Data shows the Bitcoin Fear & Greed Index has dropped into the extreme fear territory following the latest crash in the cryptocurrency market.

Bitcoin Fear & Greed Index Now Pointing At ‘Extreme Fear’

The “Fear & Greed Index” refers to an indicator created by Alternative that tells us about the sentiment that’s present among the average trader in the Bitcoin and wider cryptocurrency markets.

The index uses the data of the following five factors to determine the investor mentality: trading volume, market cap dominance, social media sentiment, volatility, and Google Trends.

To represent the sentiment, it utilizes a numeric scale running from zero to hundred. All values above 53 signal a net sentiment of greed, while those under 47 imply fear in the market. The indicator being between the two cutoffs naturally indicates a neutral mentality.

Besides these three main sentiment zones, there are also two special regions called the extreme fear and extreme greed. The former occurs below 25 and latter above 75.

Historically, the extreme sentiments have held much importance for Bitcoin and other cryptocurrencies, as they are where major tops and bottoms have tended to form. The relationship between sentiment and price has been an inverse one, however, meaning extreme fear facilitates bottoms, while extreme greed results in tops.

Followers of a trading technique called “contrarian investing” exploit this fact to time their moves. Warren Buffet’s famous quote sums up the idea, “Be fearful when others are greedy, and greedy when others are fearful.”

After the latest crash in Bitcoin and altcoins, sentiment among investors has worsened into the extreme fear zone, as the Fear & Greed Index shows.

Looks like the value of the metric is 21 at the moment | Source: Alternative

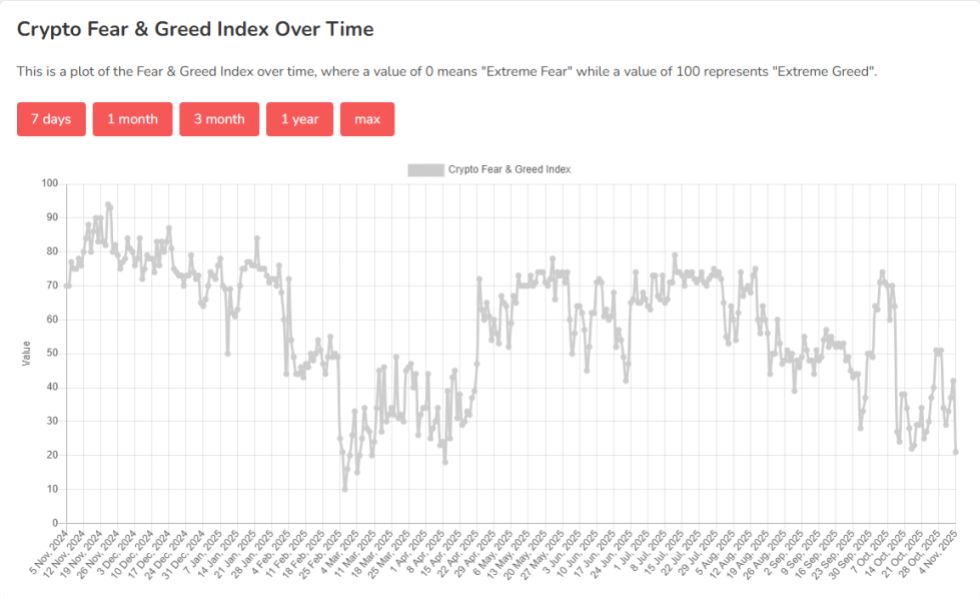

As is visible above, the Fear & Greed Index is down to 21 on Tuesday, a sharp change compared to Monday’s value of 42, nearly in the neutral zone. The current extreme fear sentiment is the strongest since April. Interestingly, that low in April coincided with a bottom in the Bitcoin price.

How the Fear & Greed Index has changed over the past twelve months | Source: Alternative

The reverse side of the pattern played out in early October, when Bitcoin formed its top above $126,000 alongside a Fear & Greed Index value of 74, right at the boundary of extreme greed.

With the trader sentiment now back inside the extreme fear zone, it only remains to be seen whether a bottom will follow for the market. In the past, the index has often stayed inside the region for an extended period before a turnaround, so it could be a while for BTC this time as well.

BTC Price

At the time of writing, Bitcoin is trading around $100,400, down more than 11% over the last week.

The trend in the price of the coin over the last month | Source: BTCUSDT on TradingView

Featured image from Dall-E, Alternative.me, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.