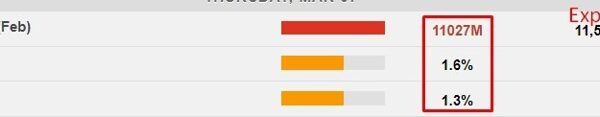

The crypto market responded positively to the FASB announcement, with Bitcoin’s value rising over 4.12% to $42,979 following the steering launch.

The Monetary Accounting Requirements Board (FASB), the US entity chargeable for detailing how firms report property on their steadiness sheets, has launched new requirements permitting companies to measure Bitcoin (BTC) and different crypto property at truthful worth.

FASB’s Shift In direction of Truthful Worth Measurement

This marks a departure from the earlier accounting guidelines, often called the “indefinite-lived intangible asset accounting model,” which mandated utilizing the unique buy value and cumulative impairment fees.

The FASB’s determination, outlined in a requirements replace released on Wednesday, responds to suggestions from stakeholders advocating for improved accounting and disclosure requirements for crypto property.

FASB Chair Richard R. Jones emphasised the transfer’s significance:

“It will provide investors and other capital allocators with more relevant information that better reflects the underlying economics of certain crypto assets and an entity’s financial position while reducing cost and complexity associated with applying current accounting.”

As highlighted within the launch, the brand new guidelines will probably be efficient for fiscal years starting after December 15, 2024, although firms have the choice to undertake them earlier for monetary statements that haven’t been issued. These guidelines particularly apply to intangible property created or residing on a distributed ledger based mostly on blockchain or related know-how, secured by way of cryptography, and never issued by the reporting entity or its associated events.

Corporations holding crypto on their steadiness sheets, comparable to MicroStrategy Inc (NASDAQ: MSTR), stand to profit from these adjustments. Below the earlier rulebook, reporting a loss was required if the crypto’s worth dropped under the acquisition value, even when the property weren’t bought.

Nevertheless, the brand new requirements mandate reporting truthful worth, cost-basis, and asset sorts, offering a extra complete and correct monetary image. Michael Saylor, former CEO of MicroStrategy has expressed help for these adjustments, stating that “the upgrade to accounting standards will facilitate the adoption of $BTC as a treasury reserve asset by corporations worldwide.”

Market Response and Future Implications

The crypto market responded positively to the FASB announcement, with Bitcoin’s value rising over 4.12% to $42,979 following the steering launch. This transfer is seen as a web optimistic for the crypto market, as favorable accounting remedies are more likely to enhance the willingness of US firms to carry crypto property on their steadiness sheets.

Ethereum (ETH), the second-largest cryptocurrency, additionally rallied on the information, reflecting a powerful dip-buying mentality out there. Whereas the FASB’s new guidelines convey optimistic sentiment to the crypto market, merchants are actually turning their consideration to the Federal Reserve’s coverage announcement.

The Fed stored the rate of interest unchanged on the shut of the market on Wednesday giving extra readability to the market that has intently analyzed financial projections and rate of interest forecasts. The Fed’s stance on potential price cuts in 2024 might influence market sentiment, with implications for each conventional and crypto markets.