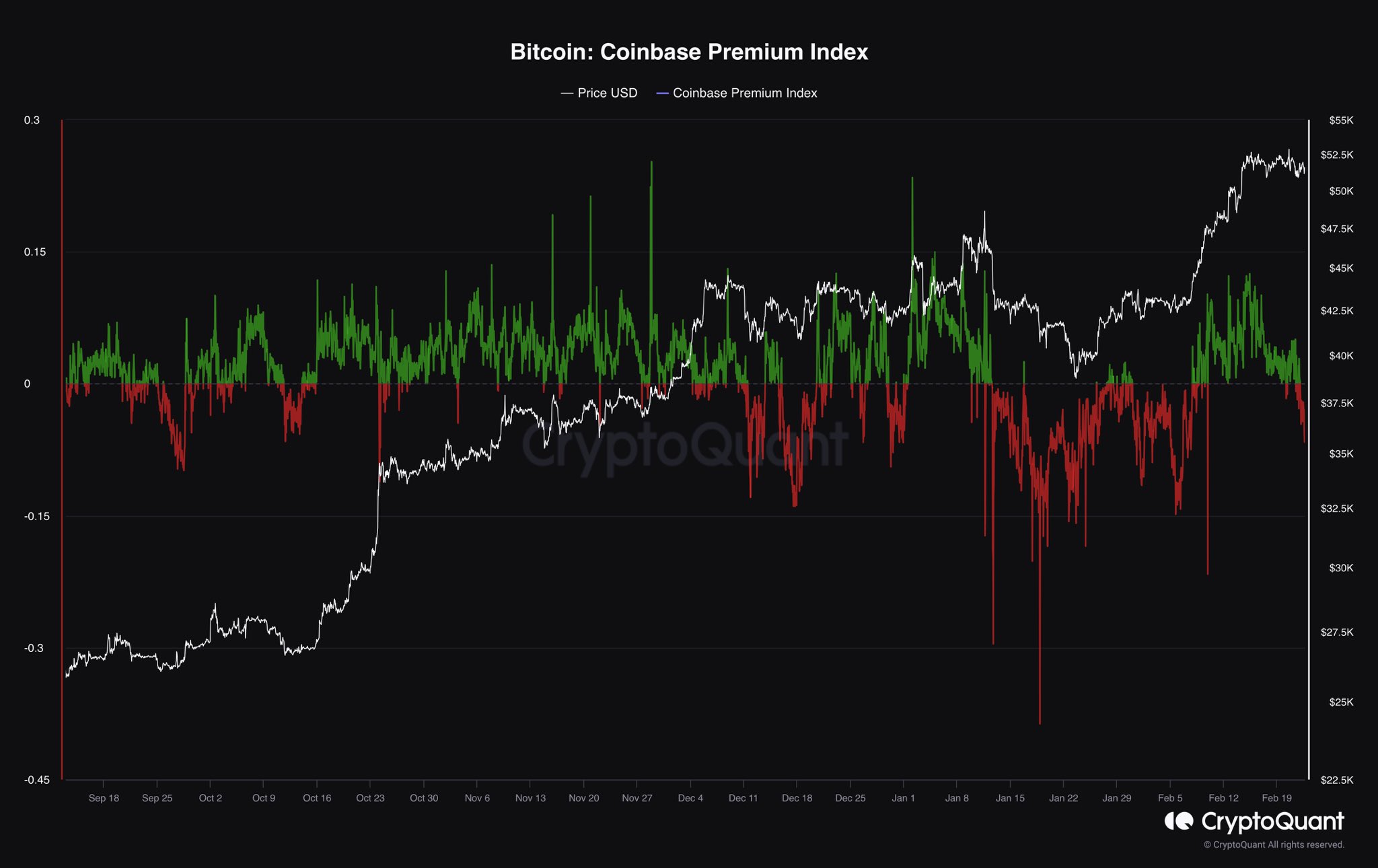

Knowledge exhibits the Bitcoin Coinbase Premium Index has turned adverse as soon as extra, an indication that would show to be bearish for the asset’s worth.

Bitcoin Coinbase Premium Index Has Dipped Into Purple Territory

As identified by an analyst in a post on X, promoting stress on Coinbase has risen not too long ago. The indicator of curiosity right here is the “Coinbase Premium Index,” which measures the proportion distinction between the Bitcoin costs listed on cryptocurrency exchanges Coinbase and Binance.

When the worth of this metric is optimistic, it implies that the worth listed on Coinbase is bigger than that on Binance proper now. Such a pattern implies both the shopping for stress on the previous is increased than the latter or the promoting stress is decrease.

However, a adverse worth implies Coinbase could also be witnessing a better quantity of promoting stress presently, as the worth listed right here is decrease than on Binance.

Now, here’s a chart that exhibits the pattern within the Bitcoin Coinbase Premium Index over the previous few months:

The worth of the metric seems to have simply turned pink | Supply: @IT_Tech_PL on X

As displayed within the above graph, the Bitcoin Coinbase Premium Index had been notably optimistic earlier, and alongside these excessive values, the cryptocurrency’s worth had rallied up.

This might suggest that the comparatively excessive shopping for stress on the platform might have contributed to the coin’s surge. As soon as the indicator had cooled to low (however nonetheless optimistic) values, the worth slumped to a sideways motion.

The Coinbase Premium Index has not too long ago taken to outright adverse values, implying that sellers have doubtlessly appeared on the trade. The final time the indicator turned pink was in the course of the spot ETF sell-the-news occasion, which didn’t finish effectively for the coin.

Coinbase is popularly identified for use by the US-based institutional investors, so the Premium Index can inform us about how the habits of those giant entities differs from that of Binance’s international userbase.

The most recent rally was pushed by shopping for from institutional entities like ETFs, which is why the metric had been optimistic. However it could seem that purchasing stress from these traders has now run out as sellers have leaped forward.

If previous precedent is something to go by, this dip into the adverse territory may imply that Bitcoin would a minimum of proceed to consolidate, if not outright register a drawdown.

Nonetheless, a bearish final result could also be averted if the Coinbase Premium Index switches again into optimistic territory within the coming days. It stays to be seen if this promoting stress from the American whales is the beginning of a brand new pattern or if it’s solely momentary.

BTC Worth

On the time of writing, Bitcoin is buying and selling across the $50,900 mark, down 2% prior to now week.

Appears to be like like the worth of the coin has been transferring sideways in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, CryptoQuant.com, chart from TradingView.com