As Bitcoin value has rallied previous $42,000, the surge in BTC perpetual futures open curiosity suggests additional value rally going forward.

On Monday, December 4, the world’s largest cryptocurrency Bitcoin (BTC) delivered a bullish rally capturing previous $42,000. The current bullishness round Bitcoin revolves across the expectations of a Bitcoin ETF approval in early January 2024.

Bitcoin surging previous $42,000 is seen as the start of a brand new crypto supercycle, with lovers predicting it may surpass $500,000. The digital belongings neighborhood is brimming with optimism as Bitcoin information its third consecutive month of features, rising 11% in December.

The sudden revival in 2023, with a greater than 150% improve, is fueled by anticipation of a possible approval for a Bitcoin exchange-traded fund within the US. Coinbase CEO Brian Armstrong even suggests Bitcoin may very well be key to extending Western civilization. Predictions for Bitcoin’s future vary from $50,000 to over $530,000, reports Bloomberg.

Tuesday’s optimistic momentum for Bitcoin additionally influenced numerous crypto-related shares, together with notable names like Coinbase World Inc (NASDAQ: COIN), MicroStrategy Inc (NASDAQ: MSTR), and Marathon Digital Holdings Inc (NASDAQ: MARA).

Coinbase shares, specifically, noticed a sturdy improve of 5.5% on Monday, constructing on the 7.3% achieve recorded on Friday. Notably, COIN inventory has soared a formidable 299% because the starting of the 12 months.

MicroStrategy, an organization with substantial investments in Bitcoin, additionally skilled a notable uptick of 6.7% on Monday, contributing to its general achieve of roughly 298% within the 12 months 2023. The cryptocurrency mining sector additionally confirmed energy throughout this rally, as Marathon Digital surged by 8.5% on Monday, and competitor Riot Platforms Inc (NASDAQ: RIOT) noticed an much more important spike of 10.2%.

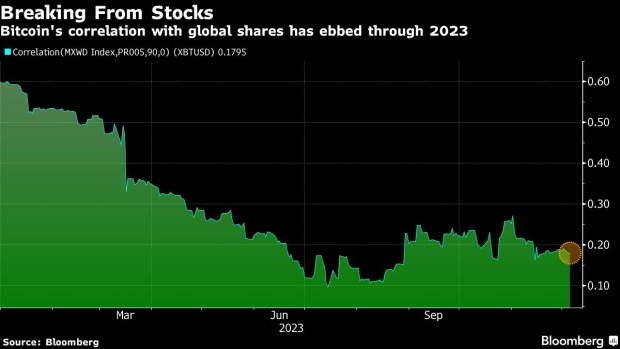

Bitcoin Decoupling from Equities

Because the Bitcoin value hits a 19-month excessive, it has been strongly decoupling from equities. Bitcoin surged by 5.8% on Monday, surpassing $42,000 and sustaining shut ranges on Tuesday throughout Asian buying and selling. This achieve contrasts with losses seen in international shares and bonds this week.

Analysts notice a low correlation between cryptocurrency and conventional belongings, citing components just like the anticipation of the U.S. approving its first spot Bitcoin exchange-traded funds. Bitcoin’s correlations with shares and gold have diminished in 2023, with a 90-day correlation coefficient dropping to 0.18 from 0.60 for shares and to close zero from 0.36 for gold. This signifies a altering relationship between cryptocurrencies and conventional monetary belongings.

-

Photograph: Bloomberg

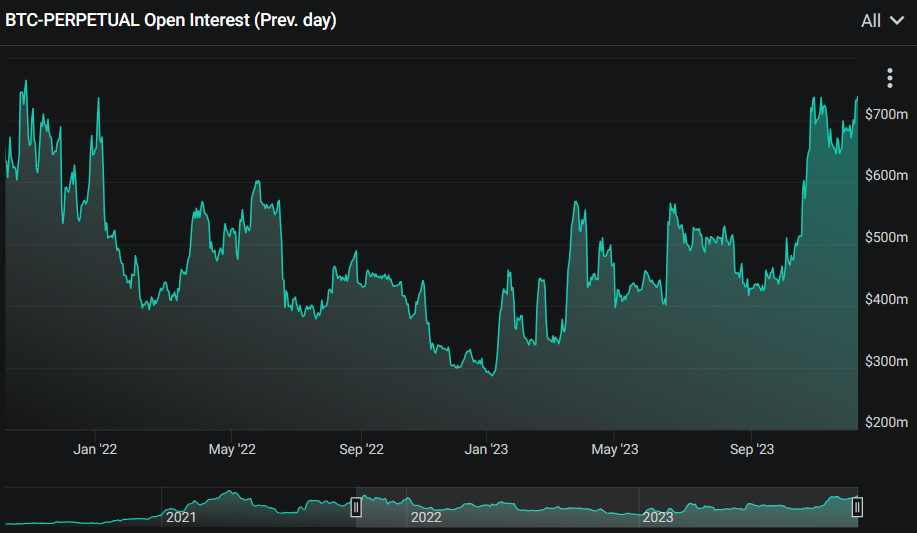

- The open curiosity in bitcoin perpetual futures on the Deribit derivatives alternate has surged to a yearly excessive of $740 million, reaching a stage not witnessed since November 2021 when bitcoin set its all-time excessive of over $68,000.

Commenting on this improvement, Justin d’Anethan, the Head of Enterprise Improvement for APAC at Keyrock, highlighted that the present premium on CME bitcoin futures contracts serves as an extra indicator of heightened institutional involvement.

D’Anethan noted:

“One can’t help but notice a healthy futures premium on CME contracts, hinting at some large sophisticated players wanting BTC exposure.”

This remark underscores the rising curiosity and participation of institutional buyers within the cryptocurrency market.