If there has been any doubt about the arrival of the bear market, the latest drop in the Bitcoin price to around $81,000 somewhat made it more believable. While different triggers, including geopolitical tensions, Microsoft’s earnings miss, and liquidation cascades, have been credited for this drop, the premier cryptocurrency seems to be struggling catch any break at the moment.

Interestingly, the latest decline not only shattered the remains of the Bitcoin price bullish structure but also tilted the on-chain framework towards an even more bearish outlook. With both technical and on-chain data looking less optimistic, the bears appear to be winning the battle for dominance in the BTC market.

This Metric Changes First, BTC Price Reacts Later: Crypto Founder

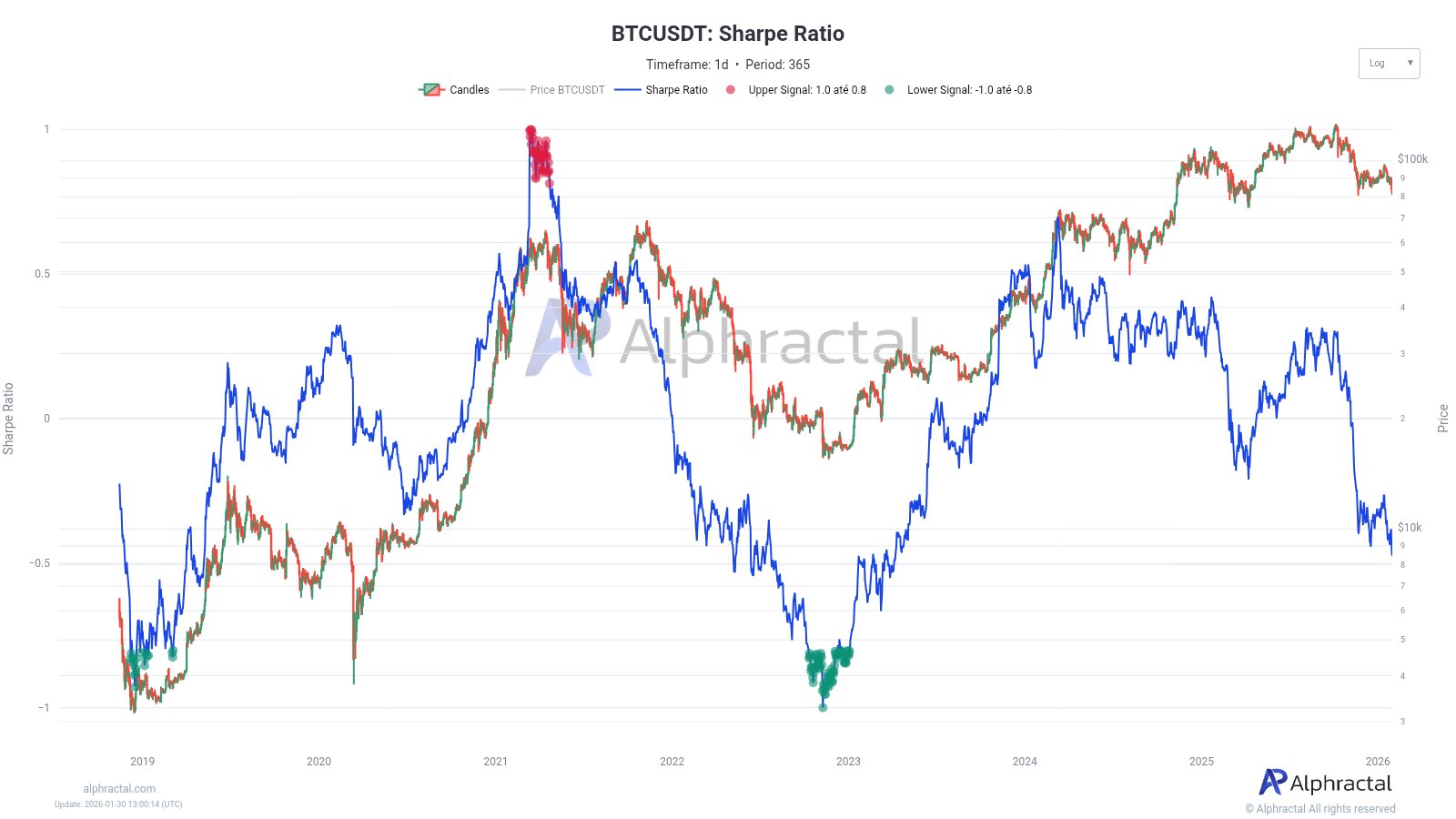

In a January 30 post on the X platform, Alphractal’s founder and CEO, Joao Wedson, revealed that the Bitcoin Sharpe Ratio is declining at a rate faster than the BTC price. The relevant indicator here is the Sharpe Ratio, which assesses the risk-adjusted returns of a particular cryptocurrency (Bitcoin, in this case).

This on-chain metric basically tracks the amount of profit an investment offers per unit of risk (considering risk is measured by volatility), with a high value signaling a higher risk-adjusted performance. Meanwhile, a negative Sharpe Ratio indicates that the returns being realized on an investment are not commensurate with the risk being taken.

Wedson wrote in his post on X:

Simply put: the market is taking more risk for less return.

Source: @joao_wedson on X

Indeed, the Bitcoin Sharpe Ratio slipped into the negative territory a few days into the new year. However, BTC’s price action still enjoyed an incredible run of form — running to as high as $97,000 — after this shift, placing less significance on the on-chain observation.

What’s more interesting is that the Sharpe Ratio is falling and weakening at a pace faster than the Bitcoin price. Historically, this rate of decline has often coincided with extended periods of momentum loss and sideways price movement. In fact, Wedson concluded that the risk-adjusted metrics need to change before price can react positively.

Bitcoin Price Could Fall To $65,500 If This Happens

In a case where the premier cryptocurrency continues its downward spiral, Wedson has projected a target for the BTC price. In an older post on X, the Alphractal founder had revealed that the Bitcoin price cannot lose the $81,000 level under any circumstances.

The on-chain expert stated that a capitulation phase similar to the one seen in 2022 could unfold if the market leader breaks below the $81,000 level. Based on the Fibonacci-Adjusted Market Mean Price, Wedson identified $65,500 as the next major support level.

The $81,000 came under focus as the Bitcoin price approached this level during its decline on Thursday, January 29. As of this writing, though, BTC has recovered above the $83,000 mark, with the price still down by nearly 8% on the weekly timeframe.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.