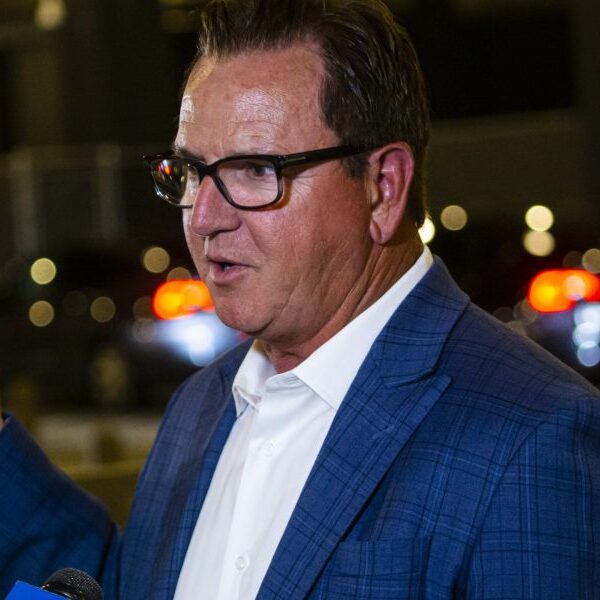

James Seyffart, a distinguished analysis analyst for Bloomberg Intelligence has provided his tackle the timeline approval of a Bitcoin Spot Change-Traded Fund (ETF) and the aftermath of the product.

James Seyffart On Bitcoin Spot ETF Approval Timeline

Members of the crypto group have been getting fairly curious concerning the Bitcoin Spot ETFs because of the growing anticipation surrounding it. One of many predominant questions swelling across the group is when they may begin buying and selling on the open market if accepted.

Bloomberg analyst James Seyffart shared his two cents on this just lately, revealing his optimism concerning the approval timeline of the BTC spot ETF on X (previously Twitter). Seyyfart highlighted in his put up that each the 19b-4 and S-1 fillings are essential for complete consideration of the product.

In his opinion, getting clearance for the 19b-4 set of ETFs won’t be too tough. Nevertheless, the difficult half is figuring out when the ETF can start buying and selling following approval.

Seyffart additionally asserted that “there is no way to know for certain” when that may occur. Nevertheless, he additional estimated that it would take “one or two days for trading to go live after approval, or even weeks later.”

Moreover, for the S-1s, Seyffart has expressed a sense of uncertainty for the functions. In line with him, he isn’t positive if the ETFs beneath the S-1 filings are ready for approval at this junction.

The analyst defined that the S-1s will get accepted if solely the USA Securities and Change Fee (SEC) indicators it off. He additional added that if each the 19b-4s and the S-1s get accepted, then the house between approval and launch might be little.

To this point, Seyffart is assured that either side can iron out the specifics, on condition that corporations like Hashdex and BlackRock are meeting with the SEC this week.

He said:

That mentioned, Primarily based on all these conferences and re-filings I’ve to imagine each the issuers and the SEC are working arduous to get issues completed.

$100 Billion Influx Hypothesis Following Approval

Together with the anticipation following a possible approval of a Spot Bitcoin ETF is how a lot might stream into the ETFs. High mathematician Fred Krueger has highlighted a possible $100 billion influx into Bitcoin if it will get accepted.

Krueger’s projections triggered fairly a stir within the crypto group, which led to a response from Seyffart. The analyst has issued a public warning to traders cautioning them in opposition to setting their expectations too excessive.

He claimed that it’s “extreme” to forecast this type of influx, contemplating how lengthy Gold has been accessible. He additional went on to say that regardless of gold has been accessible within the US since 2004, its price within the nation is at the moment $95 billion.

Featured picture from iStock, chart from Tradingview.com