Bitcoin is entering a pivotal phase as it hovers near key resistance levels, with traders anticipating an expansive move that could define the next leg of the market cycle. The broader macro backdrop adds complexity to this moment—gold continues to rise, signaling mounting stress across traditional financial systems and renewed interest in hard assets. Historically, such moves in gold have preceded similar reactions in Bitcoin, often serving as a leading indicator of capital rotation into digital stores of value.

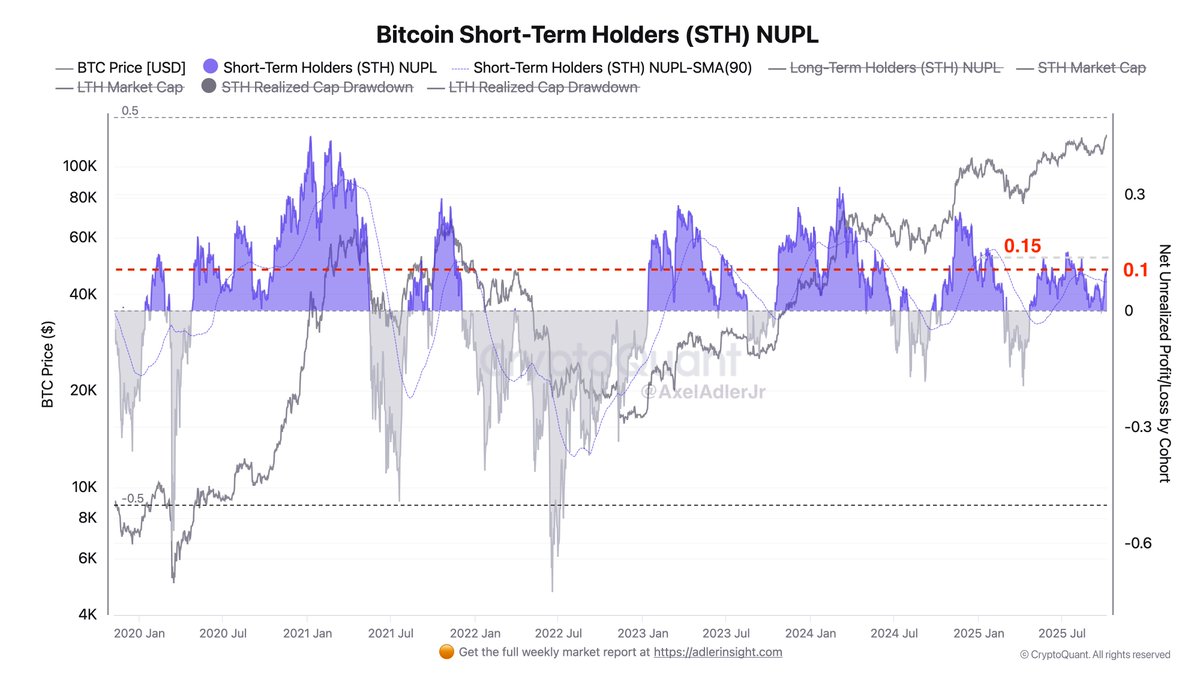

Amid this setup, on-chain data from CryptoQuant reveals an important dynamic among short-term participants. The Short-Term Holder Unrealized Profit metric has started to rise, showing that recent buyers are sitting on growing paper gains. This behavior often serves as an early signal of market tension—either preceding a wave of profit-taking or marking the beginning of an accelerated bullish phase.

Analysts are divided: some see parallels with previous pre-breakout periods when BTC consolidated before massive upside expansions, while others warn that excessive unrealized profits could trigger a short-term correction. In either case, the data points to an increasingly active market structure, where both macro catalysts and onchain sentiment align for what could be Bitcoin’s most decisive moment since its last all-time high.

Bitcoin Short-Term Holders Signal $131K Target

Analyst Axel Adler shared onchain insights suggesting that Bitcoin may be on the verge of another major move. According to Adler, Short-Term Holders’ (STH) unrealized profit has now risen to 10%, reflecting growing optimism among recent market participants. This level of profitability has historically coincided with heightened volatility, as traders begin to decide between locking in gains or riding the trend higher. Adler highlighted that earlier this year, when unrealized profits reached 15%, the market experienced a wave of selling pressure — triggering a temporary correction before resuming the uptrend.

Adler’s analysis places the next critical threshold around $131.8K per BTC, where short-term holders may again be incentivized to take profits. However, this level also marks a potential acceleration point if demand from institutions and ETFs continues to absorb supply efficiently. The market’s structure suggests that BTC could be preparing for a large breakout after weeks of consolidation near the $125K region.

While caution remains warranted due to elevated unrealized gains, the broader macro backdrop — including rising gold prices and liquidity rotation into risk assets — supports the view that Bitcoin’s bullish cycle remains intact. Many analysts expect a strong push toward new highs in the coming weeks if momentum persists and short-term selling remains limited.

Bulls Hold Ground Near All-Time High

Bitcoin is currently trading around $124,316, consolidating just below its all-time high near $126,000 after a strong multi-week rally from the $109,000 region. The chart shows BTC holding above key support at $117,500, a level that acted as major resistance throughout August and September. Its successful breakout and subsequent retest confirm a shift in market structure toward a sustained bullish trend.

The 50-day, 100-day, and 200-day moving averages are now trending upward, reinforcing the positive outlook. Price action shows tightening candles near resistance, a sign of equilibrium between buyers and short-term profit-takers. If BTC manages to close decisively above $125,000, it could trigger an acceleration toward $130,000–$132,000, aligning with the next key Fibonacci extension levels.

However, momentum appears to be cooling slightly after an extended run, suggesting a potential short-term consolidation phase before another impulse. As long as the price remains above $120,000, the broader bullish structure remains intact. The ongoing strength in gold and renewed inflows from ETFs provide a supportive macro backdrop, hinting that Bitcoin could soon enter price discovery if bulls maintain control and short-term holders resist the urge to realize profits prematurely.

Featured image from ChatGPT, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.