On-chain knowledge reveals the Bitcoin Trade Stablecoins Ratio has plunged to its lowest since March 2023. Right here’s what this might imply for BTC.

Bitcoin Trade Stablecoins Ratio Has Been Heading Down Not too long ago

As defined by an analyst in a CryptoQuant Quicktake post, the Bitcoin Trade Stablecoins Ratio has been declining not too long ago. The “Exchange Stablecoins Ratio” is an indicator that retains observe of the ratio between the Bitcoin and stablecoins trade reserve.

The exchange reserve right here is the overall quantity of a given cryptocurrency that each one centralized exchanges are holding of their wallets proper now. Typically, this a part of the availability sitting in these platforms is taken into account the accessible buying and selling provide of the asset.

What the pattern on this indicator might indicate for the market, although, is determined by the precise kind the cryptocurrency in query is. Within the case of unstable belongings like Bitcoin, buyers might switch to those platforms once they wish to promote.

As such, a rise within the trade reserve might indicate that the accessible promote provide of the asset has gone up, which may naturally show to be bearish for the worth.

For stablecoins, trade deposits additionally indicate that buyers wish to commerce from these cash into different belongings or fiat. The distinction, although, is {that a} shift of stables into different cryptocurrencies is bullish for his or her costs, as this swap clearly acts as shopping for strain for them.

For that reason, the overall trade reserve of all stablecoins is usually thought of the accessible shopping for provide for the unstable aspect of the cryptocurrency sector.

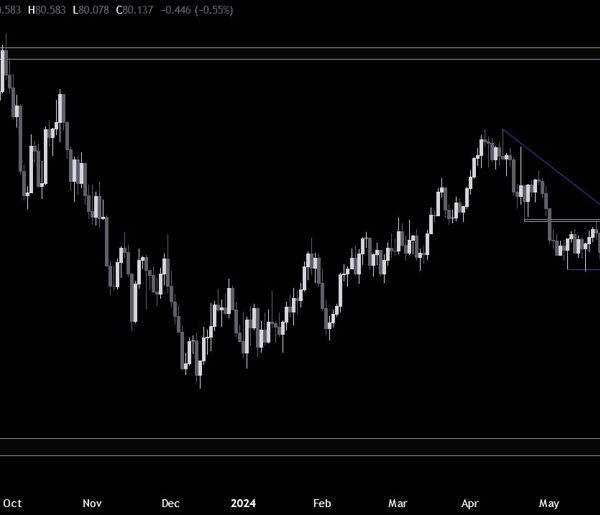

Now, here’s a chart that reveals the pattern within the Bitcoin Trade Stablecoins Ratio over the previous few years:

The worth of the indicator seems to have been driving a downtrend in current days | Supply: CryptoQuant

As displayed within the above graph, the Bitcoin Trade Stablecoins Ratio has been declining for some time now, however the indicator’s downtrend has particularly sharpened not too long ago.

When this indicator has a low worth, it implies that the BTC trade reserve is low compared to that of all stablecoins proper now. Since this will likely correspond to the ‘sell supply’ of the asset being decrease than the ‘buy supply’, the indicator assuming such a price could be bullish for BTC.

Based on this indicator, the potential promoting strain out there had risen to its peak in mid-2023, but it surely has been on its method down since then. Up to now, the metric has retraced again to ranges noticed in March 2023.

The most recent values of the indicator are nonetheless excessive when in comparison with these noticed in the course of the 2022 bear market lows, however the truth that they’re solely happening could also be an optimistic signal.

That mentioned, within the present post-ETF atmosphere, it’s unclear how related the trade reserves at the moment are (and subsequently, the indicator), because the ETFs provide a distinct avenue into Bitcoin, for which demand has been vital thus far.

BTC Worth

Since its preliminary surge past the $70,000 mark, Bitcoin has been caught in consolidation throughout the previous few days, because it’s nonetheless buying and selling round this stage.

Appears to be like like the worth of the coin has gone stale over the previous few days | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, CryptoQuant.com, chart from TradingView.com