On-chain information suggests the Bitcoin whales have simply participated in some giant distribution, however the asset’s worth has managed to carry on to date.

Bitcoin Whales Are Promoting, However Sharks Are Increasing Holdings

In response to information from the on-chain analytics agency Santiment, giant BTC wallets are displaying an fascinating sample proper now. The indicator of relevance right here is the “Supply Distribution,” which retains observe of the whole quantity of Bitcoin the assorted pockets teams are at present holding.

Addresses are divided into these cohorts based mostly on the variety of tokens that they’re carrying. The 1 to 10 cash group, as an illustration, contains all wallets holding between 1 and 10 BTC.

Within the context of the present matter, two cohorts are of curiosity: sharks and whales. The previous traders are sometimes outlined as these proudly owning between 100 and 1,000 BTC, whereas the latter group contains these with 1,000 to 10,000 BTC.

Since each of those cohorts have such giant balances, their conduct will be price following, as it might find yourself having results on the broader market. The whales are naturally the way more highly effective of the 2, as they maintain considerably better quantities.

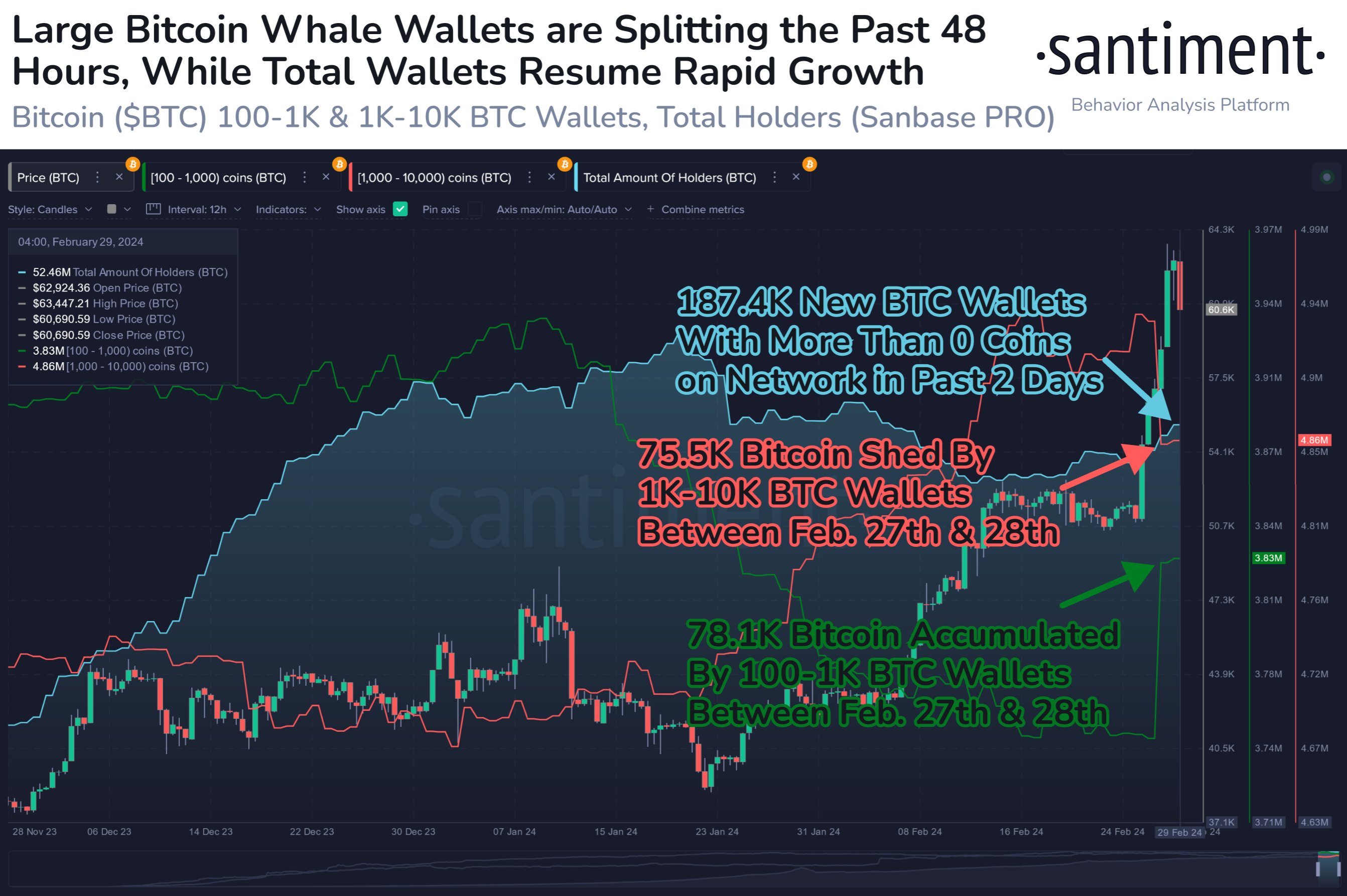

The chart beneath exhibits the development within the Bitcoin Provide Distribution for these two giant investor teams over the previous few months:

Appears like the 2 metrics have gone reverse methods lately | Supply: Santiment on X

As displayed within the above graph, the Bitcoin whales seem to have shed numerous cash from their holdings as the most recent rally within the cryptocurrency’s worth has occurred.

In complete, these humongous entities have distributed round 75,500 BTC. Whereas the whales seem to have participated on this selloff, the sharks have as a substitute seen a pointy uptrend of their provide.

This cohort has picked up 78,100 BTC throughout this accumulation spree. Curiously, the quantity that the whales have bought is sort of the identical as what the sharks have purchased. This can be due to one among two issues.

The primary risk is that the sharks have merely purchased these tokens off the arms of the whales. The opposite, and maybe the extra fascinating, state of affairs is that the “selloff” isn’t truly a selloff however reasonably a results of the whales breaking down their wallets.

Such a redistribution of holdings into many smaller wallets can naturally trigger the form of impact that has simply been noticed out there. And given the symmetry, this might, the truth is, be a possible risk.

Now, why would the whales be displaying such a conduct? As Santiment has defined in a reply to a person asking the identical query, the whales could also be shifting smaller parts into or out of exchanges, or they might merely be taking safety precautions.

On condition that the Bitcoin worth has wobbled after the formation of this development, some promoting would have nonetheless occurred, however it could seem that the market hasn’t been having an excessive amount of hassle absorbing this promoting stress to date, because the BTC worth has managed comparatively nicely.

BTC Worth

Bitcoin had declined into the low $60,000 ranges simply earlier, however the coin appears to have already bounced again because it’s now again at $62,400.

The value of the coin has loved a pointy rally over the previous few days | Supply: BTCUSD on TradingView

Featured picture from Mike Doherty on Unsplash.com, Santiment.web, chart from TradingView.com