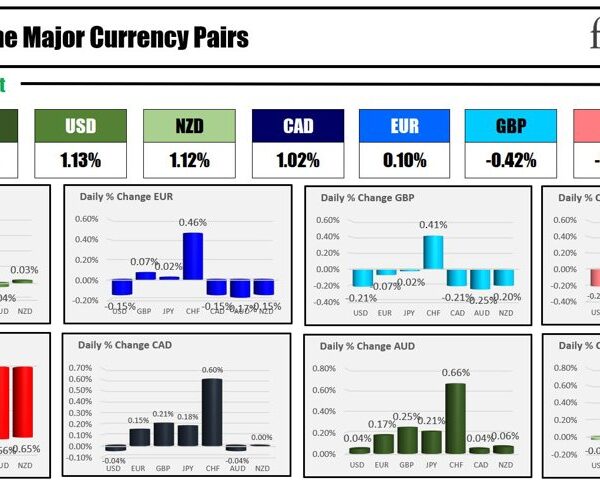

Bitcoin, the decentralized cryptocurrency created by the pseudonymous Satoshi Nakamoto, has undergone its fourth deflationary evolution, lowering the block reward to three.125 BTC.

The much-anticipated fourth Bitcoin “halving” occasion has come and gone with little fanfare or market response. Many members famous that the change was already priced in by market makers.

Bitcoin “halving” is a pre-coded software program replace that reduces the reward for miners–community operators who play an important position by devoting their processing energy to the “discovery” of latest cash. These halving occasions happen each 210,000 blocks mined, traditionally equating to 1 halving occasion each 4 years.

Chatting with The Block, crypto alternate Kraken’s head of technique Thomase Perfumo defined that this halving was presumably the “most significant” but:

“Firstly, after April 2024, nearly 95% of all bitcoins that will ever exist will have been mined. Furthermore, the annualized growth of bitcoin’s supply each year will soon fall to less than 1% for the first time,” Perfumo mentioned.

These modifications may end in some community underperformance as some gamers select to exit the market, as Binance CEO Richard Teng cautioned:

“The Bitcoin network has shown resilience in the face of such challenges in the past. Advancements in mining technology and strategies, as well as potential adjustments in mining difficulty, could mitigate the impact of reduced miner participation,” Teng mentioned. “Additionally, some miners may opt to switch to mining altcoins or explore alternative revenue streams within the crypto space, which could help maintain a balance in the overall mining ecosystem.”

However for these speculating on the longer term value of the cryptocurrency, halving occasions are sometimes a second of jubilation. Billionaire Tim Draper defined his trigger for celebration to Cointelegraph, predicting that the worth might rise as much as $250,000.

“The simple reason that Bitcoin price goes up after the halving is that the supply goes down, and with continued upward pressure on demand, the price goes up naturally in a free market,” he mentioned.

When Nakamoto launched Bitcoin in 2009, the block reward distributed to miners amounted to 50 BTC. The primary halving occasion in 2012 lowered this reward to 25, and the following rounds in 2016 and 2020 lowered this reward additional to 12.5 and 6.25, respectively.

Bitcoin incorporates a tough cap of 21 million on the entire variety of cash in a position to be found. With blocks–parts of the general public ledger that validate transactions processed throughout a given interval–averaging 10 minutes for his or her discovery, the community will proceed to supply new cash for miners till 2140.

At this level, miners will nonetheless revenue from their involvement within the bitcoin infrastructure, however will accomplish that solely by amassing charges from finish customers sending bitcoin to 1 one other.